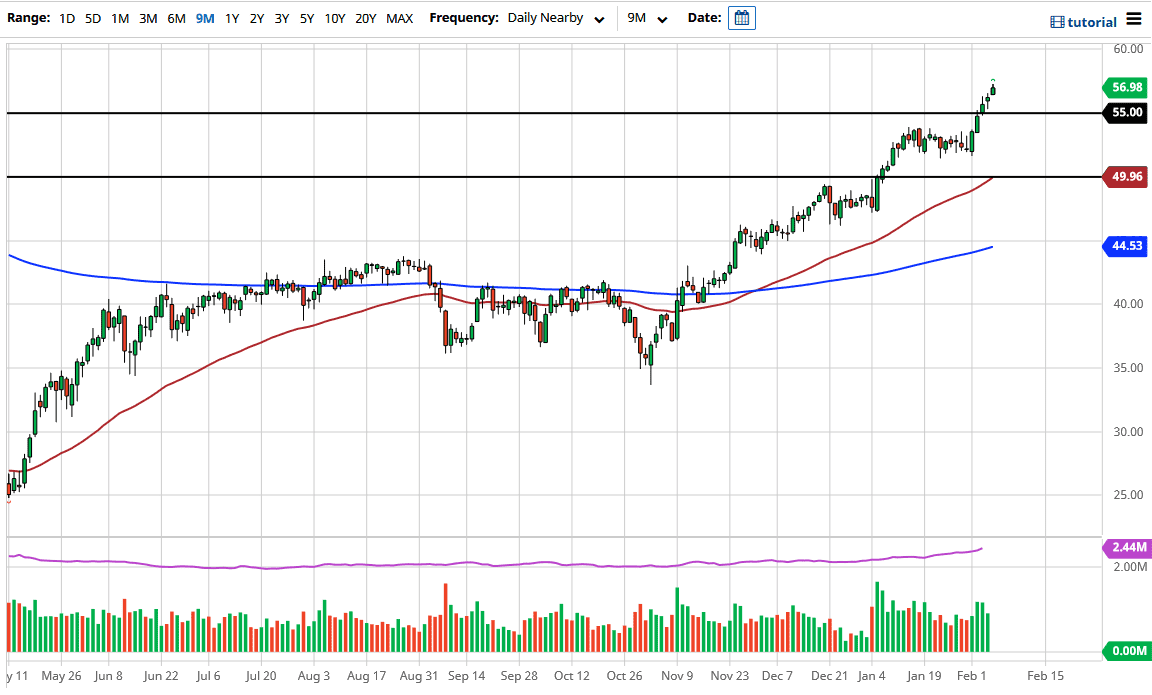

The West Texas Intermediate Crude Oil market rallied again during the trading session on Friday as we pierced the $57 level. By doing so, it looks as if the market is trying to extend the gains even further, but we might be getting a little overdone at this point. I anticipate that a pullback is probably the healthiest thing that we can see right now, with perhaps the $55 level being the perfect area to retest.

Stimulus seems to be the order of the day, and as long as stimulus is going to be big, people are going to do everything they can to pump up the commodity markets. Oil is one of the first places people go looking for returns in that situation, because the idea is that the economy is suddenly going to explode to the upside. The reality is that the economy is starting from a very low base, so although there might be a bit of a “sugar rush” to start things off, eventually the reality that a lot of business has gone forever since then. Unfortunately, the markets have become divorced from reality, because of all of the liquidity that the Federal Reserve has pumped into the marketplace. (I am speaking of markets in general, not just the crude oil market.)

We are overdone, and I think that a bit of a pullback is probably necessary in order to build up the necessary momentum to continue going towards the $60 level. Even if we broke down below the $55 level, I believe that we would probably have to take out the $52.50 level to have any significant downward momentum into the marketplace. Furthermore, the US dollar will probably have its say, and even though Friday was rather rough for the greenback, it is worth noting that oil was rallying in the face of US dollar strength over the last week, so I believe that the decoupling of that inverse correlation should be noted. Eventually, the strengthening US dollar could come into play, but right now it does not seem to be the case. OPEC production cuts have been one of the big drivers for crude oil, as for once they have actually started them. We are a little overdone and the next day or two might offer a buying opportunity at lower levels.