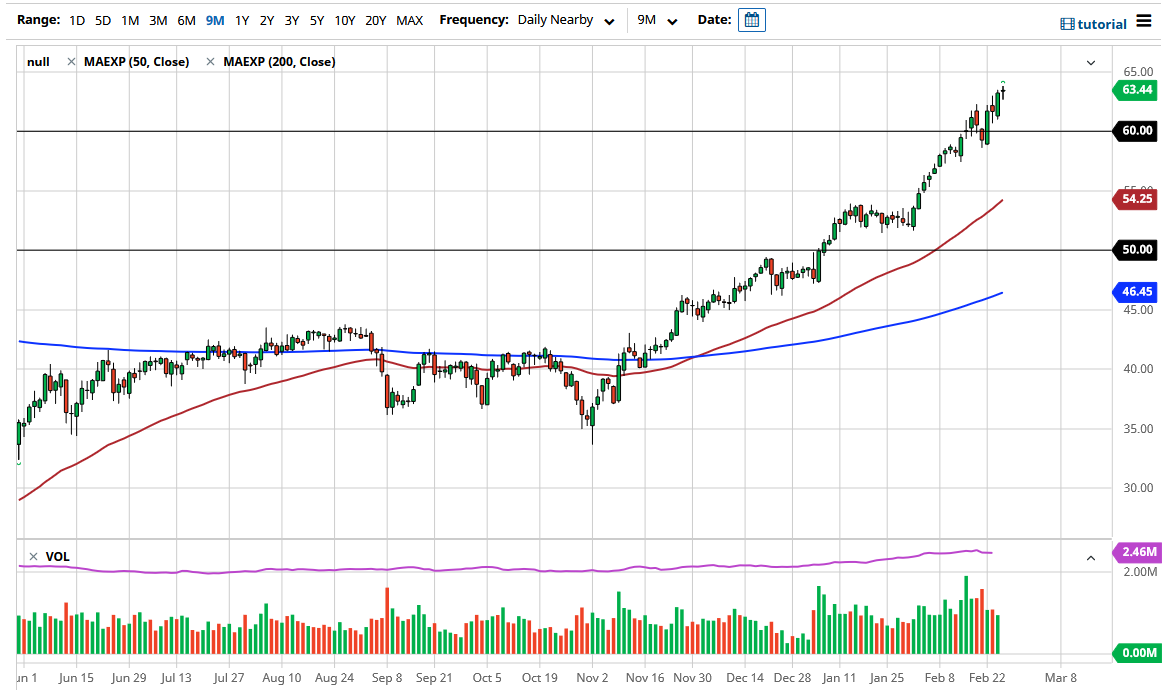

West Texas Intermediate Crude Oil markets went back and forth during the trading session on Thursday to show a little bit of exhaustion as the market may have finally reached the limit of buying pressure. That being said, I would not bet against the market quite yet, but I do think that the $65 level above is going to be difficult to deal with, as the $65 level has been massive resistance in the past. Quite frankly, the trend is going to stop, it is probably going to be at that level.

At this point, the market is likely to continue to see choppy volatility, and quite frankly at this point the energy trade is the one that everybody is involved in, so I do believe that it is only a matter of time before we make an attempt to break above the $65 level and breaking above there would be a major breakout. At this point, I do believe that we are getting closer to the idea of a pullback, but I do not necessarily think that we are ready to turn the entire trend around. The market turning around and falling from here should find a certain amount of support near the $60 level, an area that might entice bullish traders to get involved yet again.

The idea is that the markets are going to open up and start demanding more crude oil, and the market would rally as a result. That being said though, we have rallied so much that it is difficult to imagine a scenario where we would continue to see a bigger push to the upside. The market has been extraordinarily impulsive, and therefore we could turn around rather quickly based upon everybody leaving the trade at one time. After all, “one-way trades” tend to end poorly, so ultimately the market is being very dangerous if there is a sudden shift in attitude. Ultimately, the candlestick for the trading session is neutral, and therefore it suggests to me that it desperately needs some type of good news to continue going higher and most certainly breaking through the $65 level is going to take a big catalyst. I do not expect it to happen very easily, so short-term pullbacks will more than likely be a serious threat.