Prior to the closing of last week’s trading, the Japanese yen fell against the rest of the other major currencies. The USD/JPY pair was able to bounce back up to the 104.94 resistance level, its highest in two-and-a-half months, before closing the week’s trading by stabilizing around 104.72. The yen's decline was driven by more confidence in global financial markets and disappointing economic data. According to the Cabinet Office, the Japanese Consumer Confidence Index fell to 29.6 in January, its lowest reading since August. The last time consumer confidence fell below the 50 level was at the end of 2013. Japanese consumer confidence in overall livelihoods, income growth, purchases of durable goods, and employment perceptions decreased.

Housing starts fell 9% year-on-year in December, down from 3.7% in November. The expectations were for a reading of -3.8%. Construction orders fell at an annualized rate of 1.3% last month, up from 4.7% in November. Japanese retail sales were down 0.8% in December, the Consumer Price Index (CPI) fell 0.4% and industrial production fell 1.6%. On the whole, the Japanese economic data was weak.

Speaking at a virtual meeting of the World Economic Forum, Bank of Japan (BoJ) Governor Haruhiko Kuroda predicted that the world's third-largest economy would recover to pre-pandemic levels as early as March 2022. Kuroda stated that a combination of fiscal and expansionary monetary policy contributed to the stability of the economy, which indicates that the central bank's policy tools will be sufficient to support the Japanese economy.

The Japanese stock market has successfully emphasized both fiscal and monetary policies in preventing corporate failure and unemployment. It is likely that by the end of fiscal year 2021 or early fiscal year 2022, the Japanese economy will recover and return to levels before the outbreak began. Kuroda also stated that the long-term challenge that Japan faces is “greening the economy,” which was crucial before the public health crisis of the coronavirus paralyzed the country and the global economy.

Wages and benefits rose for American workers in Q4 2020, putting the entire year in a somewhat normal range as the pandemic continued to worry the economy. Accordingly, the US Labor Department said on Friday that total workers compensation in the United States rose by 0.7% in the fourth quarter from October to December, an increase from the previous two quarters. Growth was 0.5% in the second and third quarters, down from 0.8% in the first three months of the year. Over the year, wages and benefits grew by 2.5%, with wages and salaries increasing by 2.6% and benefits, which include social security, by 2.3%. Wages and salaries grew by 0.9% in the fourth quarter of 2020, while benefits rose 0.6%.

Compensation costs for workers in the private industry rose 0.5% in the quarter and 2.6% in 2020. The data comes from the Labor Department's Cost of Employment Index, which measures changes in wages for workers who keep their jobs. The data is not affected by mass layoffs in the spring.

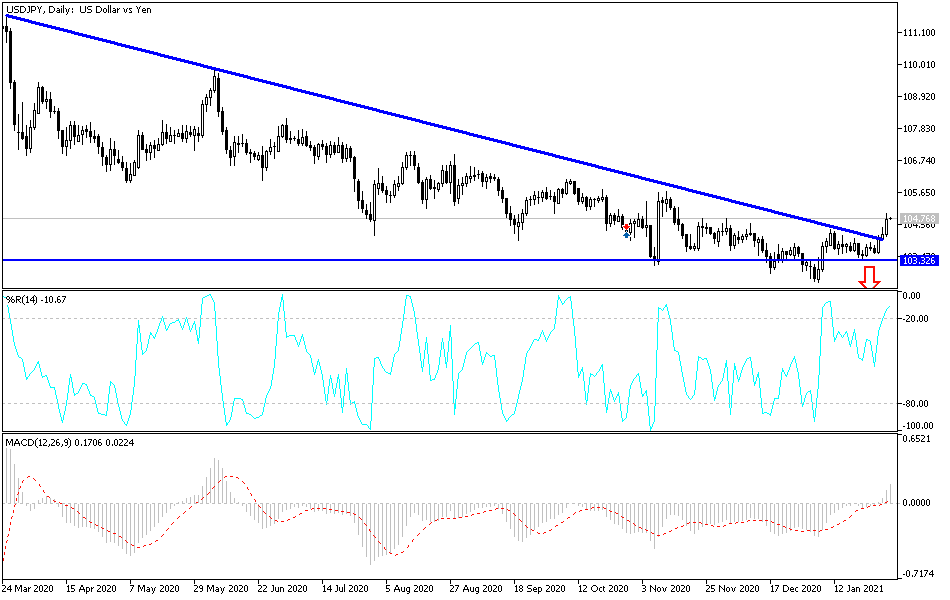

Technical analysis of the pair:

There is no doubt that last week’s trading was important for a general bullish trend in the USD/JPY. As noted on the daily chart, there is a clear bullish break of the downward trend, which will be confirmed by breaching the 106.00 resistance level. The currency pair continues to be affected by global efforts to contain the coronavirus and the future of US economic stimulus plans. According to the performance over the same period of time, the bears will not regain control without moving towards the support levels at 103.90 and 102.85. In general, I still prefer to buy the pair from every downward level, as the technical indicators are still around the oversold areas.

Today's economic calendar:

For the JPY, the Manufacturing PMI reading will be announced. For the USD, the ISM Manufacturing PMI and Construction Spending Index will be announced.