The USD/ARS remains a long-term buy for speculators with the capability to hold onto positions and manage their risks. The Argentine peso remains within a death spiral. This may sound overdramatic, but it is an actual fact. The USD/ARS has little hope of suddenly developing a consistent bearish trend until a massive upheaval in the way Argentina conducts its government policies. The Argentine peso is not a coveted currency.

Argentina is within the midst of asking for more time to pay back debt to a variety of global institutions and investors. Arbitration decisions which have gone against Argentina have been acknowledged, but that hasn’t made collecting money owed by the nation to its creditors any easier.

The value of the USD/ARS remains a virtual world in many respects. While the government quotes a rate of exchange, which is what speculators see on their trading platforms, the actual cash value on the streets of Buenos Aires for those who seek to change USD into pesos is nearly twice the ‘official’ rate. The people of Argentina are suffering the perils of long-term corruption via its governments. The USD/ARS needs to remain a speculative buy for traders with the capability to pursue its bullish run which persists.

Traders should be careful when buying the USD/ARS by using limit orders so their price fills are not exaggerated. It is a wise decision to also use appropriate and active take profits within trading platforms, and keep stop loss targets away from potential momentary spikes downward which are sometimes generated. Speculators are also advised to acknowledge the cost of carrying the USD/ARS overnight which likely carries a steep price for the privilege of being allowed to trade the Forex pair.

Traders new to the USD/ARS may be skeptical about the one-way avenue upwards that the Forex pair has provided. Speculators who are new to the USD/ARS are encouraged to look at long-term charts and understand the persistent bullish trend which is clear. Buying the USD/ARS is not the difficult part of trading the Forex pair; having the patience for the track upwards to develop needs to be understood because going long and profiting from the USD/ARS is likely not a one-day trade.

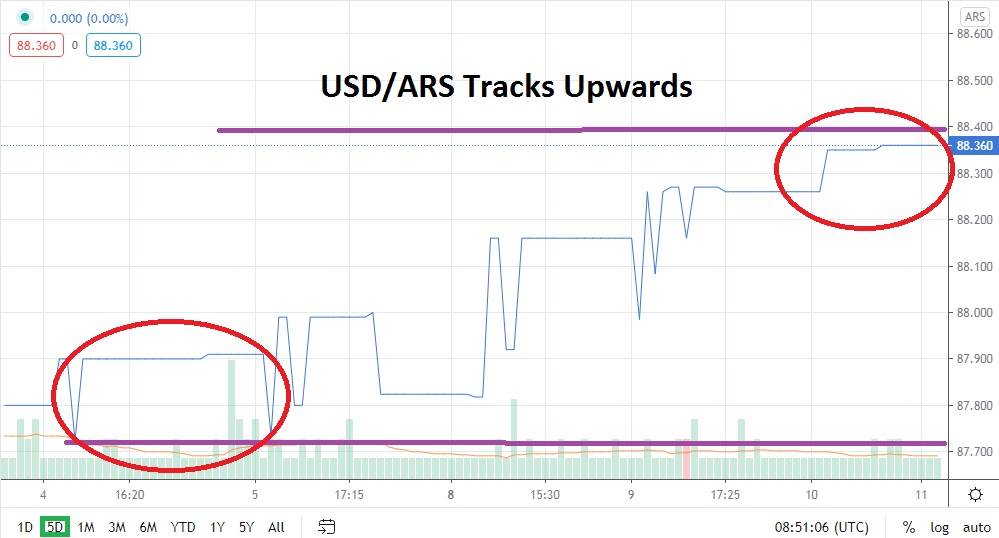

Argentine Peso Short-Term Outlook:

- Current Resistance: 88.500

- Current Support: 88.080

- High Target: 88.700

- Low Target: 87.800