For three trading sessions in a row, gold benefited from the weakness of the US dollar after the disappointing US employment figures were released. The price of gold rose today to $1844 , where it settled as of this writing, after sell-offs last week pushed the price of gold down towards the support level of $1784. The US dollar fell amid optimism about a major economic stimulus from the Biden administration.

Markets remain optimistic about additional stimulus in the US after the Democrats took the first steps towards passing President Joe Biden's $1.9 trillion relief package without Republican support. US Treasury Secretary Janet Yellen predicted that the relief plan could generate enough growth to restore full US employment by next year.

House Speaker Nancy Pelosi said she believes final COVID-19 relief legislation could pass Congress before March 15, when special unemployment benefits added during the pandemic expire.

Russia released updated statistics on coronavirus-related deaths that showed that 162,429 people infected with COVID-19 died last year, a number much higher than government officials previously announced. The government statistics agency, Rosstat, released its figures for December on Monday, updating its census of deaths related to the coronavirus, which includes cases in which the virus was not the main cause of death and where the virus was suspected but not confirmed.

Of the more than 162,000 deaths between April and December, there were 86,498 deaths from confirmed COVID-19. The virus may have caused 17,470 more deaths, but this has not been confirmed by a test. In 13,524 cases, the virus has "significantly" contributed to fatal complications from other diseases, and 44,937 people have been infected with the virus, but they have died from other causes.

The number of Rosstat is much higher than the toll reported by the Russian government's Coronavirus Task Force, which is reflected in the figures released by the World Health Organization. By January 1, the task force had reported a total of 57,555 deaths.

Russia has reported more than 3.9 million confirmed cases of the coronavirus, the fifth-highest toll in the world, according to Johns Hopkins University.

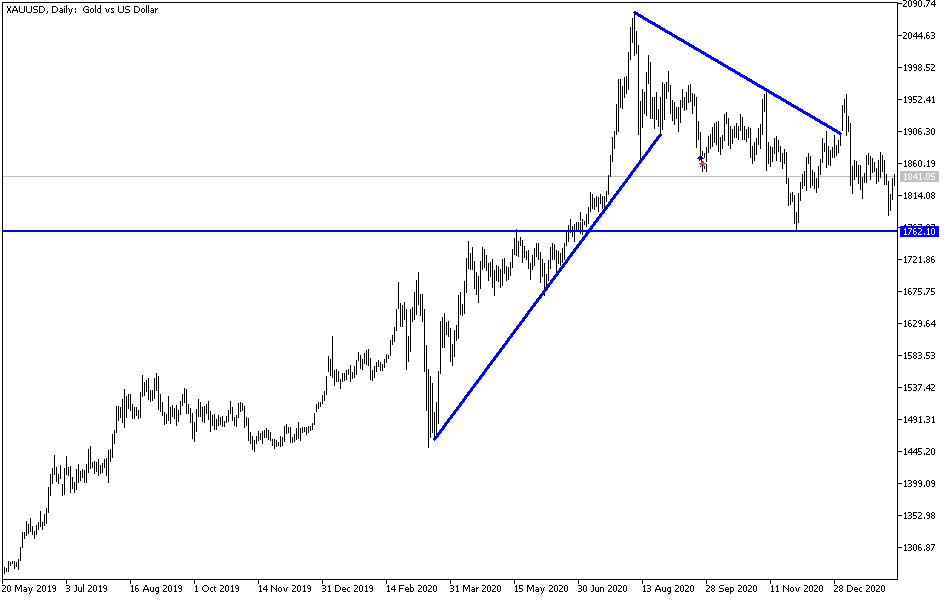

Technical analysis of gold:

The recent performance of gold confirms the importance of the pivotal $1800 level, which is the skirmish line between bulls and bears. Stability above is currently stimulating bulls to move towards stronger ascending levels, the closest ones being $1848, $1860 and $1875, and the last level supports the move towards psychological resistance of $1900. The return of the dollar’s strength has halted gold’s current gains, and the bears will not control the performance without stability below the $1800 level.

The price of gold today is not anticipating any important data or events. The price of gold today will interact with the strength of the dollar and the extent of investor risk appetite.