At the beginning of last week's trading, the USD/JPY performed well, as it aggressively breached the 106.00 resistance level and reached the 106.22 resistance level, its highest in five months. However, in the last three trading sessions of the week, the US dollar suffered a strong setback, which pushed the pair to retreat again, reaching the support level of 105.23 before closing the week’s trading and settling around 105.42. The greenback was greatly affected by the economic data and inflation concerns. The dollar often defied market expectations in the first several weeks of 2021, but the dollar has weakened in recent weeks due to increased confidence in the global economic recovery.

By the end of the week, IHS Markit's Manufacturing Purchasing Managers' Index (PMI) fell to 58.5 in February, down from a reading of 59.2 in January - any reading of the index above the 50 mark indicates growth. The Manufacturing PMI recorded stronger customer demand, higher export orders and higher production expectations. But hiring, inflation, cost burdens and lengthy delivery times weighed on the PMI readings.

The Composite PMI - which includes the manufacturing and service sectors together - rose to a reading of 58.8 this month, while the Service PMI rose to a reading of 58.9. On the housing front, existing home sales increased 0.6% in January, beating the median forecast for a 1.5% decline. In total, the US real estate market registered 6.69 million in existing home sales, up from 6.65 million in December.

In her interview with CNBC, Treasury Secretary Janet Yellen said that the US economy needs more financial incentives to support the recovery, which added to inflation concerns. "We think it's very important to have a big package that addresses the pain this caused - 15 million Americans are late for their rent, 24 million adults and 12 million children don't have enough to eat, and small businesses have failed,'' she said. "I think the price of doing a little is much higher than the price of doing something big. We believe the benefits will far outweigh the costs in the long run."

The US bond market was in mixed performance at the close of the trading week, with the 10-year Treasury note rising 0.063% to 1.35%. The one-year notes were unchanged at 0.056%, while the 30-year notes rose 0.068% to 2.144%.

The US Dollar Index (DXY), which measures the greenback against a bundle of six competing currencies, slipped 0.21% to 90.40, from an opening at 90.57. DXY is on track for a weekly decline of 0.1%, giving back its 2021 year-to-date gains to 0.5%.

Sales of previously occupied US homes rose again last month, in a sign that the strong housing market momentum from 2020 may continue this year. The US housing market has witnessed a strong recovery since last summer after falling sharply in the spring when the coronavirus broke out. Accordingly, the National Association of Realtors said that US existing home sales rose 0.6% in January compared to the previous month, to a seasonally adjusted rate of 6.69 million units year-on-year. It was the strongest sales rate since October. Sales jumped last year to the highest level since 2006, at the height of the housing boom.

According to data from Johns Hopkins University, there were 69,230 new cases of COVID-19 and 2,452 deaths in the United States by the end of the week. The record for new cases was 300,282 on January 2nd and the record for deaths was 5443 on February 12th. The total number of deaths from COVID-19 in the United States has reached 493,718.

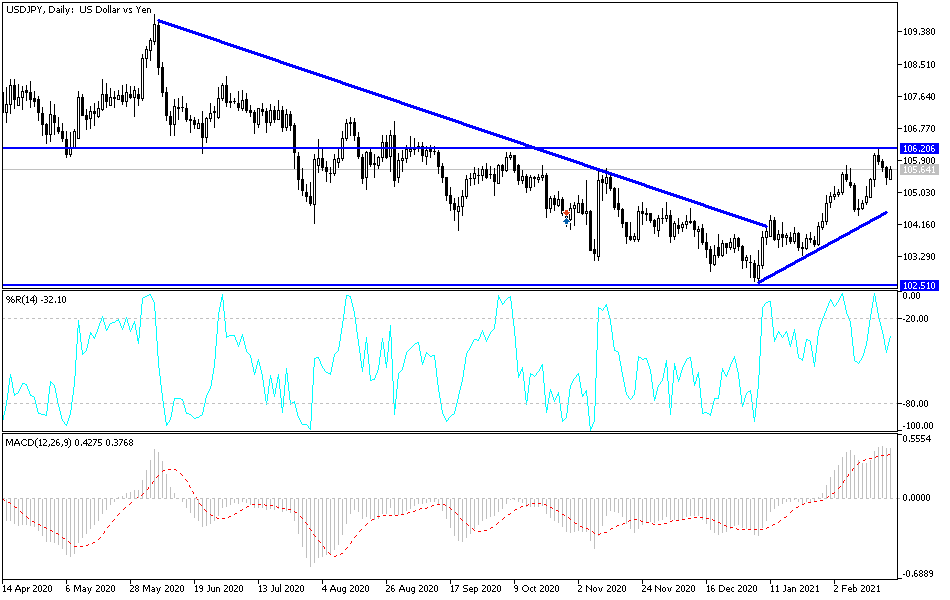

Technical analysis of the pair:

The stability of the USD/JPY above the 106.00 resistance will continue to fuel bullish momentum to move towards higher resistance levels. This contributes to a bullish trend shift instead of the bearish outlook, which the pair is still closest to, especially if it returns to stability below the 105.00 support level. I still prefer buying the pair from every downside level, especially from the support levels of 104.45, 103.80 and 102.90. The goal of the pair's stronger bullish transformation in the long run depends on the movement towards the psychological resistance of 110.00, and this may be possible in passing more stimulus and global elimination of the epidemic.