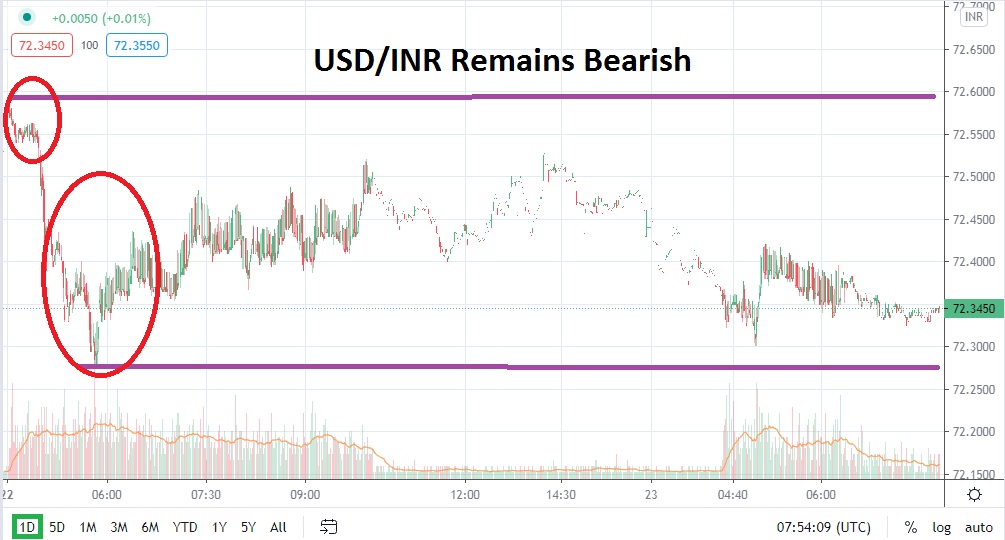

The USD/INR in early trading this morning continues to demonstrate an ability to challenge support levels and prove them vulnerable. The bearish move within the USD/INR has taken an aggressive stance as lower prices have been produced rapidly. Intriguingly for speculators, there is an absence of volatile reversals higher in recent USD/INR trading as the Forex pair has accomplished its current low water marks.

The 72.300 support level should be watched carefully. Yesterday, for a brief moment, the 72.270 level was actually tested within the USD/INR, but the Forex pair then traded higher until it hit a high value of nearly 72.520. Since hitting this higher mark, the USD/INR has recaptured its downward trend rather well and now finds itself within a crucial testing ground.

Even though the USD/INR has produced a fast move downwards, experienced traders know that moves are seldom in one direction. The current support levels of the USD/INR are important because they have not been tested since last year. The last time the Forex pair tested its current values was in February of 2020. This opens the door for technical traders to contemplate long-term charts and consider what may happen if current support levels fail to hold back the bearish tide.

The 72.300 support level could prove important and, if the 72.270 juncture then proves to be inadequate, the 72.223 mark should be watched carefully. The USD/INR has certainly exhibited bearish movement and some traders may suspect that a reversal higher may be a natural reaction to the quick-hitting force of the downward price action. However, until proven otherwise, pursuing more selling positions remains a logical decision within the USD/INR.

Traders who want to buy the USD/INR and look for small reversals higher near current values cannot be faulted, but they should be extremely careful and use rather close take-profit orders above as they target reactionary higher moves. Speculators who continue to pursue selling positions within the USD/INR may want to wait for slight moves higher which touch nearby resistance and then activate their short positions using limit orders. The USD/INR is within an important value range and if current support levels prove vulnerable, lower prices could produce additional fireworks downward.

Indian Rupee Short-Term Outlook:

Current Resistance: 72.395

Current Support: 72.300

High Target: 73.440

Low Target: 72.230