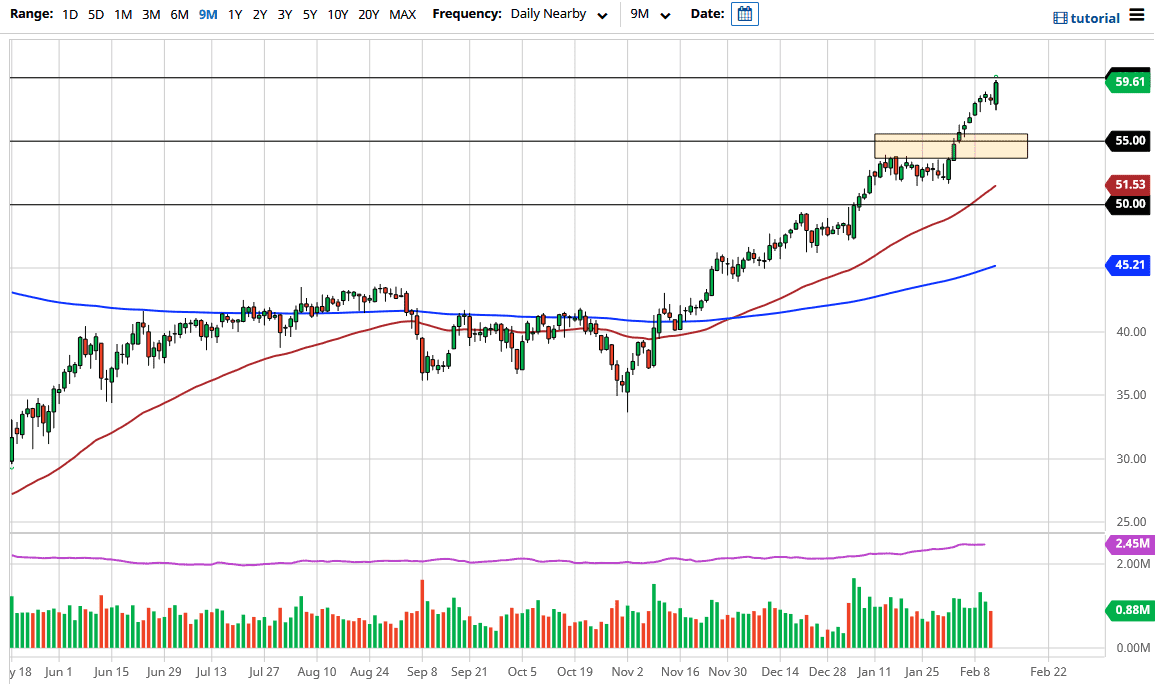

The West Texas Intermediate Crude Oil market initially pulled back during the trading session on Friday but turned around to take off to the upside yet again. This is a reflection of the potential reflation trade, as the US Congress is going to pass through a $1.9 trillion stimulus plan. The idea is that eventually, once things get going, the demand for crude oil will take off. While I do disagree with that, at least as to the severity of the demand, I recognize that it is the narrative that the market is moving on right now, and that is what you need to pay attention to.

The size of the candlestick is worth looking at, due to the fact that we had initially pulled back and then engulfed the previous three sessions. This is a strong sign that we are eventually going to try to take off to the upside. If we can get above the $60 level, that would be the next barrier to overcome. On the other hand, every time we pull back, I think that there will be plenty of value hunters looking to get involved as the oil market has been so bullish as of late that a lot of people will be experiencing “FOMO.” Because of this, I think that there are multiple levels you should be looking at as potential buying opportunities.

The $57.50 level is the first support level that I would be paying attention to due to the fact that it did offer a bit of support for the session, and then after that I would be looking at the $55 level which is a large, round, psychologically significant figure and an area that will attract a certain amount of attention as well. While I do recognize that the market is a bit overdone, I do not have any interest in shorting, because I think it is likely to slice through $60 and perhaps go as high as $65, from where the market had sold off previously, when the first signs of the pandemic broke out and China started to cause ripples throughout the system. Because of this, I do think that we will eventually get to that level, especially as people are ignoring any signs of a potential slowdown going forward.