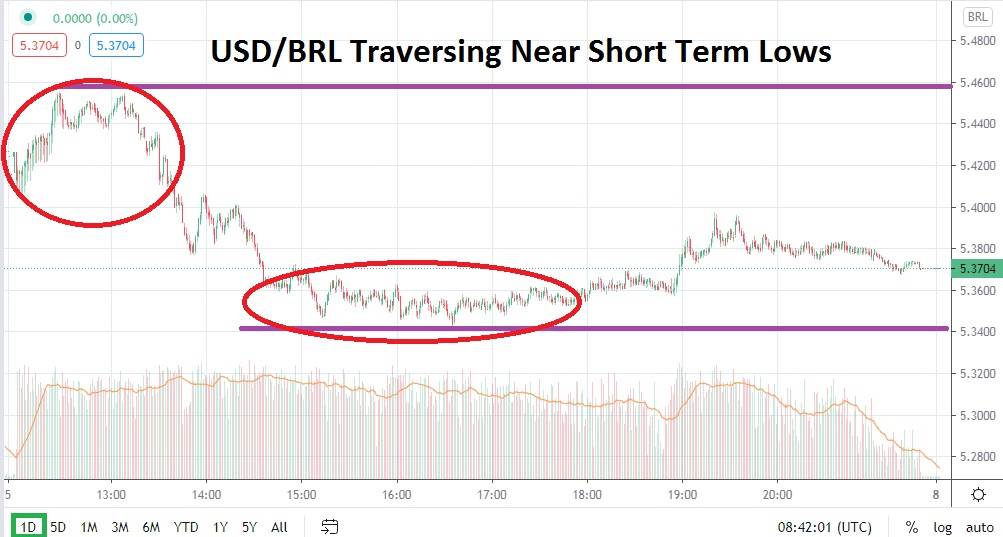

The USD/BRL is trading within proximity of short-term lows, but traders should not be fooled into thinking there is a certainty that the Forex pair is going to break through support levels. The past year of trading within the USD/BRL has delivered a fairly constant barrage of choppy waters. Speculators who have been successful trading the Forex pair have likely been able to take advantage of short-term trends and been able to adapt to changes in direction astutely.

Current support levels for the USD/BRL have actually increased the past week of trading via technical charts and resistance levels have also incrementally moved lower. While the consolidated trading range of the Forex pair may lead some traders to suspect that a sudden breakout is about to occur, taking into consideration the long-term value of the USD/BRL since April of 2020, no guarantees look secure.

The USD/BRL may have speculative optimistic winds blowing short-term, because global equity indices including the Ibovespa have done better recently. However, Brazil remains an outlier regarding value of the Brazilian real compared to the US dollar. Other major currencies have achieved bearish trends against the USD, while the BRL has not. Traders should remain cautious within the Forex pair and not be targeting gigantic moves until otherwise proven wrong.

The support juncture of 5.3450 to 5.3100 remains quite strong. Until the 5.3100 mark is brushed aside and the 5.2800 level proves vulnerable, traders may want to continue to target higher reversals from these levels. Yes, the USD/BRL was trading near the 5.1800 level in the middle of January, but the tendency of the Forex pair to produce an abundance of reversals within the 5.2400 to 5.5500 has been demonstrated excessively. Until these low and high water marks are broken, traders should consider looking for reversals to be the norm.

Buying the USD/BRL if it touches the 5.34000 mark and using a close stop loss below may prove to be a favorable speculative wager. If the USD/BRL trades higher and reaches the 5.4200 to 4.4600 range, speculators may want to sell the Forex pair. Again, short-term goals within the USD/BRL which are modest may produce the best results as the Forex pair fights to establish a more significant trend.

Brazilian Real Short-Term Outlook:

- Current Resistance: 5.4000

- Current Support: 5.3450

- High Target: 5.4600

- Low Target: 5.3200