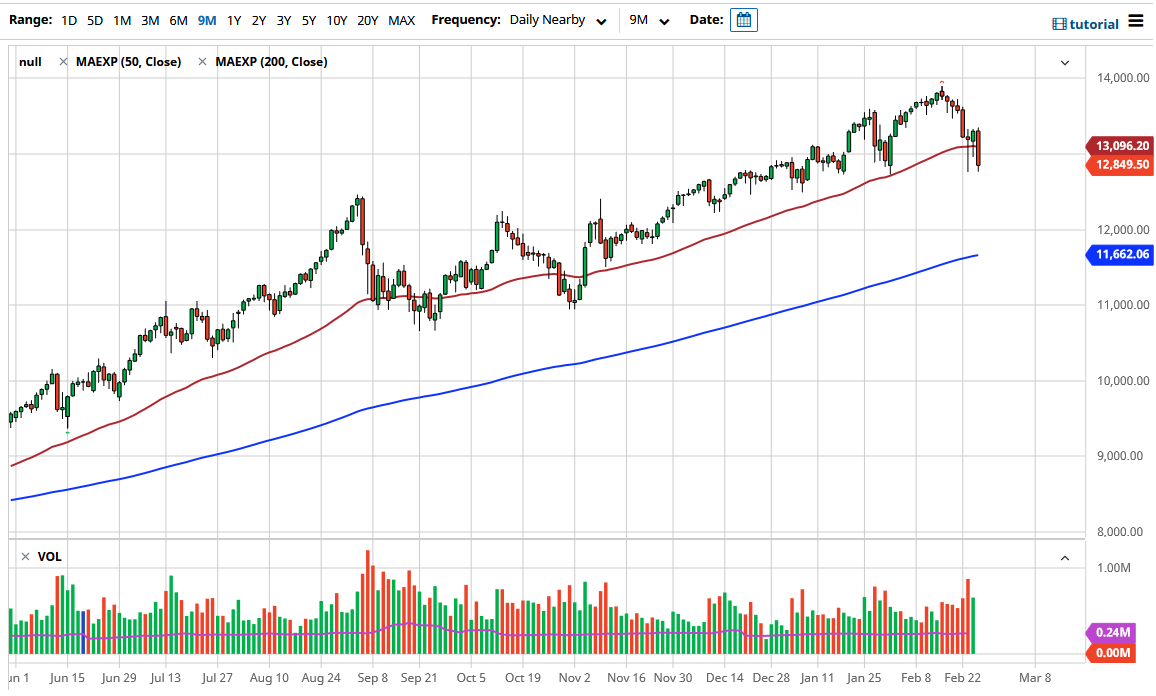

The NASDAQ 100 has broken down significantly during the course of the trading session on Thursday to slice through the 13,000 level. Ultimately, the market is testing the bottom of the hammer from the Tuesday session, which looks so hopeful. That being said, the 10 year yield has caused absolute chaos in general, as the NASDAQ 100 had been one of the big “highflyers on Wall Street.” As the market broke down below the 13,000 level, the correlation between the interest rates rising in the United States and stocks being crushed fed the machine. Algorithms continue to sell, and quite frankly one of the things that probably saved the market more than anything else with the fact that it had to close.

That being said, the candlestick is closing close to the bottom, and I do think that it is only a matter of time before we break down rather significantly if this keeps up. If we break down below the bottom of the hammer from the Tuesday session, that could have a lot of selling pressure coming into the market, and we may at last get the overdue correction that most traders have been waiting for. It is a bit interesting that we could not quite reached the 14,000 level, but I think we probably find a way back up there given enough time.

“Private Equity Powell” gave his testimony in front of Congress the other day but was not there to calm down the markets on Thursday. That being said, it is more than likely going to facilitate some type of selloff that buyers will get involved in sooner or later. However, one of the things that Federal Reserve governors have been stating is that they are no longer as concerned about interest rates in the short term as they once were, and that gives people the idea of selling bonds. However, I do think that it is only a matter of time before the Federal Reserve steps in and start buying them again. Ironically, this is almost a situation where bad news will become good news again, at least for the moment. Traders are desperately looking for some type of help from the Federal Reserve, and we all know from watching for the last 13 years that it is only a matter of time before it happens.