At the beginning of Thursday's trading, the price of gold stabilized around the $1835 level after the dollar's decline had pushed it towards the resistance level of $1855. Gold is closely watching the performance of the dollar, the future of US stimulus, and global efforts to contain the coronavirus. In general, investors are still betting on hopes that the demand for minerals will increase significantly soon, as the global economy is likely to witness a rapid recovery thanks to the launch of vaccinations and a decrease in the rate of new coronavirus cases in several parts around the world.

US President Joe Biden's $1.9 trillion coronavirus relief bill is expected to pass through Congress despite Republican opposition.

Silver futures contracts ended yesterday's trading lower at $27,078 an ounce, while copper futures settled at $3.7725 a pound, recording the highest in eight years in the session. Platinum futures ended trading at their highest level in nearly 6 years, with gains of about 4.4% for the day, as it settled at $1,246.90 an ounce.

Data from the Labor Department showed that consumer prices in the US rose in line with economists’ estimates in January. The report said that the Consumer Price Index rose 0.3% in January after rising by an adjusted 0.2% in December. Economists had expected consumer prices to rise 0.3% compared to the 0.4% increase originally reported from the previous month. The consumer price growth is primarily due to the continued jump in gasoline prices, which rose by 7.4% in January after rising by 5.2% in December.

The increase in gasoline prices contributed to the increase in the Energy Index by 3.5%, despite the decrease in electricity and natural gas prices. The report also showed a slight increase in food prices, which rose by 0.1% in January, as higher food prices away from home offset a drop in food prices at home.

Excluding food and energy prices, US core consumer prices were unchanged for the second month in a row. Economists had expected core prices to rise 0.2%.

Commenting on US inflation, Cathy Bostancec, chief US financial economist at Oxford Economics, said: “Looking to the future, inflation is expected to rise to more than 2% in the spring, but this will be largely driven by soft fundamental effects and should be temporary. Consequently, the Federal Reserve Board should patiently look beyond this increase and postpone raising the interest rate until mid-2023 and decreasing quantitative easing until 2022."

Next Wednesday, the Labor Department is set to release a separate report on producer price inflation for January. Economists are currently expecting producer prices to rise 0.4%, while core producer prices are expected to rise 0.2%.

Fed Chairman Jerome Powell said that maintaining “accommodative monetary policy patiently” would be important to return to a strong labor market, but said that more must be done. Powell warned during statements at a virtual event that the United States is still "very far" from a strong labor market despite the recovery in the early days of the pandemic. The published unemployment rate fell to 6.3% in January, but Powell said the actual number was close to 10% when taking into account classification errors by the Labor Department as well as those who have left the workforce since February.

The Fed chief also said that policies that end the pandemic as soon as possible are "of the utmost importance" while also noting the need to provide continued support to workers and families struggling to find their place in the post-pandemic economy.

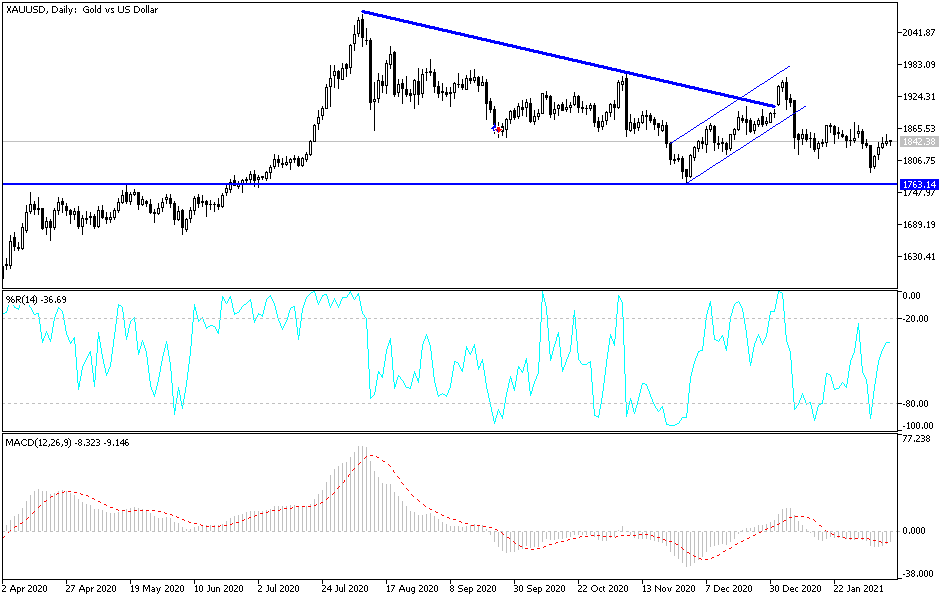

Technical analysis of gold:

On the daily chart, the price of gold is trying hard to achieve more gains to preserve the bullish legacy it enjoys due to pressure on the dollar. The outlook will be strongly bullish if gold moves towards the resistance levels of $1865, $1888 and $1900. On the downside, a move below the $1800 support level will restore a bearish outlook again and move towards stronger descending levels.