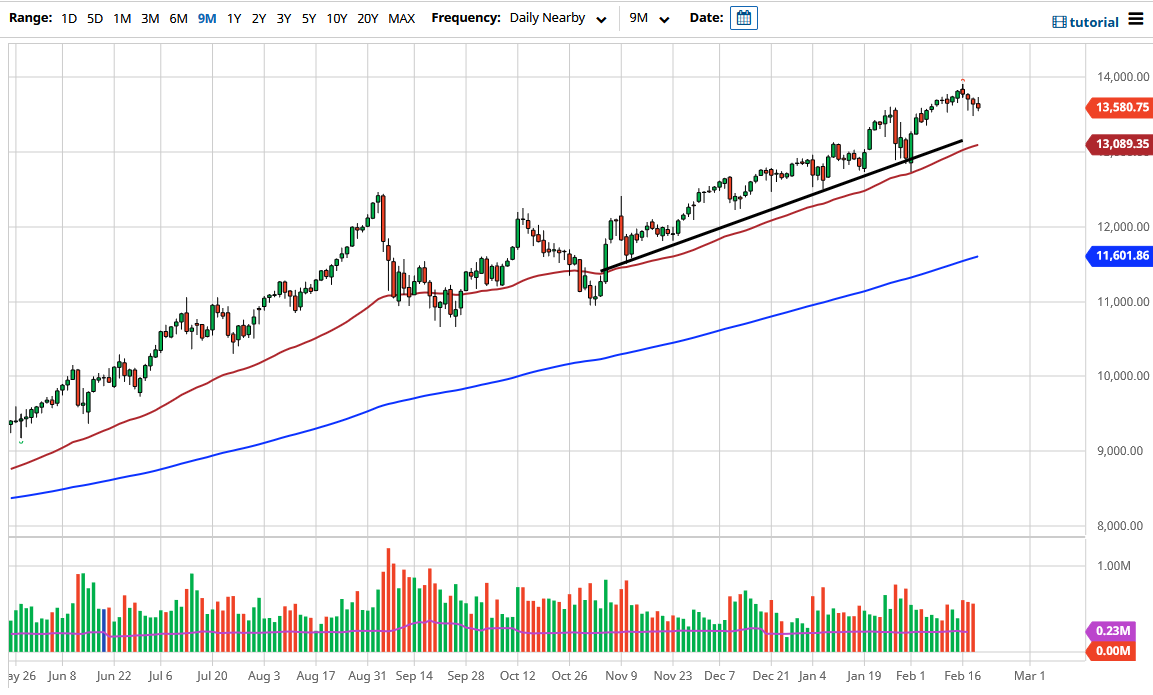

The NASDAQ 100 initially tried to rally during the trading session on Friday but gave back the gains to form a less than impressive candlestick. By forming the candlestick that we have, the market looks as if it is going to try to go down to the 13,500 level, which is a minor support level. If we can break down below there, then we are looking at an uptrend line that will also come into play and that uptrend line is backed up by the 50-day EMA.

The NASDAQ 100 is laden with the “stay-at-home stocks” that everybody has loved during the pandemic, so we are starting to see a little bit of a reshuffling when it comes to allocations of money, and we may see a bit of selling off just as money moves around more than anything else. I do not think that the NASDAQ 100 will suddenly become very bearish or anything like that, but a pullback should be thought of as the most likely of outcomes. The NASDAQ 100 has been the place people go to right away when there is a significant amount of “risk on attitude” in the markets, so pay close attention to the 10-year note. If we start to see yields fall again, then it might free up more money to be rebalanced back into this index.

I still believe that the market is going to the 14,000 level, possibly to the 15,000 level given enough time. However, the market obviously will pull back occasionally, and when that happens, there are plenty of people who have been missing out on this trend or looking to load up on some of the heavyweights such as Apple, Netflix, and the like. Even if the selloff becomes somewhat vicious, I think what most people would be best served doing is either sitting on the sidelines and waiting for value based upon a daily supportive candlestick or buying put options instead of risking shorting this index which tends to be volatile under the best of conditions. Last week was rough, because we simply have not really had any significant amount of momentum, as there has been a lot of recalibration in large portfolios.