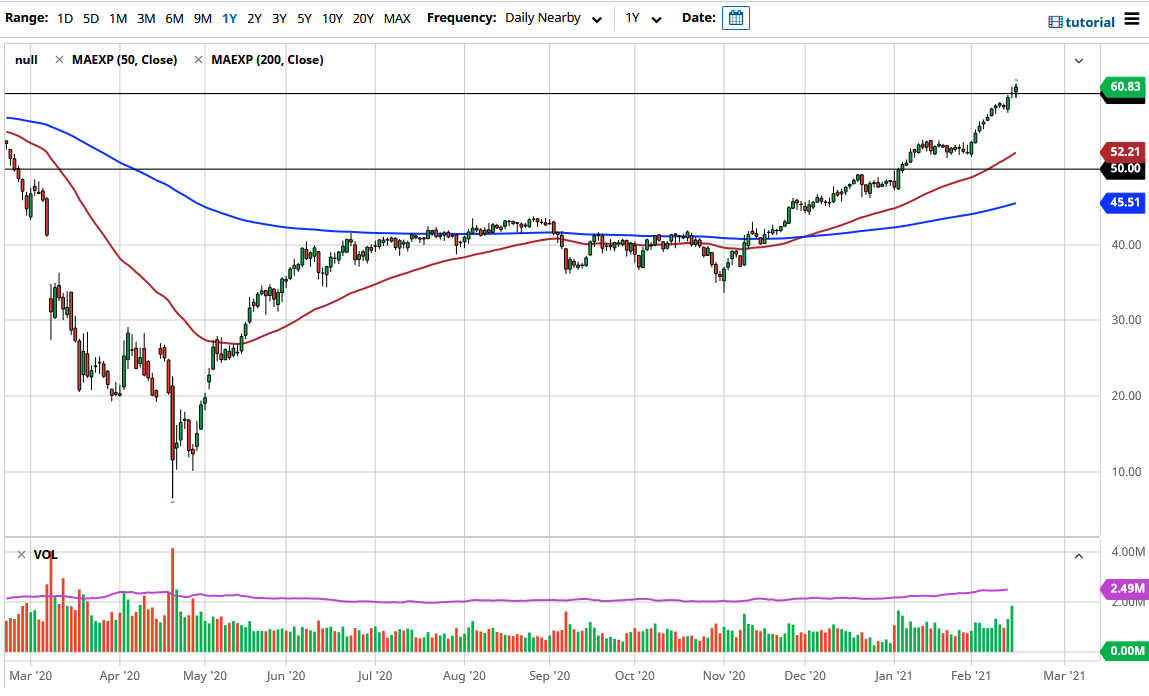

The crude oil markets initially dipped during the trading session on Wednesday to break down below the $60 level before turning around to show signs of strength. This is a market that is in a very strong uptrend, but I think the biggest problem that we have is that we are simply overextended at this point. Because of this, I think that pullbacks are healthy and I am a bit surprised that we could not have been bothered to do so along the way. Yes, I understand that there is the idea of an explosive economy as we exit the pandemic, but at the end of the day there is going to be a major supply issue down the road.

The major supply issue is mainly due to the fact that the Americans are going to start throwing oil at the markets as fast as they can. Yes, it will take a while to make that felt, but it appears to me that the market is probably running on somewhat borrowed time. Furthermore, the word on the street is that OPEC is likely to increase production in the month of April. That is whispered to be 500,000 barrels per day, which would have a small effect on the market. However, more important is the fact that the Baker Hughes Oil Rig Count number continues to rise, as for the last 12 weeks in a row Americans have increased the amount of oil rigs in the field.

The question at this point is where do we end up? I do think that we will probably go higher given enough time, but I think getting above the $65 level might be a bit of a stretch, so we are getting relatively close to the end. We probably have at least one more leg higher, and on that exhaustive move I would be more than willing to start shorting. In the short term though, I think you have to buy short-term dips as the market will certainly find plenty of buyers underneath due to the “FOMO” that is certainly forming in the market. To the downside, I would anticipate that the $57.50 level is an area of interest, just as the $53.50 level will be.