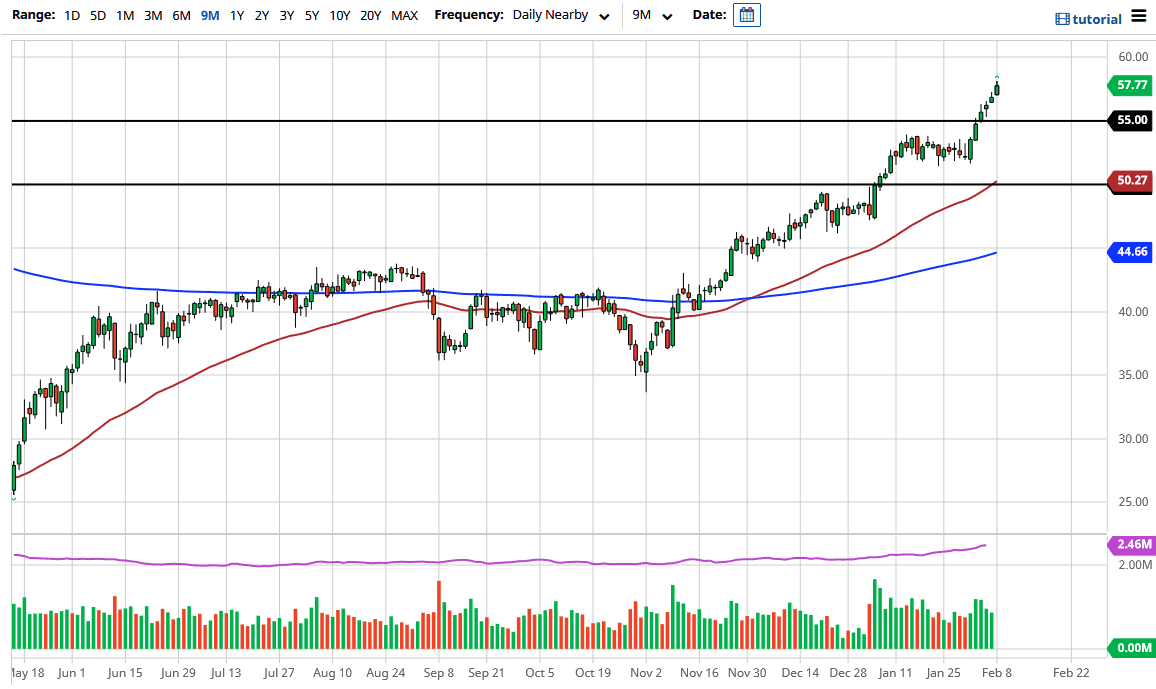

The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Friday, as we have now cleared the $57.50 level. This was an area that I thought was going to cause some issues, and now that we have popped through it, even if it was just for a moment, it shows that we continue to see plenty of buying opportunities. We are a little bit overdone at this point, but I think even if we do pull back, it is likely that we will find plenty of buyers underneath at the $55 level.

If we do pull back, there will be plenty of value hunters willing to get involved. After all, the idea is that the reflation trade will take off, and you would have people looking to take advantage of buying commodities going forward. For a longer-term target, it is likely that we could go looking towards the $60 level, as it is a large, round, psychologically significant figure. Nonetheless, this is a market that I think continues to see upward pressure in general, so even if we do pull back, I am not willing to sell it quite yet.

The idea is that there will be more demand out there for crude oil given enough time, but that does not mean that we need to get to the $60 level immediately. Whether or not we actually have significant demand for crude oil is a completely different question, and not necessarily one that I believe in, but the market certainly is buying that narrative right now so you cannot get in front of it. The volatility that occurs occasionally could offer plenty of buying opportunities, but I think we will eventually get an opportunity to pick up for a move to the $60 level, as the Brent market has already broken out.

It is not until we break down below the $52.50 level that I would be concerned about the long-term trend. The 50-day EMA is rapidly reaching towards that area, which is something to pay attention to as well. That seems to be very unlikely, and as long as there are hopeful traders out there due to the idea of stimulus, then I think that there will continue to be people out there willing to get involved.