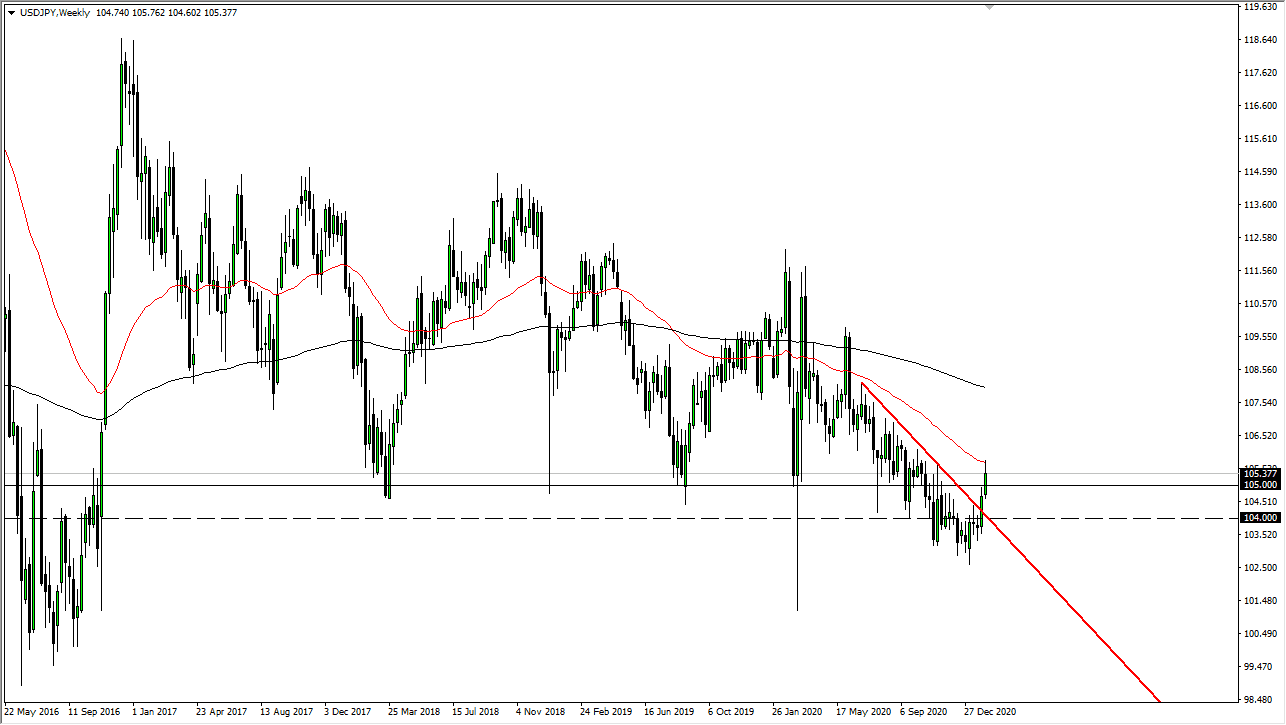

USD/JPY

The US dollar has had a strong week against the Japanese yen, but Friday gave back quite a bit of the gains. By slamming into the 50-week EMA, it suggests that we are in fact trying to make the breakout. You can see clearly that there is a downtrend line that has been broken, and now I suspect the next move could be a pullback in order to find more momentum to go to the upside. In fact, I am not necessarily convinced that we should be selling until we break down below the ¥104 level again. When you look at the daily chart, we are hovering right around the 200-day EMA that we did in fact pierce this week.

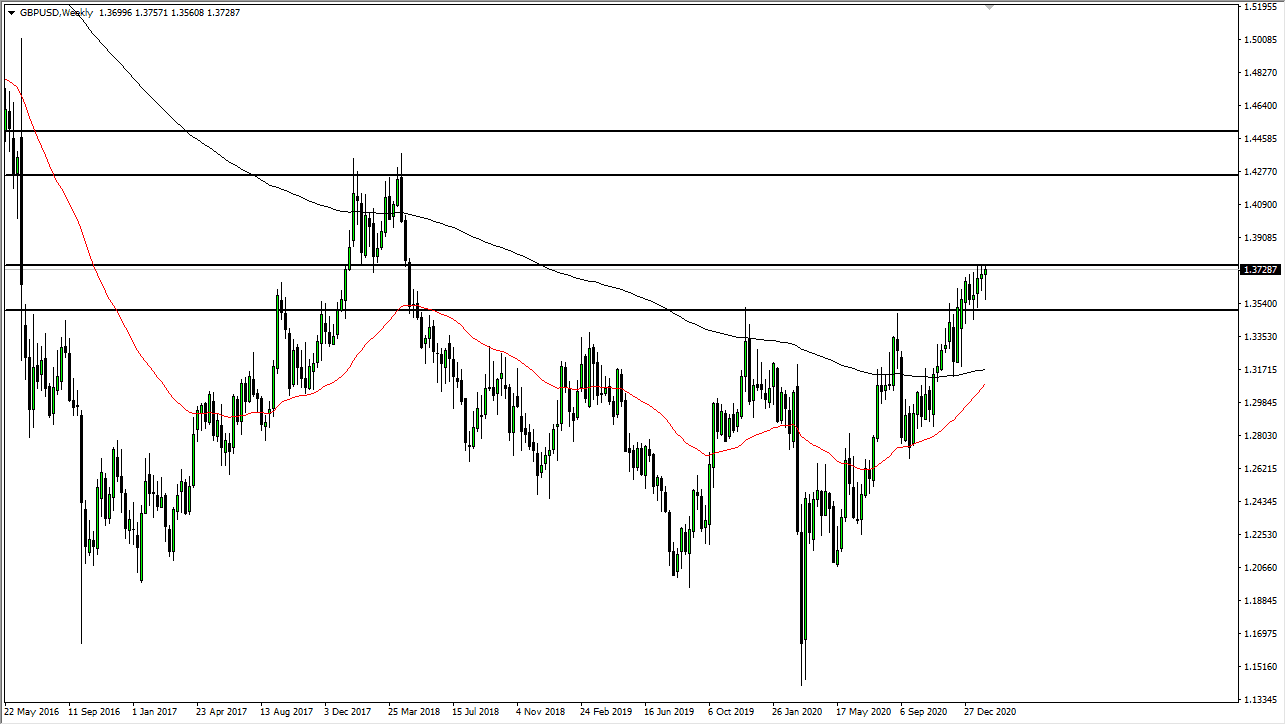

GBP/USD

The British pound initially fell during the course of the week but continues to find support just above the 1.35 handle. By turning around the way we did, it suggests that we are going to continue to be very stubbornly bullish and try to break through the 1.3750 level. However, you can see that we have failed three times in a row now, so it will be interesting to see what happens next. A daily close above the 1.3750 level will open up a possible move all the way up to the 1.4250 level above. On the other hand, if we were to break down below the 1.35 handle on a daily close, that could lead to a deeper correction.

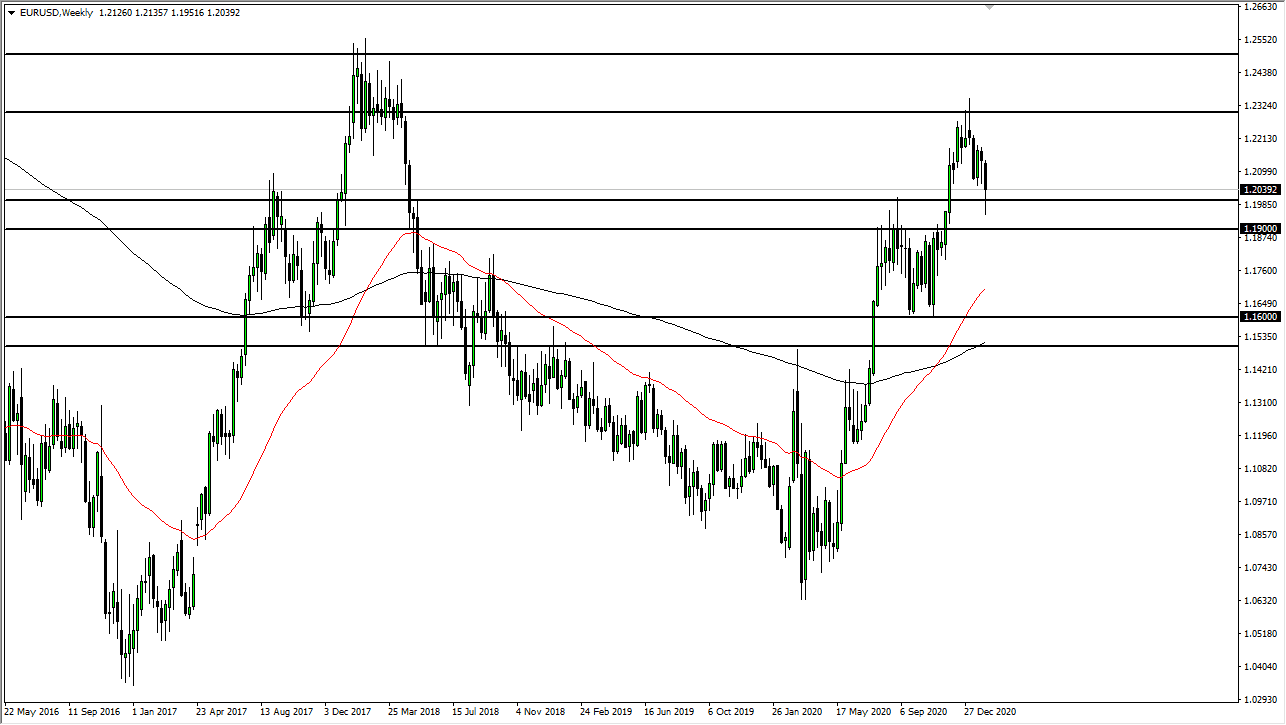

EUR/USD

The euro fell rather hard during the course of the week, slicing through the 1.20 level at one point. However, after the very anemic jobs number in the United States, the euro did gain back some of those losses to break above the 1.20 level yet again. At this point, it is all about stimulus; but at the same time, you have to worry about very soft economic growth in the European Union. I believe that this pair is going to be a great place to chop back and forth in order to do real damage to your account if you are not cautious. Range-bound systems may work with a slight nod to the downside, but this looks like a mess just waiting to happen.

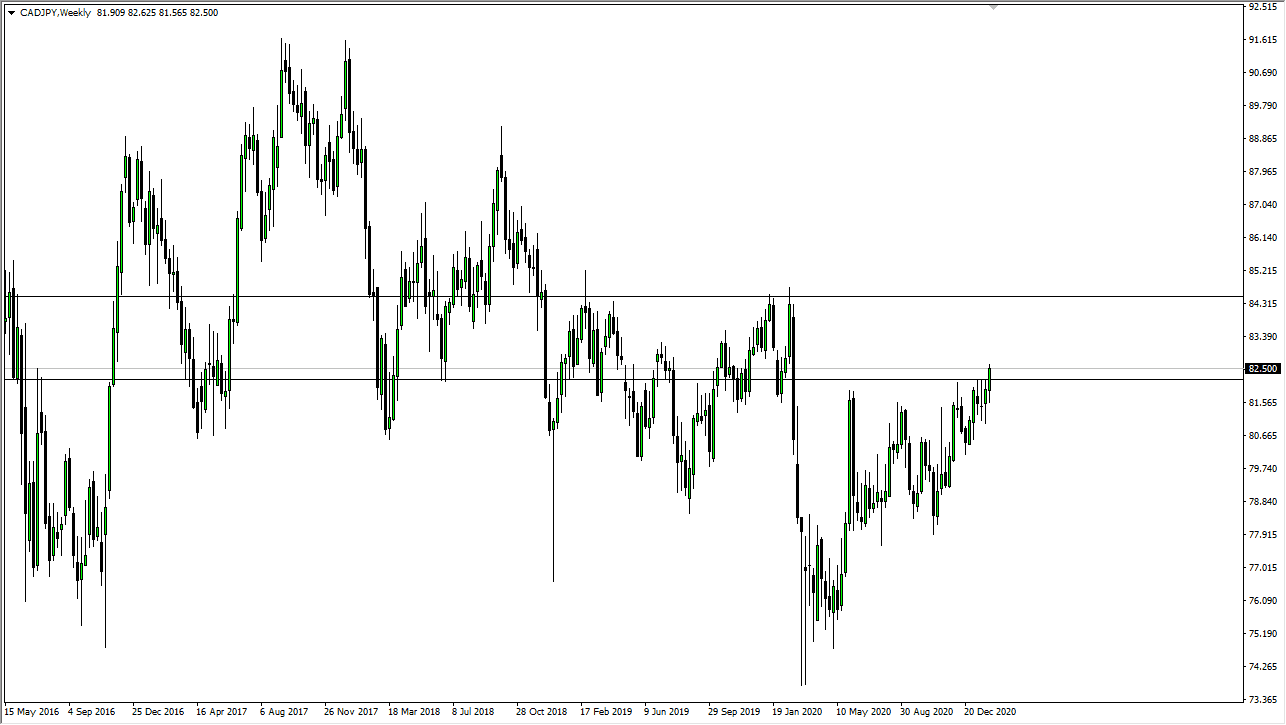

CAD/JPY

The Canadian dollar has broken higher against the Japanese yen during the course of the week, and it now looks as if it is ready to continue going to the upside. If that is the case, you need to see oil continue to rally, and initially, oil may pull back early in the week. However, if you see a pullback towards the ¥82.25 level in this pair, accompanied by a bounce from a pullback in the crude oil market, that should be a pretty good signal that we are going to go looking towards the ¥84.50 level.