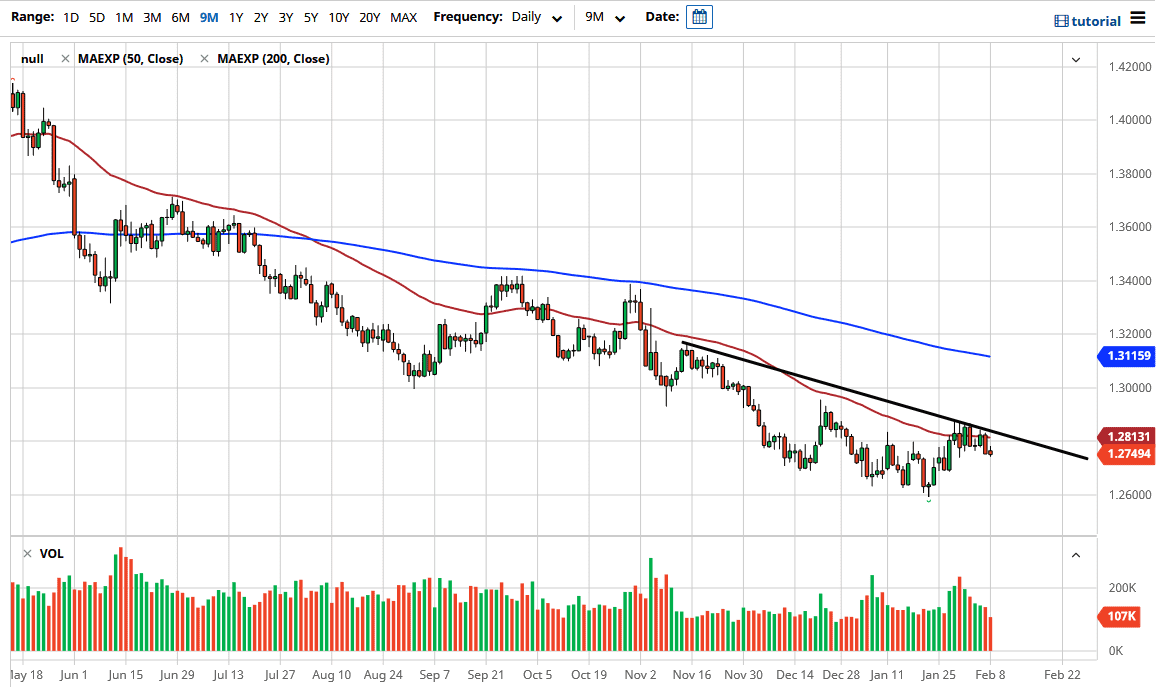

The US dollar initially tried to rally on Monday but then fell again as crude oil markets rallied. It does look as if the Canadian dollar continues to go higher in value, especially as crude oil is such a major driver of it. That being the case, I think that we may continue the overall downtrend, but if we can break above the downtrend line that I have on the chart and the 50-day EMA, that could be the start of something quite interesting, perhaps opening up a move towards the 1.30 level above.

This is a market that is going to behave just as it always has, moving on crude oil. The crude oil market has seen several strong sessions as of late, so I think that is worth paying attention to. The candlestick is a little bit weak, further showing the negativity in this pair that we had seen on Friday. What is interesting is that the jobs number in Canada was actually worse than the one in the United States, but people are choosing to overlook that, and focus solely on oil.

There are plenty of buyers underneath, extending down to the 1.26 handle. With that in mind, I think that we are probably going to struggle to break down through that area. When you look at longer-term charts, you can make a strong argument for the possibility that the 1.26 level begins significant support that extends all the way down to at least the 1.25 level after that. Because of this, I think this is a negative market, but we clearly need to keep an eye on this downtrend line because it is starting to act like what we had seen in the USD/JPY pair. As long as that is a potential problem, then you need to see whether or not we can get a daily close above this downtrend line, which could send this market much higher. Nonetheless, the one thing that we are looking at going forward is going to be significant volatility. Oil markets have gotten a little stretched, but they do tend to run based upon FOMO, just like a lot of the other commodity markets out there, so it could run longer than anticipated.