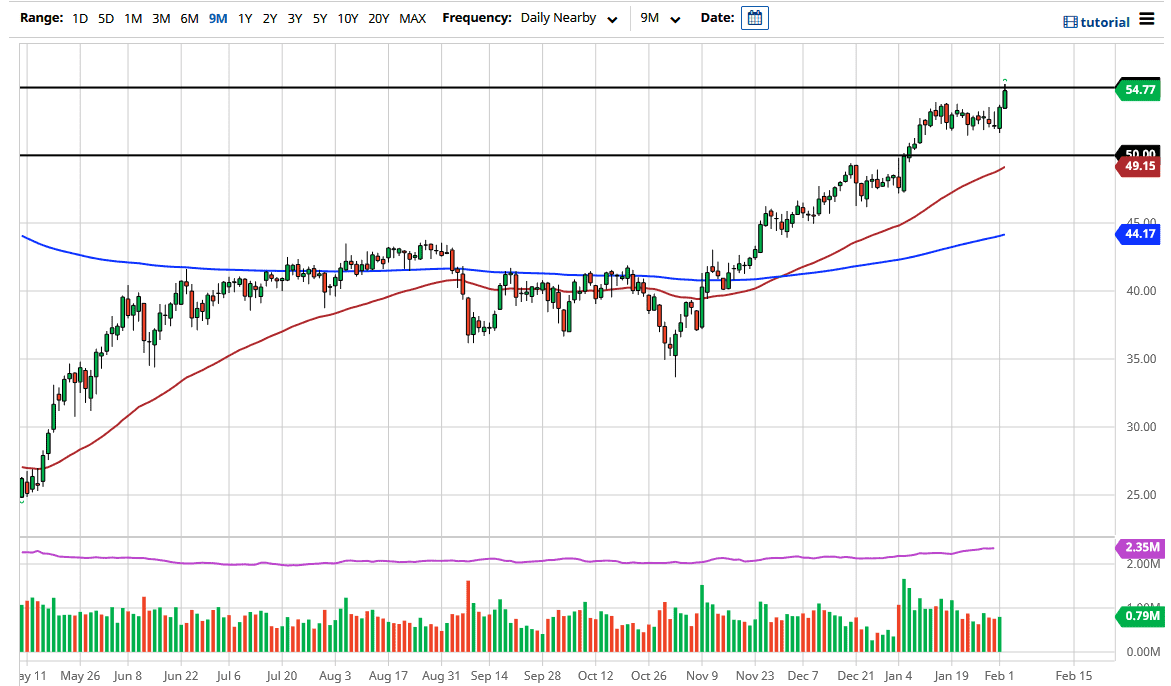

The West Texas Intermediate Crude Oil market rallied significantly during the trading session on Tuesday to peek above the $55 level for just a moment. It certainly looks as if we are trying to attack that resistance barrier, so I believe that short-term pullbacks will probably be looked at as potential buying opportunities after this move. Part of what has been driving this is that a handful of investment banks have suggested that oil prices were going higher going into next year, so people are trying to buy now in order to front-run the potential move.

OPEC has cut back reduction a bit in order to keep the price somewhat inflated, but at the end of the day it is very likely that if they continue to do so, shale producers in the United States will get involved and start flooding the market with crude oil again. (This has been done multiple times in the past.) The markets probably have bullish pressure underneath them, but it also need to keep in mind that a serious problem with demand is still an issue. After all, British Petroleum says that the year-on-year comparison for demand by retail consumers was 20% lower year-on-year in January. In other words, it was less than before the pandemic hit, which would be as expected. However, when you look at the historic charts, demand was dropping before the pandemic hit.

The size of the candlestick is somewhat impressive, just as we have seen with the previous candlestick. Once we break above the $55 level, it is likely that the market could go looking towards the $57.50 level, followed by the $60 handle after that. This does not mean that we are going to go straight up in the air, but I think that is what the buyers are trying to make happen. What is interesting is that this happened during the same day that we had seen quite a bit of US dollar strength, which typically does not happen at the same time. Nonetheless, in the short term, you should be looking for a pullback towards the $53.50 level in order to get a bit of value, and bounces should continue to see people looking towards this market to scalp to the upside every time they get a chance.