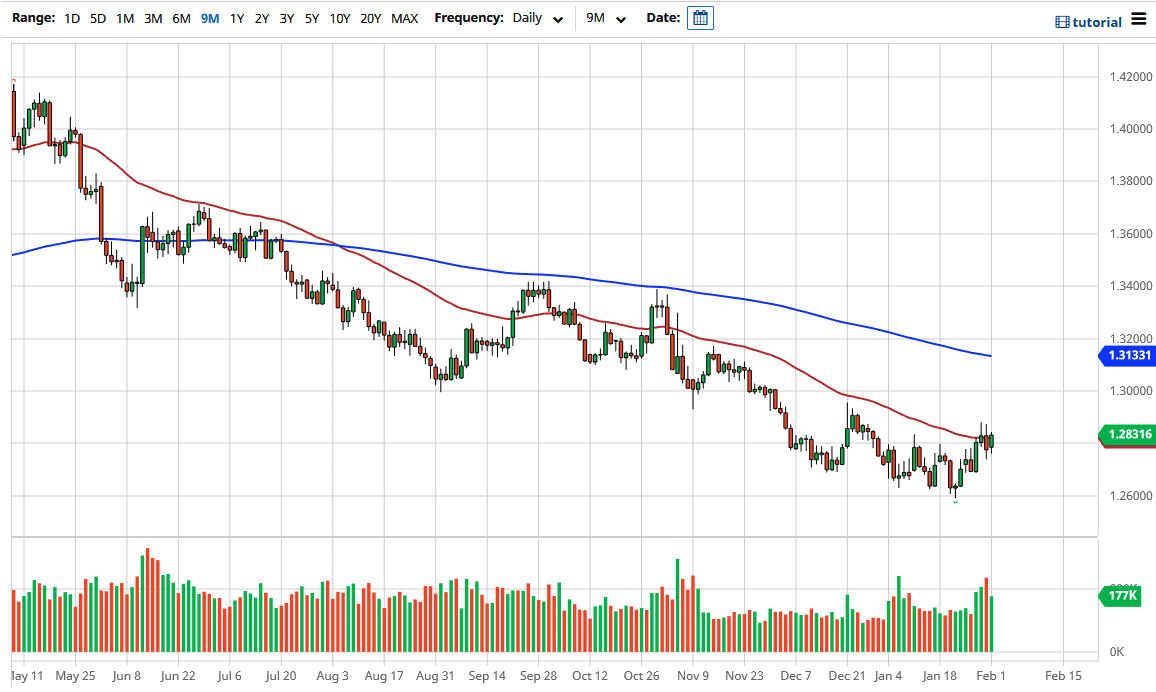

The US dollar rallied a bit during the trading session on Monday against the loonie, as we continue to pressure the 50-day EMA. Looking at the last couple of candles, there are wicks that are above the 50-day EMA, so it does in fact suggest that we could continue to see a bit of trouble. It does make sense that we would struggle, due to the fact that we have a lot of concerns when it comes to energy going higher; but at the same time, there is a ton of stimulus coming out the United States sooner or later. That weighs upon the US dollar, but I also expect that there is a lot of support underneath.

If we were to break above the candlesticks of the last couple of sessions, it is possible that we could go looking towards the 1.30 level after that. The 1.30 level is a large, round, psychologically significant figure, and could bring in more selling pressure. The Canadian dollar is going to be moving based upon oil, and at this point, oil is struggling in general. Furthermore, if we do not get the amount of stimulus that people were initially anticipating, the question then will be whether or not it is enough to drive up the massive demand the people are expecting.

We will probably consolidate in this general vicinity, but there is a real threat of this market turning around. After all, the USD/JPY pair has made a strong argument for turning around, and the correlation between these two pairs does tend to be rather strong, so that is another thing that we should pay close attention to. In fact, I took a couple of trades over the last week in the USD/CHF pair, which also correlates quite strongly to this pair at times. At this point, it is likely that we will continue to see a lot of pushing back and forth, but there is the potential of a bit of a short-term trend change. On the other hand, if we were to break down below the 1.26 level, then it is likely to go looking towards the 1.25 handle after that. That is a large, round, psychologically significant figure and an area that historically has been supported. I think we have a battle ahead.