Amid the COVID-19 pandemic, which saw India record nearly 11,000,000 confirmed infections and over 155,000 casualties to date, the political landscape changed into a binary system. Prime Minister Modi aligned with the business-friendly right and the President of the Indian National Congress, Gandhi, with the left. The Indian rupee may benefit from this change in the Indian political landscape with the USD/INR set to extend its breakdown sequence.

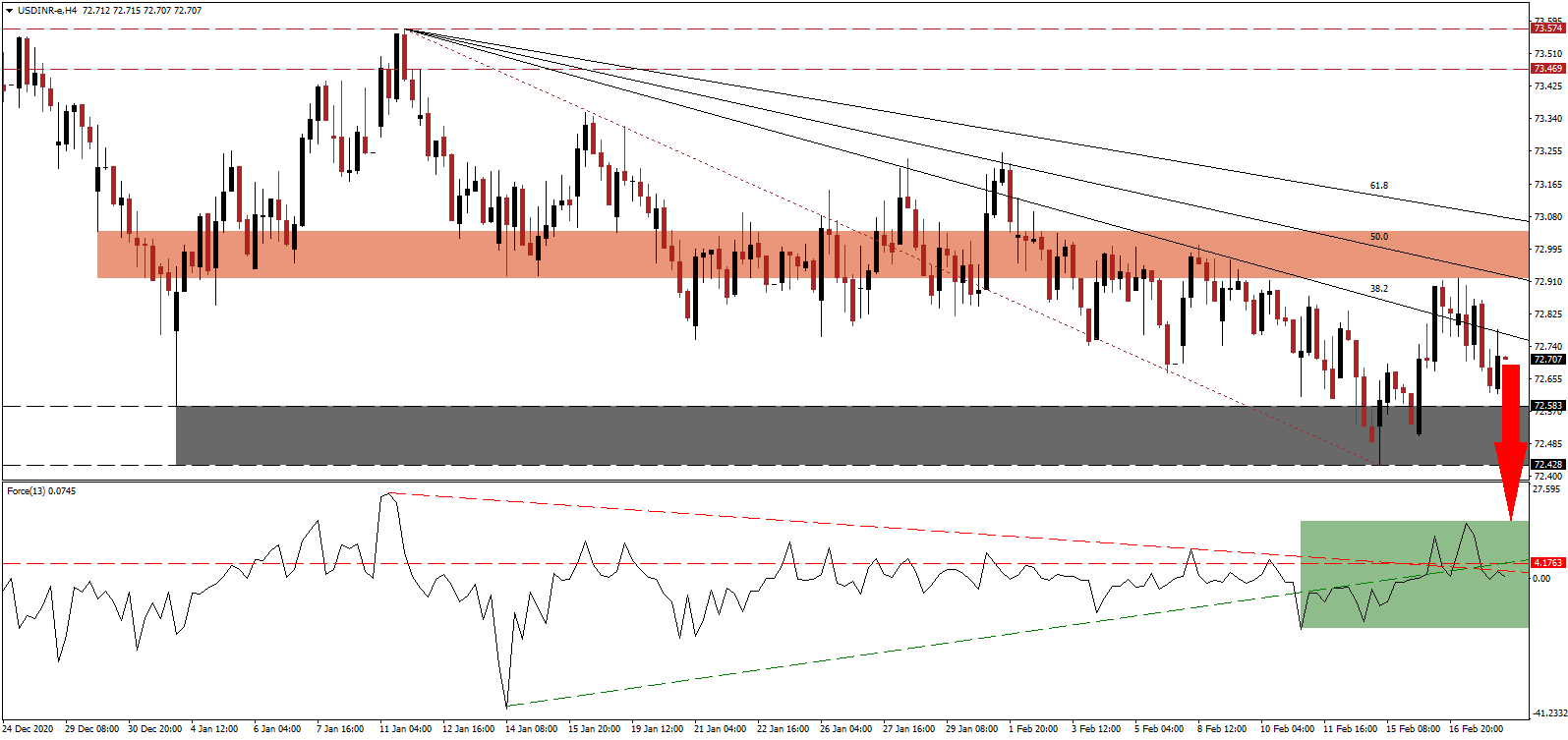

The Force Index, a next-generation technical indicator, retreated from a lower high and moved below its horizontal resistance level. It also slid through its ascending support level, and the descending resistance level adds to downside pressures, as marked by the green rectangle. Bears wait for this technical indicator to correct below the 0 center-line to regain complete control over the USD/INR.

Rating agency S&P Global Ratings believes the Indian economy can expand by 10.0% in its 2022 fiscal year. US bank Morgan Stanley upgraded its forecast to a rise of 12.1%. The increase in positive sentiment aided the USD/INR in contracting below its descending Fibonacci Retracement Fan sequence. A rejection by its short-term resistance zone between 72.918 and 73..041, as marked by the red rectangle, preceded the breakdown.

Criticism following the announcement of the Indian budget claims it ignores those in need and favors the wealthy and businesses. Budget cuts to the education sector and an increase in government debt to finance the budget shortfall remain at the core of frustration. The USD/INR is on course to challenge its support zone between 72.428 and 72.583, as identified by the grey rectangle. A collapse into its next one between 71.419 and 71.706 is likely.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 72.700

Take Profit @ 71.500

Stop Loss @ 72.950

Downside Potential: 12,000 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 4.80

Should the Force Index reclaim its ascending support level, serving as resistance, the USD/INR may embark on a limited reversal. Given the rising debt and inflationary pressures in the US, Forex traders should consider any price spike a secondary selling opportunity. The upside potential remains confined to its intra-day high of 73.248.

USD/INR Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 73.050

Take Profit @ 73.200

Stop Loss @ 72.950

Upside Potential: 1,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.50