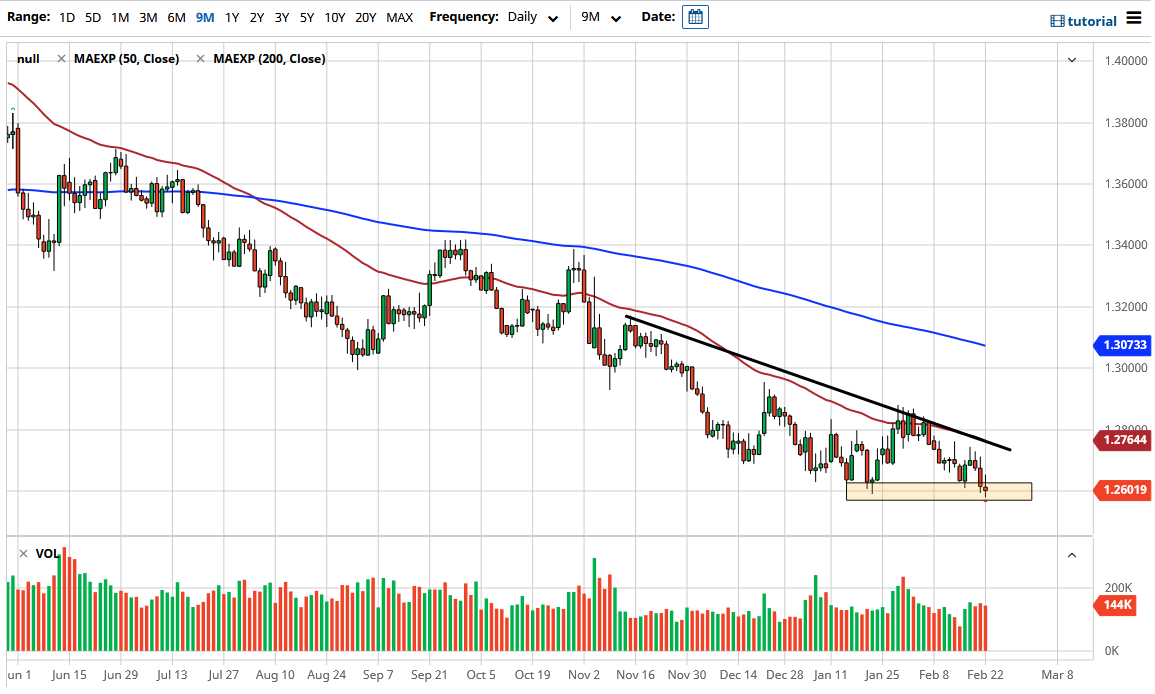

The Canadian dollar strengthened a bit against the US dollar during the trading session on Monday, as the pair has reached just below the 1.26 level at one point. Having said that, the inverted hammer that formed for the day suggests that we could continue to see bearish pressure. Furthermore, if you look at the WTI Crude Oil market, you can see clearly that we are trying to make an attempt to break above the shooting star from the previous week. If that happens, that should be a very bullish sign for the Canadian dollar, as Canada is a proxy for crude oil as far as currency traders are concerned.

On the other hand, if we were to break above the top of the candlestick from the Monday session, that could open up a move towards the 1.2750 region. Ultimately, I think that area could be rather resistive, and the downtrend line that sits just above could cause some issues. Further compounding the downward pressure is the fact that the 50-day EMA is walking right along with the downtrend line.

If we do break down below the bottom of the candlestick, then it is likely that we could go looking towards the 1.25 handle. The Canadian dollar has been strengthening quite a bit over the last couple of months as perceived demand continues to strengthen. Furthermore, OPEC has cut back on output, and then finally we also saw quite a bit of bullish pressure on the oil markets due to the freezing conditions in the central part of the United States, cutting off 40% of American production.

If we did somehow break above the downtrend line and the 50-day EMA, then I believe that this pair could go looking towards the 1.30 level. That is a large, round, psychologically significant figure, so I think that there would be a lot of noise in that area as well. Furthermore, the 200-day EMA would more than likely be down in that general vicinity if we did get the breakout. That being said, I think at the very least we are looking at a market that will continue to sell short-term rallies unless the oil market falls apart.