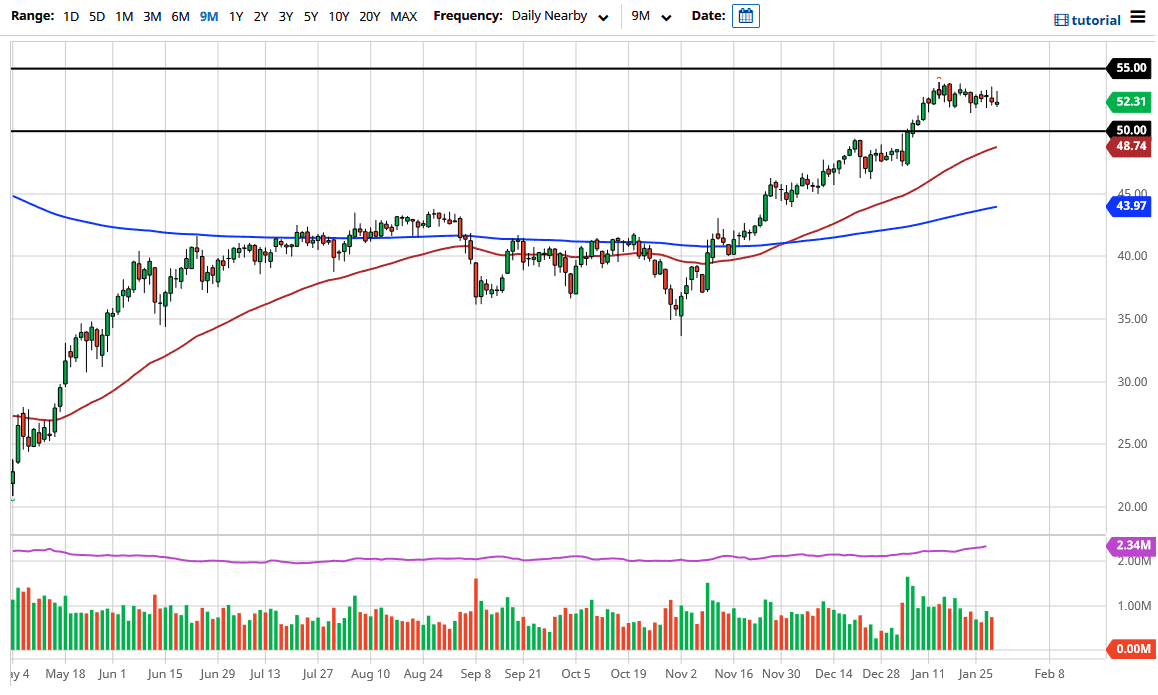

The West Texas Intermediate crude oil market did rally initially during the trading session on Friday but gave back the gains yet again as we continue to see the market struggle to go higher. The $54 level causes resistance, but it also extends all the way to the $55 level. If we were to break above there, then it is likely that the crude oil market would take off.

Having said that, it would take some type of massive stimulus package or major move in the US dollar in order to make this happen. On the other hand, if we were to rollover from here, I think that we would probably go looking towards the $50 level underneath, which is a large, round, psychologically significant figure and where we see the 50-day EMA reaching towards. We would probably see bit of support due to that technical indicator and the figure itself. There was an impulsive candlestick that reached towards that level previously, so I think that also offers a bit of potential support as well.

We have to worry about whether or not there actually will be any real demand, despite the fact that there is probably stimulus coming. After all, the demand for crude oil was dropping long before the pandemic it, so there is an argument to be made whether or not there is an oversupply. The Baker Hughes Rig Count in the United States has continued to climb, something that is not conducive for higher pricing. Furthermore, the pandemic is still locking economies down, and you have to keep in mind that the vaccine rollouts have not been as smooth as people had hoped. With all of that, the market will continue to be very noisy in the short term, so I think we will stay between $50 on the bottom and $54 on the top. It is worth noting that we have formed three shooting stars in a row on the weekly chart.