South Africa began its COVID-19 vaccine rollout with the unapproved Johnson & Johnson variant for the more aggressively spreading mutation. The previous vaccine remained ineffective. The government presented plans to vaccinate 40,000,000 and became just the fourth African nation to begin inoculations. The USD/ZAR is on track to resume its sell-off following a counter-trend breakout above its support zone.

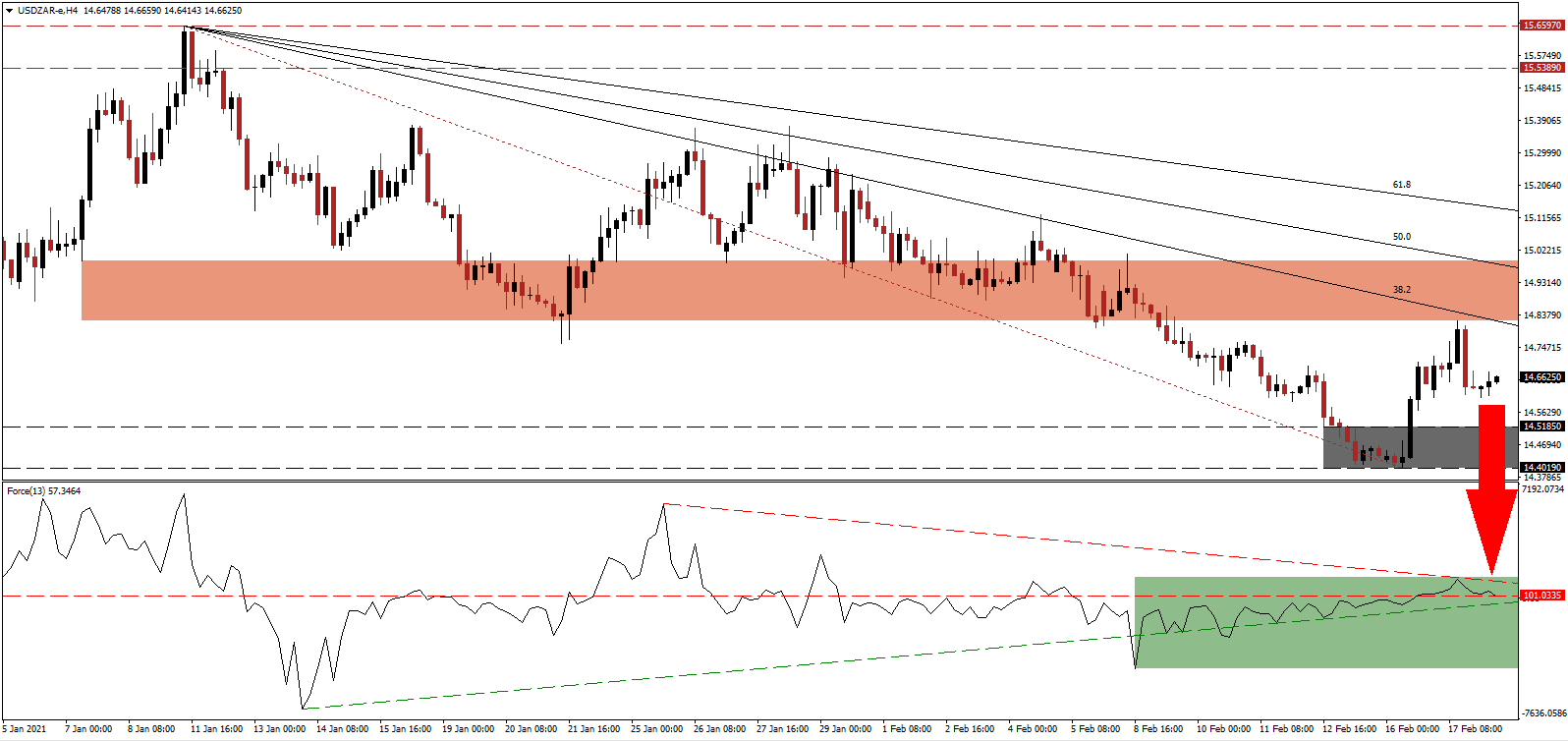

The Force Index, a next-generation technical indicator, settled for a lower high. It is now moving below its horizontal resistance level. Adding to breakdown pressures is the descending resistance level, as marked by the green rectangle. A move below its ascending support level will further fuel a sell-off extension. Bears remain in control of the USD/ZAR, and a collapse in this technical indicator into negative territory will strengthen it.

With South African economic indicators improving and investors with capital and risk appetite seeking higher-yielding markets, capital inflows can continue. 10-year bond yields hovered above 8.50%. The rejection in the USD/ZAR by its short-term resistance zone between 14.8217 and 14.9932, as identified by the red rectangle, can lead to a breakdown extension.

The 2021 budget, scheduled for release on February 24th, is anticipated to reveal better-than-expected tax receipts, adding to bullishness in the South African rand. With the descending Fibonacci Retracement Fan sequence enforcing the bearish trend, the USD/ZAR can collapse through its support zone between 14.4019 and 14.5185, as marked by the grey rectangle. The next one awaits price action between 13.9280 and 14.0605.

USD/ZAR Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 14.6600

Take Profit @ 13.9600

Stop Loss @ 14.8600

Downside Potential: 7,000 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 3.50

Should the Force Index push through its descending resistance level, the USD/ZAR may attempt to follow suit. The upside potential remains reduced to its 61.8 Fibonacci Retracement Fan Resistance Level. Forex traders should sell any rallies amid a bearish outlook for the US dollar.

USD/ZAR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 14.9600

Take Profit @ 15.1200

Stop Loss @ 14.8600

Upside Potential: 1,600 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.60