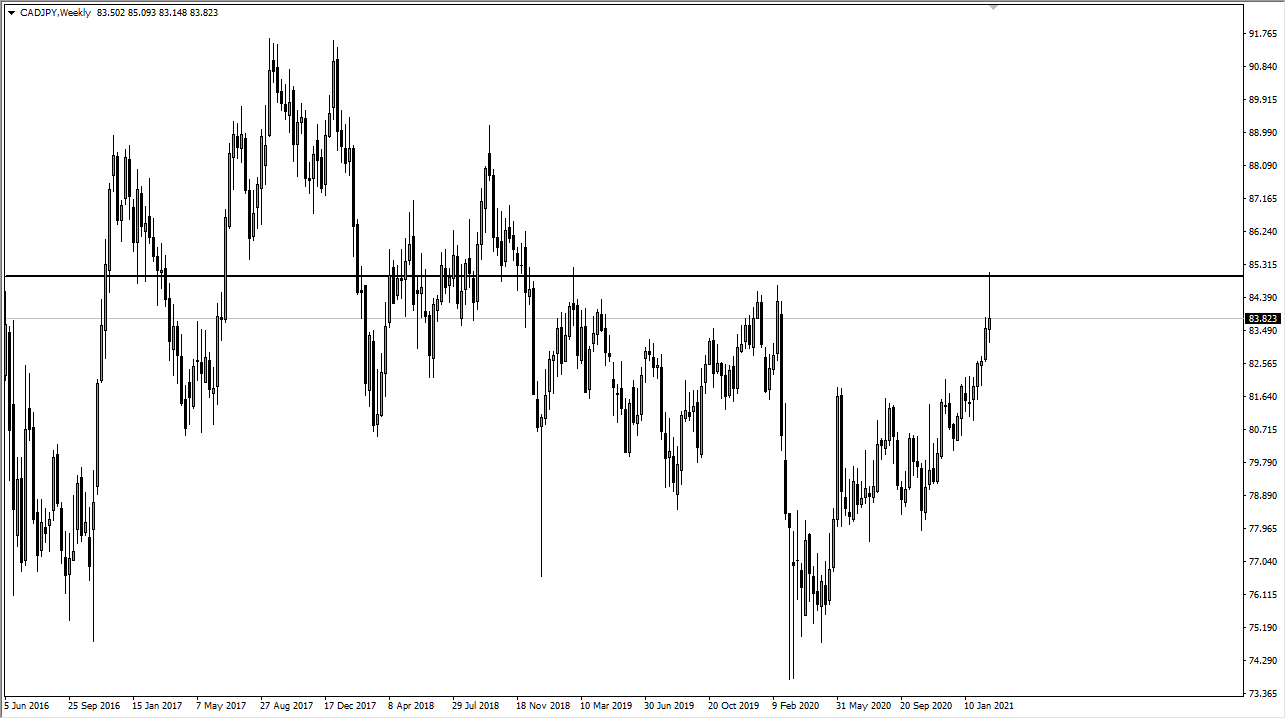

CAD/JPY

The Canadian dollar skyrocketed against the Japanese yen during the trading week to reach towards the ¥85 level, but then pulled back quite drastically. The fact that we formed a shooting star suggests that we could see a bit of a pullback from here, but you need to follow the oil market. If oil does in fact continue to go higher, then it is likely that we could see this market turn around and go back towards that high. However, if we were to break down below the bottom of the candlestick, then we could drop as low as ¥82.

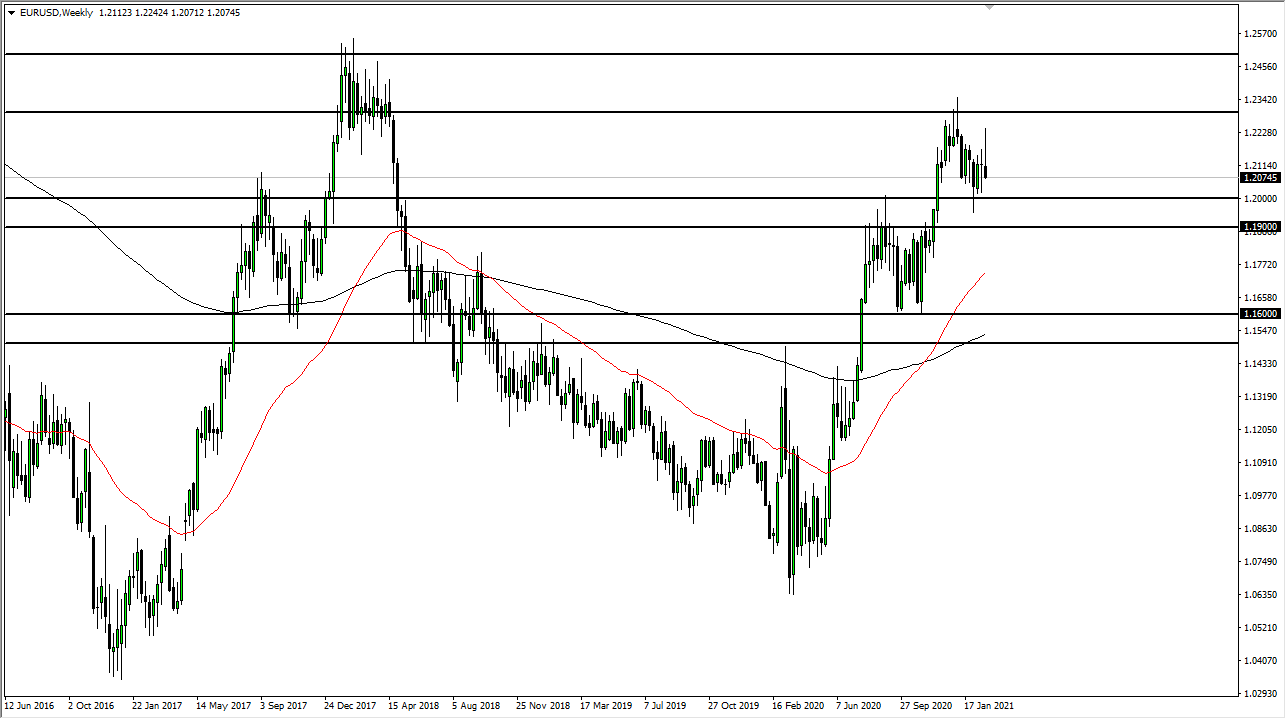

EUR/USD

The euro rallied significantly during the week but then gave back all of the gains as we started to see yields in America rise yet again. Because of this, it makes the US dollar more attractive, but at the end of the day we are still very much in an uptrend. I think this is a market that will continue to be very choppy and sloppy, with the one point to zero level underneath offering significant support. It is not until we break down below the 1.19 level that I would be truly concerned about the euro, but I am not necessarily expecting any type of massive move to the upside either. In other words, I expect more back-and-forth than anything else.

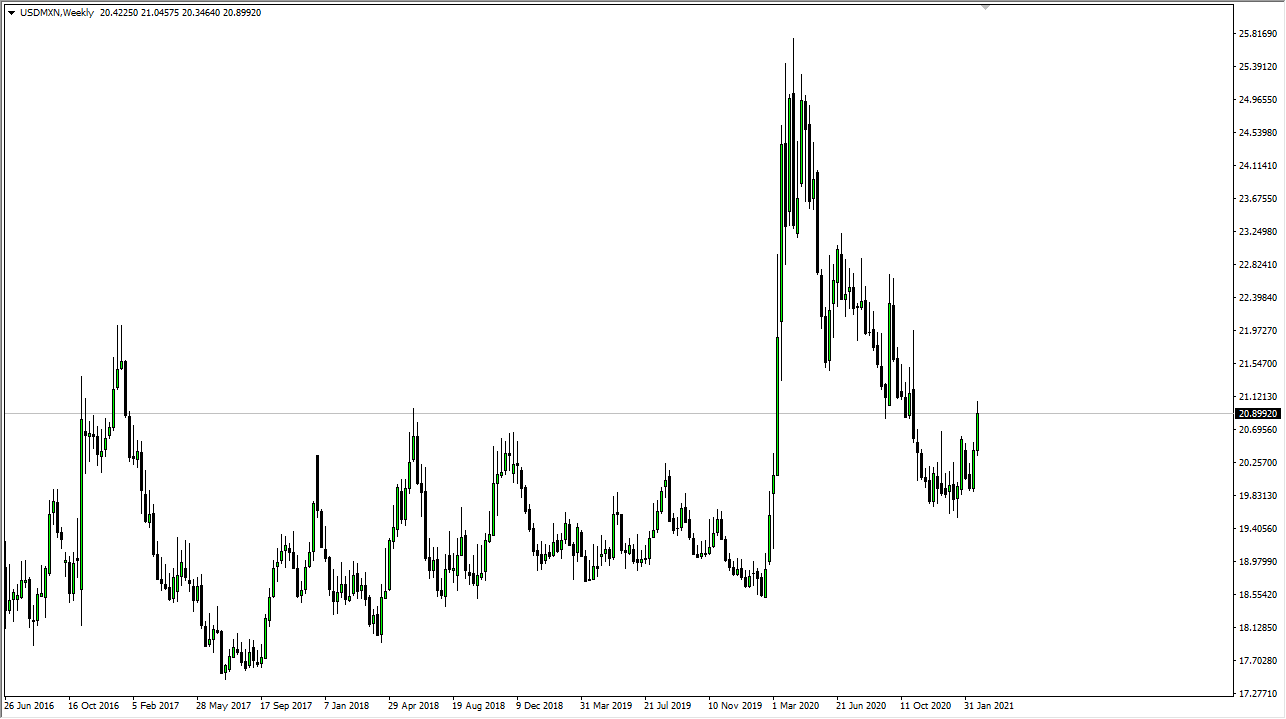

USD/MXN

The US dollar rallied significantly against the Mexican peso during the course of the week, reaching towards the 21 pesos level. It is very possible that we may have bottomed, especially if yields continue to strengthen in the United States. I believe that we may get a short-term pullback in this market, but it certainly seems as if the Mexican peso may continue to get hit, and that this market may continue to try to grind to the upside. However, if we were to break down below the 19.75 MXN level, that could send this market back to the 18.55 MXN region.

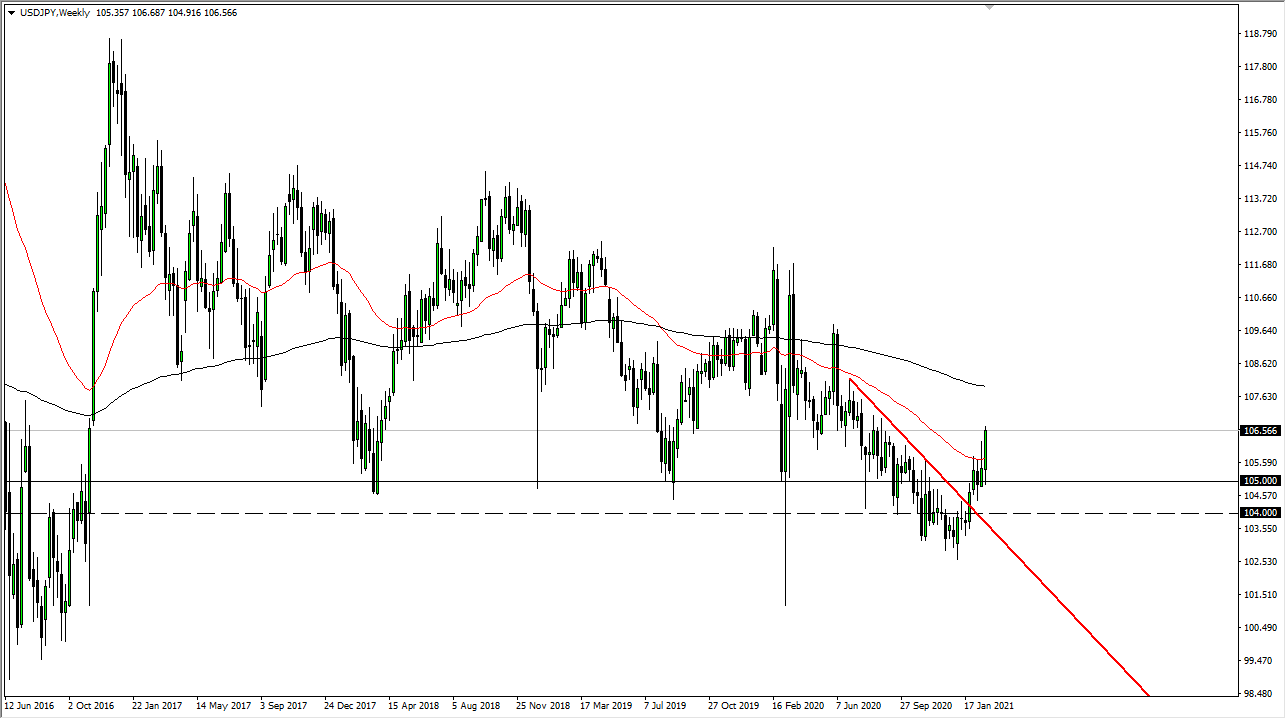

USD/JPY

The US dollar has strengthened significantly against the Japanese yen during the course of the week, breaking the back of the shooting star from the previous week. That is a very bullish sign, and we are closing at the very top of the range. I believe at this point, any time this pair pulls back there will be buyers underneath looking to pick up the US dollar. This will be especially true if 10 year note yields continue to strengthen.