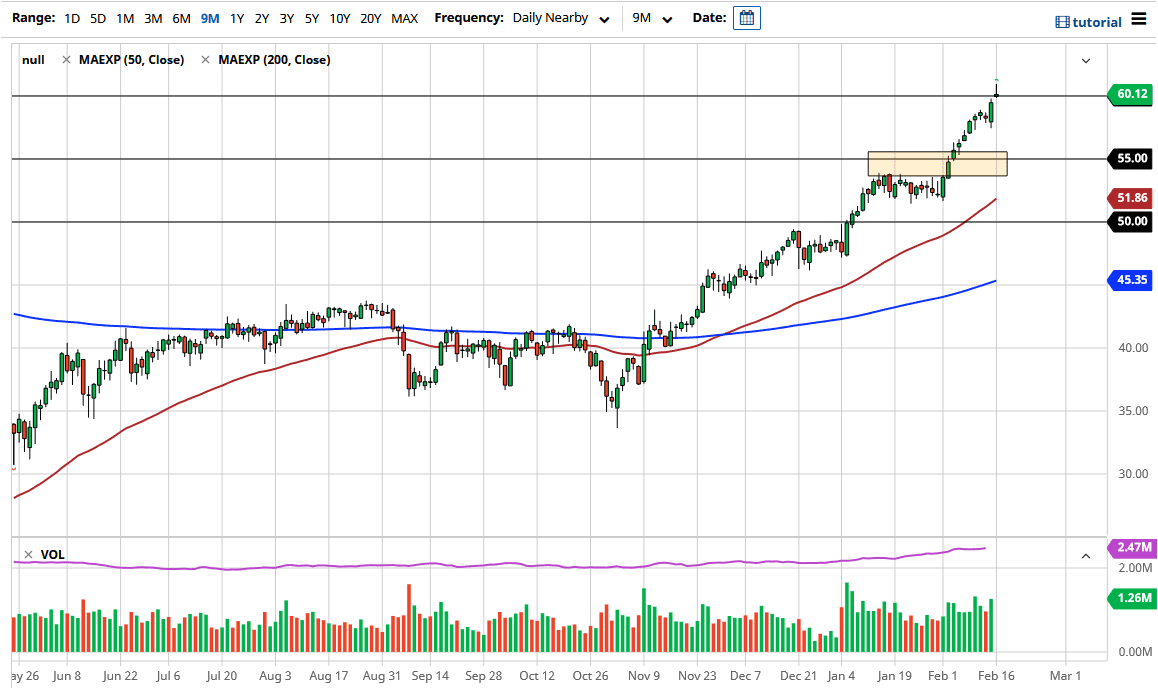

The West Texas Intermediate Crude Oil market gapped higher during the trading session on Monday as the week started out very positively. By breaking above the $60 level, we did see a significant move higher after that, but then gave it all back to form a shooting star. This suggests that the market may pull back, but whether or not it breaks down is a completely different question. The market could drop to fill the gap underneath, and then perhaps even lower. I do think that it is only a matter of time before we turn around and find buyers though, because this is a market that is jumping in the air due to the idea of the reflation trade.

The market has gotten a bit ahead of itself, due to the fact that we have gone straight up in the air. It is moving based upon the idea that we are going to get back to normal almost immediately, due to the vaccines being distributed. That suggests that the demand for crude oil should pick up, but at this point it is difficult to imagine how much further we can go. After all, the Baker Hughes Rig Count has been going on for 12 weeks in a row, so one would have to think that sooner or later the supply would start to become an issue. Furthermore, OPEC now needs to see whether or not they are going to increase production, because it is likely that the US shale producers will certainly start flooding the market with supply, as the pricing of oil is more than sufficient enough to make their companies profitable.

We are getting closer to the end of the trend, but I am not quite ready to call it. I think that we will probably drop a little bit from here and then rally again, perhaps trying to get to the $65 level, which is where Goldman Sachs suggested that crude oil was going to go by the end of the year. Having said that, I think that the gap underneath is support just as the $57.50 level is, followed by the $55 level. The fact that we pulled back should not be a huge surprise considering that most of the largest oil traders were celebrating President's Day in America, and we have gotten a bit too parabolic.