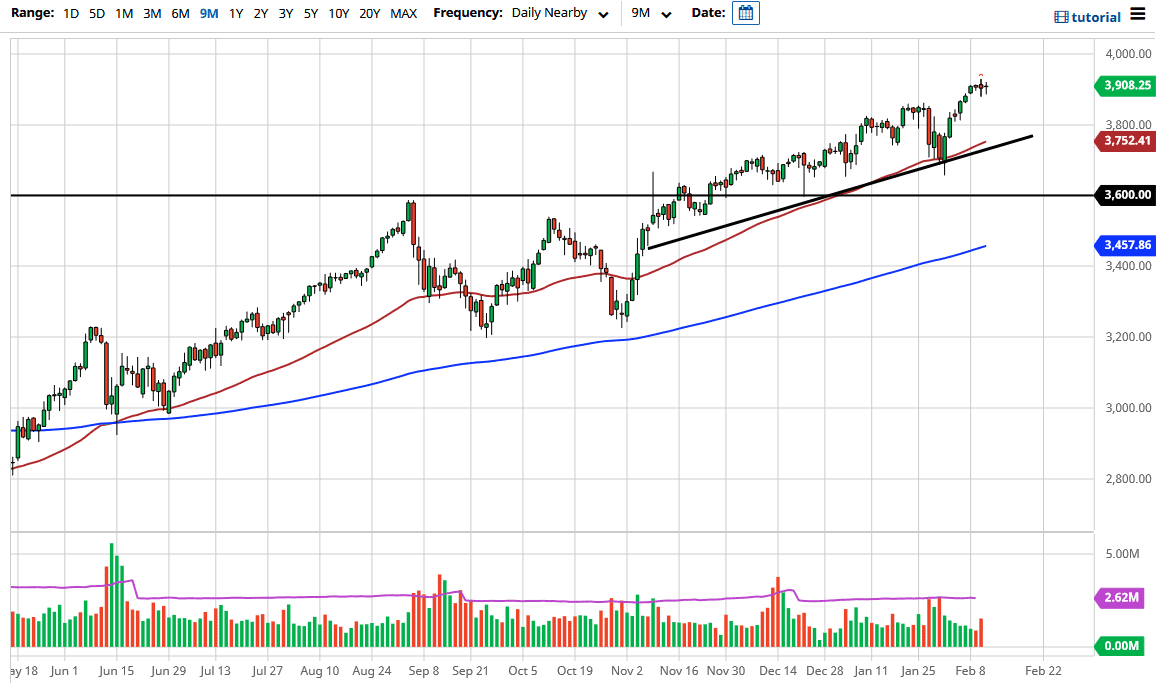

The S&P 500 has done very little during the trading session on Thursday as we continue to simply kill time after the most recent shot higher. This is actually pretty impressive, considering that one would have thought that we got a little overextended and a pullback would make quite a bit of sense. Having said that, when you go sideways you can sometimes do the same thing in order to work off some of the froth in the market that had been overdone.

Underneath, the 50 day EMA has offered support, just as the uptrend line did. I think at this point in time it is very difficult to imagine a scenario where we would break down below there, but if we did then at that point, I think you simply stand to the sidelines and wait for the market to bottom before buying again. I learned a long time ago that there is no point in shorting these indices as long as central banks continue to liquefy the market. After all, ever since the Great Financial Crisis central banks have done everything, they can support markets, and the Federal Reserve is no exception. With that in mind, I think that we will continue to see buyers on dips, especially as we have the “reflation trade” narrative.

I think overall, we will eventually go looking towards the 4000 handle, due to the fact that it is the next large, round, psychologically significant figure, and it is of course the area that I have been targeted for some time as it is a large options barrier. When you look at the previous consolidation underneath, it measured 400 points as we were trading between the 3200 level and the 3600 level. By breaking above the 3600 level, it suggests that this market is going to the 4000 handle. This does not mean that it takes off and go straight up there right away, but it does mean that we should see buyers coming in on dips regardless. Nonetheless, there is no reason to think that the markets are to behave any differently than they have in the past, so buying on the dips will continue to be one of the favored strategies used by traders. This is especially true now that we are in an environment where indexing becomes the most common way to trade.