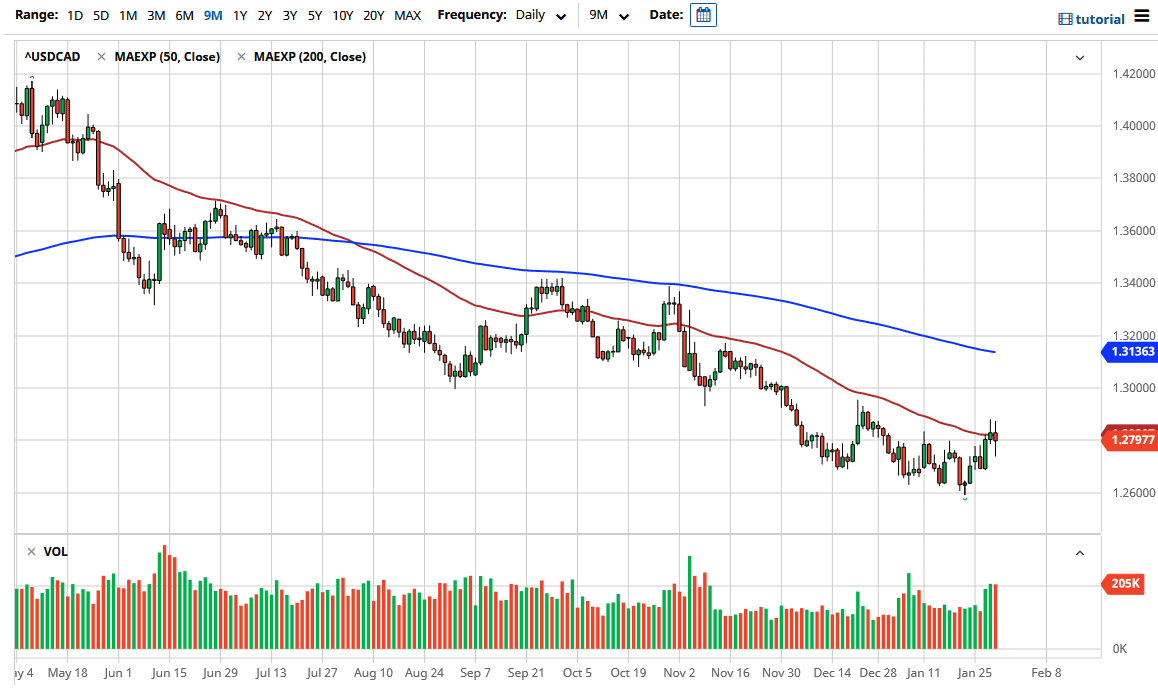

The US dollar fluctuated against the Canadian dollar during the trading session on Friday, as we continue to dance around the 50-day EMA. This suggests that perhaps there are some cracks in the ice, but we are clearly looking at an area that is going to continue to be crucial. The 50-day EMA attracts a lot of attention in general, so looking at this chart, we are probably going to see markets trying to get to the 1.30 level if we can break above the top of the candlestick for the past couple of trading sessions.

The pair is trading at extraordinarily low levels, and it should be noted that the 1.26 level - and even more importantly, the 1.25 level underneath - are massive support, so I think it is very possible that we may get a bit of a bounce. Pay attention to crude oil, because that will have an effect on the markets as well, as the Canadian dollar is essentially a proxy for crude oil. The candlestick itself for the trading session shows just how confused the market seems to be right now, so we will probably see choppy behavior more than anything else.

If we were to break above the 1.30 level, I would suggest that perhaps it is a trend change, but I think it would take quite a bit of movement to make that happen anytime soon. If we did break above the 1.30 level, then I think the next target would be the 1.34 level. On the other hand, if we were to roll over and start selling off and break down below the 1.25 level, it would be absolutely toxic for the US dollar, and that would probably see currencies around the world gaining against the greenback in a continuation of what we have seen of the last several months. Even if we were to do that, a short-term bounce probably would not be the worst thing to happen, because markets cannot go in one direction forever. It seems as if the 1.28 level in general is a bit of a magnet for price over the last 48 hours, so pay close attention to any candlestick that closes a decent distance from that level as a potential signal.