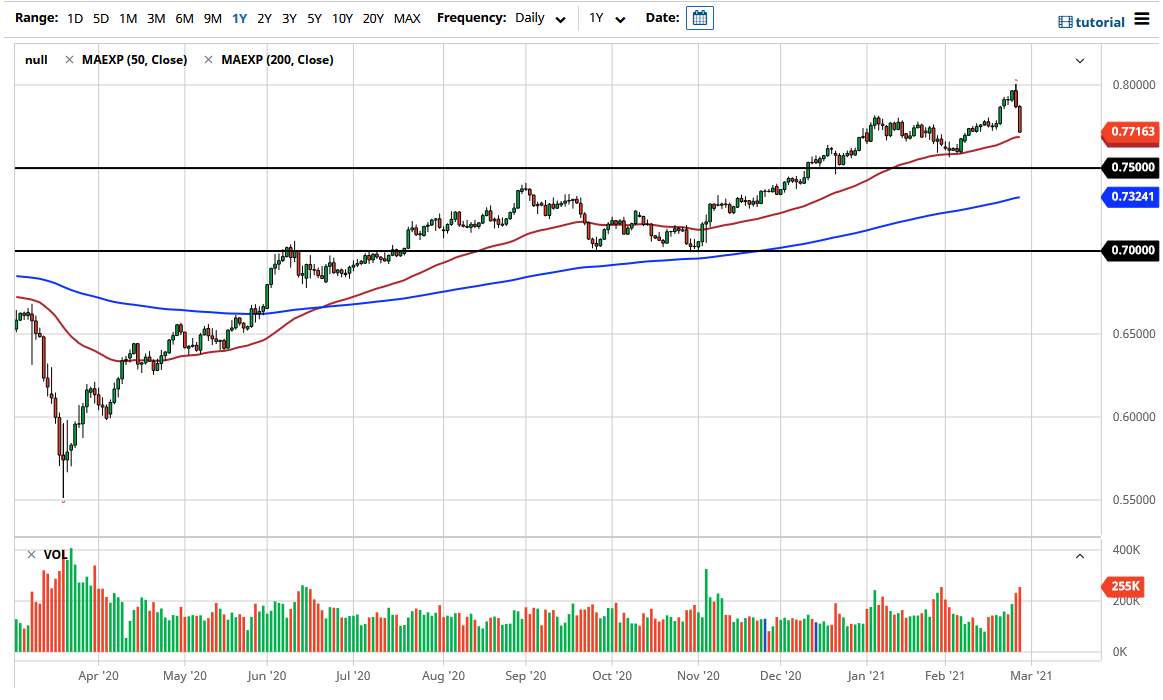

The Australian dollar initially started falling during the trading session on Friday and did not bother looking back. The market is reaching towards the 50-day EMA, an area that will be looked at by technical analysts as a potential support level. The fact that we are closing towards the bottom of the range suggests that we are more than likely going to see a continuation. At this point, the market looks as if it is going to continue to see a significant amount of noise, but I still believe that we are very much looking at a situation where the reflation trade comes back into play.

Underneath, we also have the 0.75 level, an area that I believe is significantly support. That is a level that will attract a certain amount of pressure and interest, so I think that if we were to break down below there, then it is likely that the market would continue to drop because it would be giving away the psychological barrier of that level, and at that point I think that we would go looking towards the 200-day EMA after that. The market is likely to hear a lot of noise in general, and as a result I would not be surprised at all to see this market bounce after the initial drop from here. After all, a lot of traders are banking on the idea of the reflation trade, and stimulus in the United States should continue to weigh upon the US dollar. If it were not for the noise in the bond markets, I find it very difficult to imagine that this market would have pulled back the way it has.

Nonetheless, what we are seeing is a simple pullback from an extended market, and given enough time we will find value hunters coming back in. If we can break above the 0.80 level, and close above the 0.81 handle, that kicks off a major leg higher, reaching towards the 0.90 level. I think it is going to take several attempts to finally make the breakout, but with copper and other commodities rallying rather significantly, I think the Aussie will continue to be one of the more attractive currencies longer term.