Despite the weakness of the US dollar, gold prices closed sharply lower yesterday, reaching the $1790 support level before settling around the $1796 level at the beginning of trading on Wednesday. The sharp decline in the price of gold came as demand for safe-haven assets decreased after a jump in US Treasury yields. Expectations about the economic recovery also contributed to the increase in momentum, with reports showing a decrease in coronavirus cases and faster vaccination efforts.

Silver futures closed at $27.325 an ounce, while copper futures for March were steady at $3.8340 a pound. Silver is trying to extend its bullish move above the previous day's high. However, the price is dropping with strong bearish momentum from the previous day's low. Bulls and bears continue to struggle for dominance as the price of silver has risen near the opening level. But will the price continue its upward movement, targeting the resistance levels of $30.00 and $31.50? Alternatively, will another bearish correction towards the $25.00 - $26.00 region begin? We will simply have to monitor risk sentiment towards the metals market.

A report issued by the Federal Reserve Bank of New York showed that industrial activity in New York grew at its fastest pace in months in February. Also, the Federal Reserve Bank of New York said that its General Business Conditions Index rose to 12.1 in February from 3.5 in January, with a positive reading indicating growth in regional manufacturing activity. Economists had expected the index to rise to 6.0. With a much larger increase than expected, the General Business Conditions Index reached its highest level since it reached 17.0 last September.

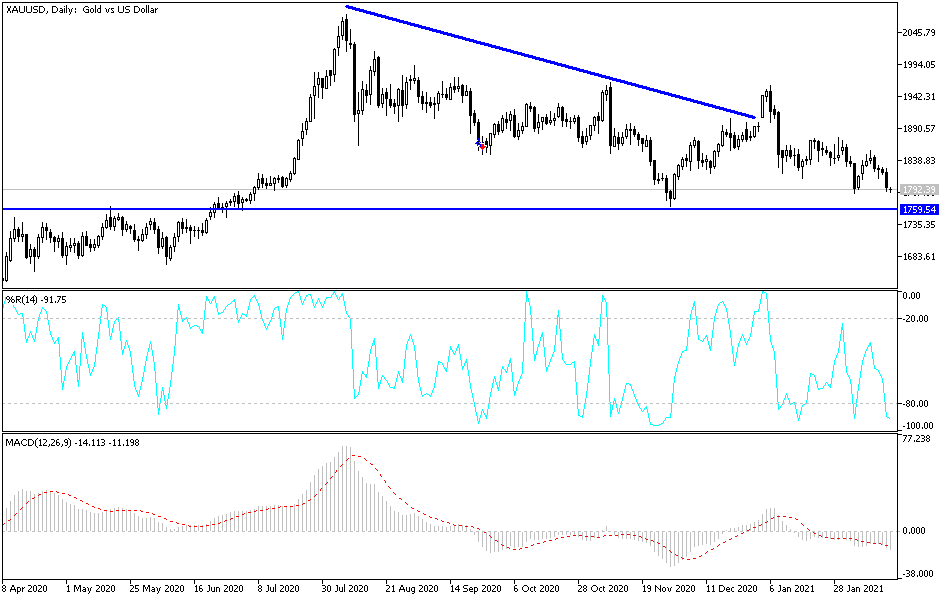

Technical analysis of gold:

Breaking through the psychological support level at $1800 would support a stronger bearish trend and a willingness to test stronger bearish levels, the closest of which are currently $1785, $1770 and $1755. According to the performance on the daily chart, the move towards those levels will move technical indicators towards strong oversold levels. On the upside, bulls will still need to move above the $1855 resistance to regain bullish momentum.

I still prefer to buy gold from every downside. The price of gold will be affected today by the strength of the dollar, with the release of US retail sales and industrial production figures, as well as the minutes of the last meeting of the US Federal Reserve, in addition to the extent of investor risk appetite.

Overall, the price action of gold is interesting, and it appears that it is expected to trade aimlessly in the $1800.00 to $1850.00 range this week. Gold support remains steady at $1760.00.