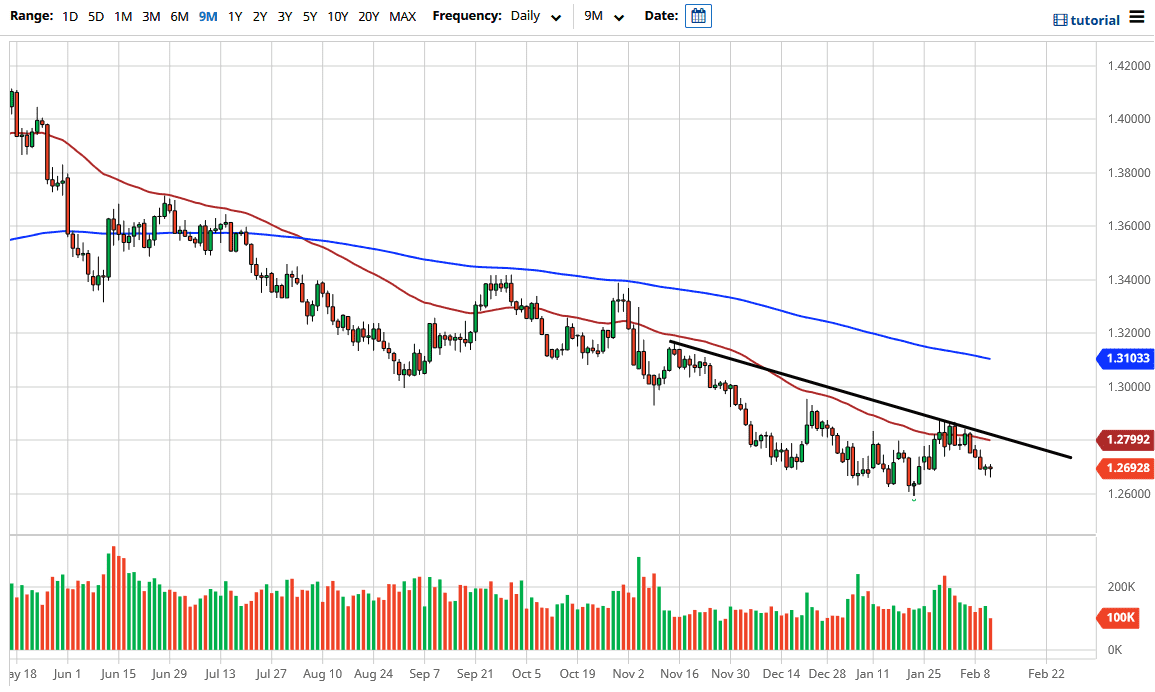

The US dollar/Canadian dollar pair has been sideways during most of the trading session on Thursday, which makes quite a bit of sense considering that the oil markets were relatively quiet as well. Furthermore, the market is a little bit oversold for the short term though, and at this point I think a bit of a bounce makes quite a bit of sense, especially if we have a scenario where oil pulls back like it looks like it could. I am not saying that I expect some type of major shot straight up in the air, but a return to the 50 day EMA which is currently at the 1.28 level certainly makes a significant amount of sense. Beyond that, we have formed the second hammer in a row on the daily chart, something that is worth paying attention to. This does not mean that the market is suddenly going to scream to the upside, but it does suggest that previously mentioned bounce.

When looking to the downside, the 1.26 level is obviously an area that a lot of people have paid attention to. We have formed a nice hammer there, so the question now is whether or not we are trying to turn the trend around? What I find particularly interesting is that just below the 1.26 level is the beginning of fairly significant longer-term support. Is this market telling us something about the US dollar or perhaps even the oil markets going forward? I think it is far too early to tell but if we broke above that downtrend line that I see intersecting with roughly 1.28, that could be a major morning sign that the Canadian dollar is about to get hammered.

Pay attention to the oil market, it certainly has its say when it comes to the value of the Canadian dollar, but it is not the entire reason to trade this currency. Canada also is highly levered to the US economy, so to come down to whether or not the Americans can pick it up going forward. It does seem like America is strengthening in a bit, so typically what will happen in that scenario as money will flow into the greenback first, and then back into the Canadian dollar. At the very least, I think a short-term bounce could offer a nice opportunity to short again, or perhaps take a longer-term buying position if we break out.