The US dollar has been all over the place against the Canadian dollar during the trading session on Thursday as we have seen oil pulled back just a bit. Ultimately, this is a market that is testing a major bottom that starts at the 1.26 level and extends down to the 1.25 handle. That is an area that I think given enough time will decide where this pair goes next, and of course oil probably only has so far to go as it is a bit overextended at the moment. Because of this, we could be getting close to a reversal, but at this point in time I think that a turnaround is possible.

In the 10 year note has shown itself to be selling off rather drastically, as yields continue to rise in America. That makes the US dollar attractive, so it is possible that this could work against the Canadian dollar and the oil market as well. With this being the case, I like the idea of taking advantage of some type of break out if we get it, but I will not hesitate to start selling if we get well below the 1.25 level as well.

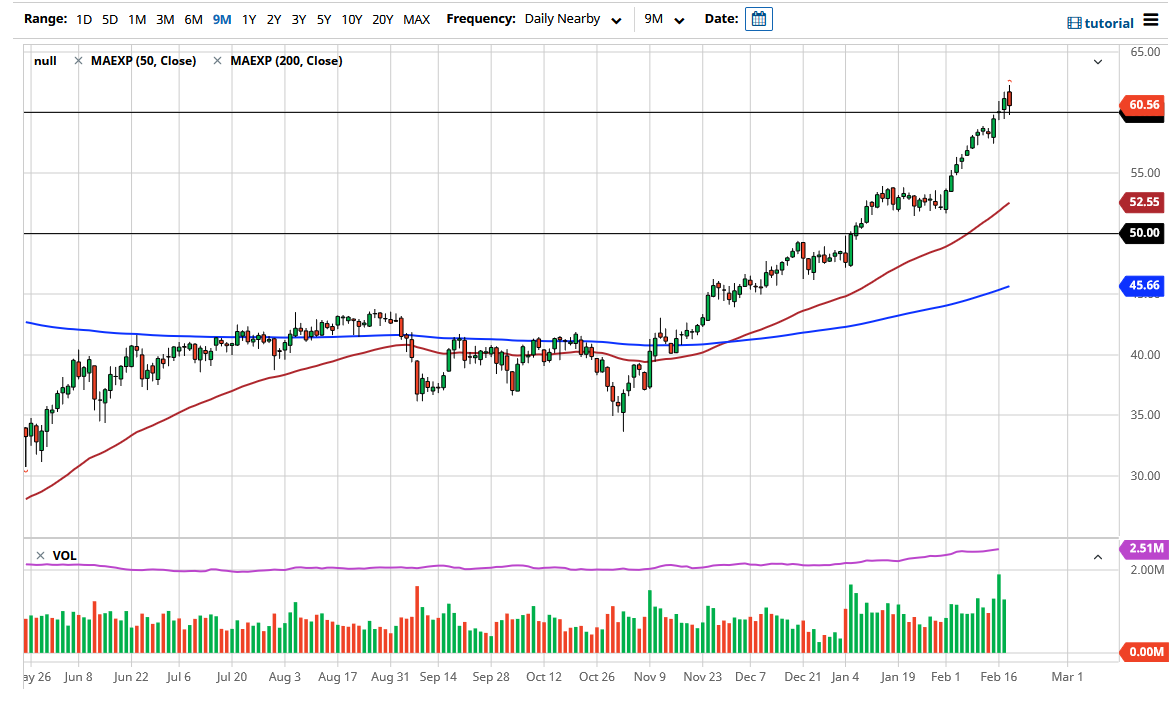

The most obvious break out point would be a move above the 50 day EMA, and perhaps the downtrend line as well. That being the case, if we break above those levels then we could see a complete reversal as we are at a major support level and of course it might only be a matter of time before we reach all the way up to the 1.30 level. That is an area that is a large, round, psychologically significant number, and we could probably see some type of significant reaction to it as well. If the market was to break above there, then it is likely that we would see an even bigger move to the upside.

Ultimately, the Canadian jobs report was a very poor as well and therefore it is possible that we could see that have a major influence on this pair also. After has been said and done, the question now is whether or not we are forming a bit of a “double bottom?” In general, this is a market that I think continues to see a lot of chop, but we will be making a longer-term decision rather soon.