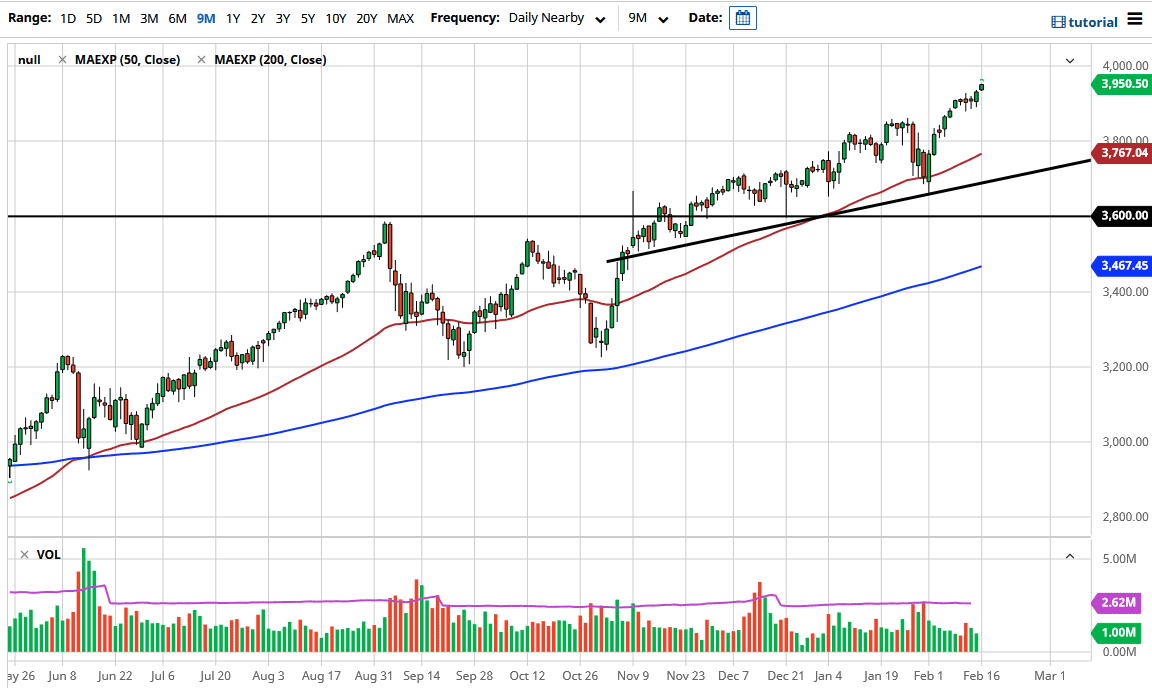

The S&P 500 gapped slightly higher to kick off the week on Monday in the futures markets, and then rallied it towards the crucial 3950 level. In fact, we closed at the very top of the range which is bullish, even though the underlying index itself was not actively trading during the session. In other words, this was completely driven by thin trading overseas, but when you look at the chart, you can see this was the direction we were already heading. We simply extended what looked like a continuation of the uptrend going forward.

Pullbacks at this point should continue to find plenty of support, especially near the 3900 level. We have seen that tested several times in the last couple of weeks, and the fact that it is holding is an encouraging sign. I have no interest in shorting this market anytime soon, because the S&P 500 is driven by about seven stocks. Those are all the household names that nobody dares to short, such as Facebook, Microsoft, Netflix, and so on. These household names continue to be the ones that everybody buys, so it is really hard to fight this overall trend.

If we did get some kind of significant break down from here, I would love to see this market look towards the 3800 level for support. It is not only a large, round, psychologically significant figure, but it is also roughly where the 50-day EMA is hanging about. That means that it has confluence that we can start to look at as a potential reason to get long.

The size of the candlestick for the day was nothing too special, but you need to keep in mind that this was electronic trading due to the fact that it was President's Day in America. None of the true money was flowing into the actual stock market, so that influence was not final. This means a “buy on the dips” type of scenario, and it certainly looks as if there is a certain amount of support near the 3900 level that has recently launched this market higher as well. I do think that it is only a matter of time before we reach towards the 4000 handle which is a large, round, psychologically significant figure as well and I believe that there will be a lot of profit-taking in that region.