The improvement in US job numbers was better than expected, contributing to further gains for the USD/JPY pair, which settled around the 105.20 resistance level as of this writing, its highest in nearly three months. This is despite the fact that here are still nearly 10 million jobs lost since the coronavirus hit, and this week, the Congressional Budget Office predicted that US employment will not return to its pre-pandemic level until 2024.

However, there is optimism that with vaccines reaching a critical mass, perhaps around the middle of the year, and the government providing more stimulus, the US economy and labor market will strengthen much faster than they have after previous recessions. Generally speaking, the brighter view falls on three things. The first is that household finances, as a whole, are healthier now, with fewer debt and more savings, than they were after the Great Recession a decade ago. Once contained, that cash protection could increase pent-up consumer spending. This spending, in turn, will support faster employment.

The second premise is that the recession caused by COVID-19 has not yet inflicted the kind of structural damage to the higher-wage sectors of the labor market that the Great Recession did. In 2008-2009, 4 million construction and manufacturing jobs were lost - many of them highly skilled and well-paid jobs - and were never fully recovered. These two sectors are still operating less than they were in late 2007.

The third dynamic is that the Fed and Treasury are now more bent on stimulating US job growth and less anxious about fueling inflation or increasing the budget deficit than they were a decade ago. Most policymakers and economists now believe that one of the reasons for the recent slow and prolonged recovery is that the government provided so little stimulus.

Overall, the prospect of a strong recovery in consumer spending has led economists to refresh their outlook. Goldman Sachs expects US growth of 6.6% this year, which would be the fastest since 1984. Unemployment will drop from the current 6.7% to 4.5% by the end of the year, Goldman Sachs forecasts. By contrast, after the Great Recession, unemployment exceeded 8% until August 2012 - three years after the recession had officially ended.

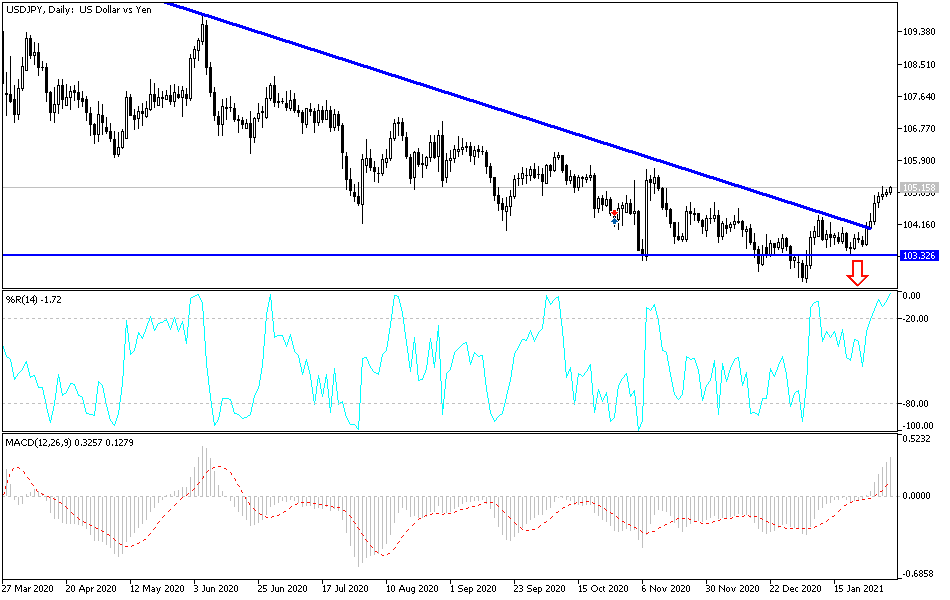

Technical analysis of the pair:

The USD/JPY is taking a strong position ahead of the announcement of US jobs numbers on Friday, which will determine the form of the weekly closing of the dollar, which has so far been in the winning position. Investors rushed to the dollar as a safe haven, despite the slow pace of the United States' vaccination campaign, coinciding with the US issuing global figures of infections and deaths. I often recommend buying the currency pair from every downward level, especially if the pair tests the resistance level at 106.00, which I mentioned is the first stage in changing the general trend to an upside. The pair will continue to maintain its gains until the US jobs numbers are released.

The bears will not return to dominate the performance without moving below the 104.00 support level again.

Today the USD/JPY will be affected by investor risk appetite, as well as the reaction from the announcement of weekly jobless claims, non-agricultural productivity and US factory orders.