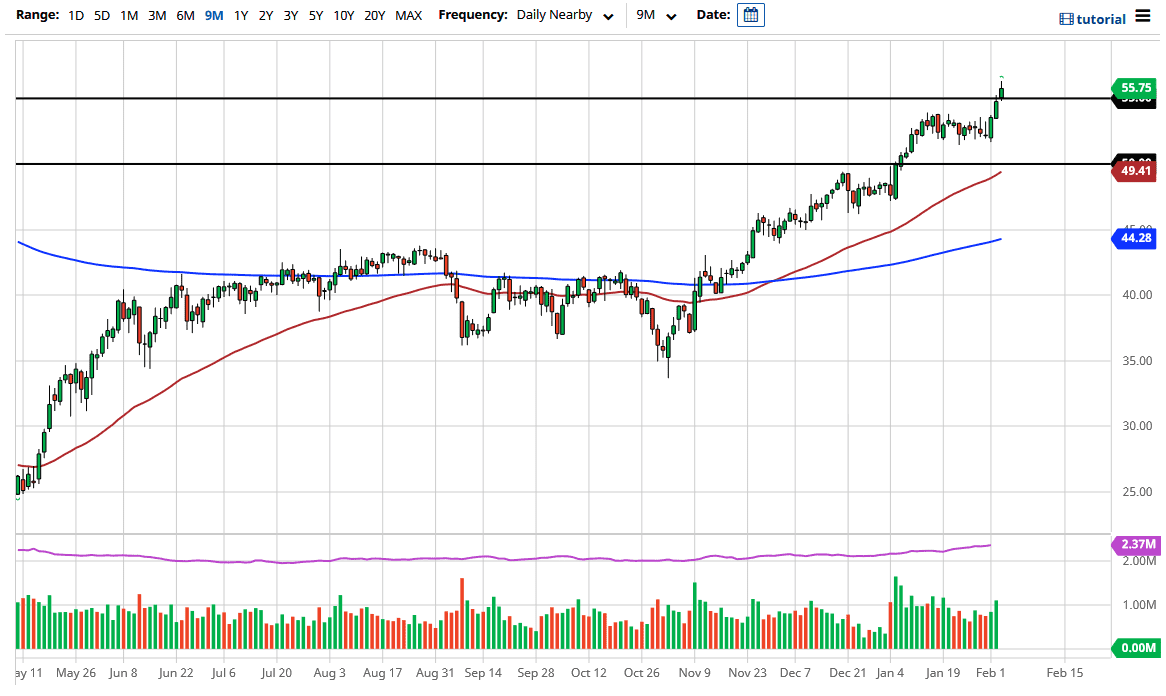

The West Texas Intermediate Crude Oil market broke above the significant $55 level during the trading session on Wednesday, showing signs of continued bullishness. This suggests that we have further to go at this point, so it is likely that we will continue to see a lot of noisy trading in general. Now that we have even pierced the $56 level, I think it has cleared the way for higher pricing, but the fact that we gave back so much of it in the later part of the session tells me that we will probably get a short-term pullback.

That pullback should end up being bullish, and it looks like we still have work to do when it comes to the crude oil market. The jobs number on Friday will be closely watched as well, because it causes so much volatility not only in the commodity markets, but the US dollar itself. More jobs would equal more demand for crude oil, just as more consumer demand would, due to the fact that everything needs to be shipped from point A to point B. With that in mind, I think that the crude oil market is going to be a very interesting place to watch over the next several weeks, as we try to discern whether or not the economy is suddenly going to take off like a rocket. There are people out there that think things are going to go right back to normal now that the vaccine is here, but the reality is probably something quite different.

There was weakening demand for crude oil before the pandemic it, so even though there is the possibility that we have a little bit of “catching up to do”, the reality is that the underlying fundamental drivers for crude oil will probably get a huge short-term burst, followed by a dose of reality. Short term, you have to be bullish of this market, but long term, you need to be paying close attention to what is going on, as the rug could be pulled out from underneath the bullish attitude of traders that we have seen. I do not have any interest in shorting anytime soon and I think that the last three days have shown exactly why.