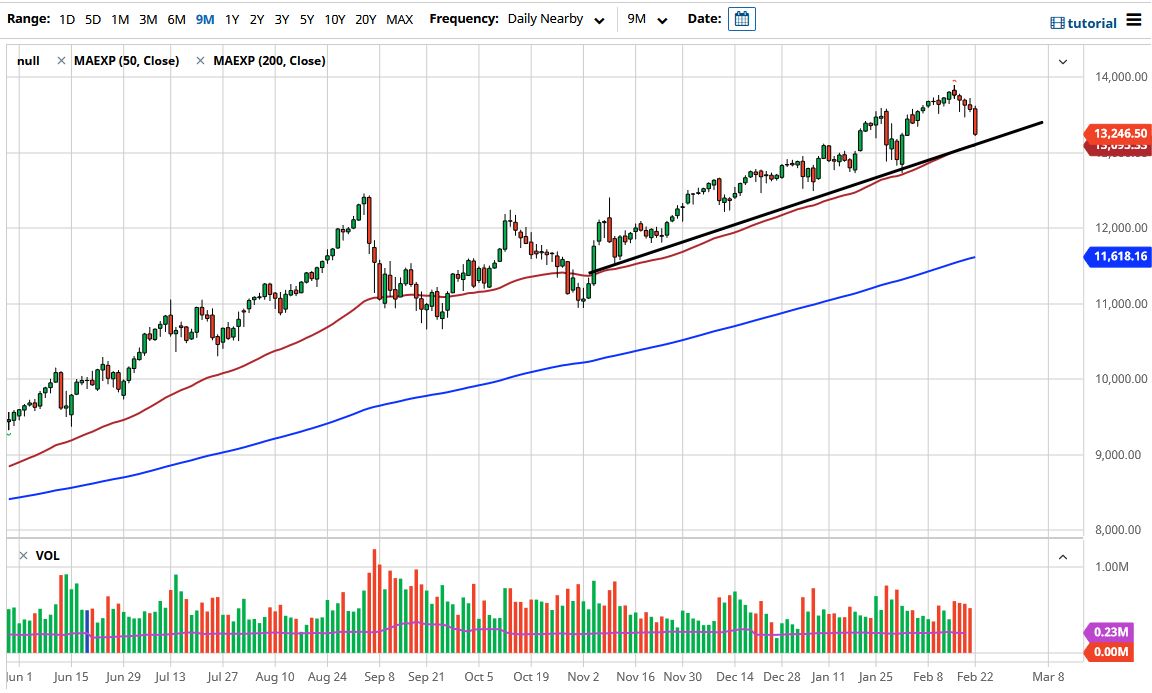

The NASDAQ 100 got hammered during the trading session on Monday as the markets got away from some of the “stay-at-home stocks” that so many people have been piling into. The market has a major uptrend line underneath to keep the market supported, and the 50-day EMA sits right there as well, offering a significant amount of support. When you look at the longer-term chart, you can see that we are in a nice uptrending channel, and that suggests that we are going to find buyers sooner rather than later.

The fact that the candlestick closed that the very bottom of the range suggests that we probably have a little bit more downside ahead of us. I would also not be surprised at all to see this market turn around and form a bit of a hammer. Nonetheless, I think we will get a lot of answers at the end of the trading session on Tuesday, and I certainly do not like the idea of shorting the NASDAQ 100 as it is the darling of Wall Street, or more specifically, the handful of stocks that tend to move the NASDAQ 100 higher are all of the stocks that everybody loves.

This is a market that still remains strong in general, and even if we do break down below the 13,000 handle, if I were to play to the short side it would be to do so using puts, not trying to short the index directly. After all, that has been a losing bet for years now, so it just is not worth the potential trouble that shorting this market can bring. Furthermore, we have Jerome Powell speaking this week, so that also brings and a certain amount of uncertainty, although at the end of the day it is hard to imagine that he will do anything to bring down the stock market, which the Federal Reserve has been watching very closely, despite what some people may tell you. We are in an uptrend, and that is the only thing that you can pay attention to. I do believe that eventually we will go looking towards the 14,000 handle, which is a large, round, psychologically significant figure, but beyond that I also think that we are looking at a potential move to the 15,000 handle if we get enough exuberance back into the market.