The NASDAQ 100 traded its e-mini contract electronically during the trading session on Monday, but the underlying index itself was closed. With Money being President's Day in America, US traders were away on holiday and the electronic trading from overseas was the main source of liquidity. As indices around the world rallied, it should be no surprise that the NASDAQ 100 did the same thing, at least in the futures market. After all, when you see massive gains in places like London and Paris, it does reason that the NASDAQ 100, which is full of growth oriented companies, would join the party.

I cannot help but wonder whether or not we would have gone farther had the Americans been at work, but that is a question that we will probably get answered on Tuesday. We are a bit overextended at this point, but I think that pullbacks will continue to attract a lot of attention. That attention will be bought into, because this is a market that only goes up over the longer term. Yes, we have periods where the market breaks down rather significantly, but the Federal Reserve will step in and do whatever it takes to lift the markets. The NASDAQ 100 will be much more aggressive than some of the other ones that I follow, and is quite often one of the first to take off when stimulus or liquidity measures are announced.

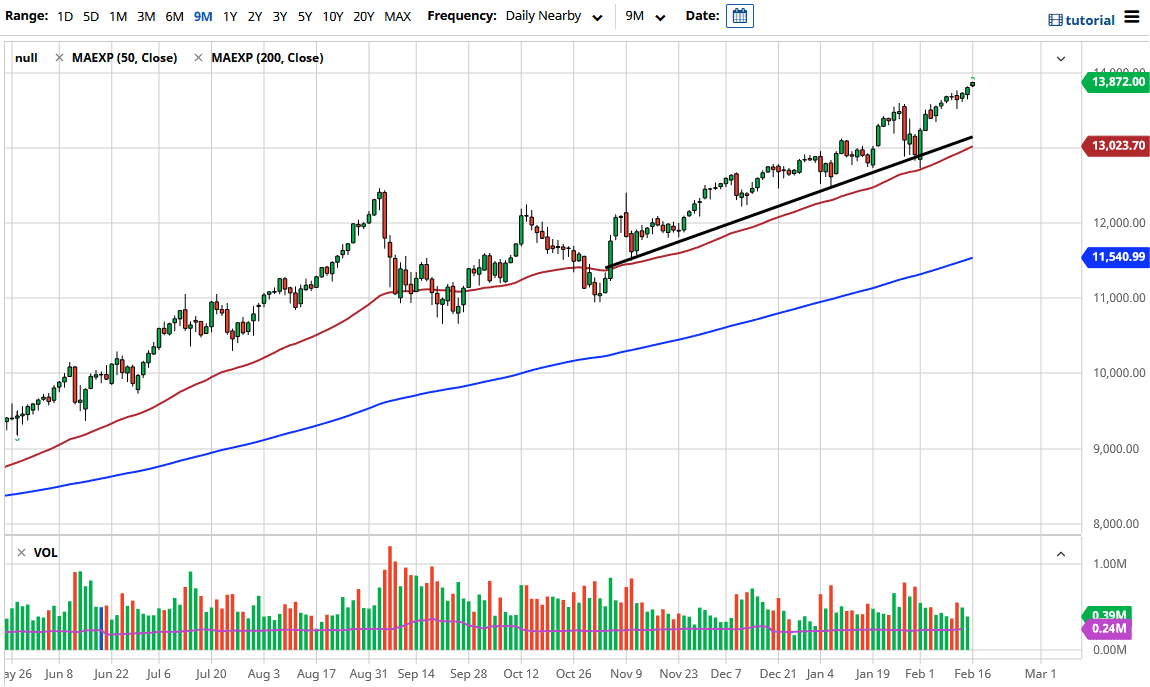

We still have a massive uptrend line underneath and the 50-day EMA to lift the market, so even if we fell 800 points, we would still be in a major uptrend, so I have no interest whatsoever in shorting. I think that short-term pullbacks will continue to offer value, as it appears we are heading towards the 14,000 handle. From a longer-term standpoint, I believe it is very likely that we could go looking towards the 15,000 level as well. We are in an uptrend and being choked to death with liquidity. This in and of itself will continue to drive markets higher, especially as people bank on the “reflation trade” going on around the world. Wall Street loves a narrative, and they always seem to have a narrative to push the NASDAQ 100 higher.