Gold has been in a downward correction range for three sessions in a row, ultimately falling to the support level at $1815 in early trading today. The strength of the US dollar had the strongest effect on the decline of the gold price. Gold and silver prices also plummeted after the CFTC and CME said that they will tighten restrictions on bullion trading after retail investors used platforms like Reddit to raise metal prices. The Chicago Mercantile Exchange sharply increased margin requirements on silver futures on Tuesday, leading to a sharp drop in silver.

Silver futures closed at $26.889 an ounce, after incurring a loss of more than 10% in the previous session, and after reaching its highest level in 8 years at the beginning of trading this week. Copper futures settled up 1.2% at $ 3.5655 a pound.

The ADP report showed that employment in the US private sector jumped by 174,000 jobs in January after falling by 78,000 revised jobs in December. Economists had expected employment to rise by 49,000, compared to a loss of 123,000 originally reported for the previous month. Commenting on the findings, Ahu Yildirmaz, Vice President and Co-Chair of the ADP Research Institute, said: "The US labor market continues its slow recovery amid the headwinds of COVID-19."

The report also mentioned that US employment in the service delivery sector increased by 156,000 jobs, reflecting remarkable job growth in healthcare/social assistance, entertainment/hospitality and professional/commercial services. Employment in the goods production sector also increased by 19,000 jobs during the month, reflecting an increase in construction jobs. ADP also said that employment in medium-sized companies increased by 84,000 jobs, while small companies added 51,000 jobs and job opportunities in large companies increased by 39,000 jobs.

On Friday, the US Labor Department will release its monthly report on the state of the closely watched labor market, which includes both public and private sector jobs. Economists are now expecting the number of US jobs to increase by 50,000 in January after dropping by 140,000 in December. The country's unemployment rate is expected to remain steady at 8.7%.

On the other hand, a separate report issued by the Institute of Supply Management showed that US service sector activity unexpectedly grew at an accelerating rate in January. The ISM said that the Service PMI rose to a reading of 58.7 in January from a revised 57.7 in December, and according to the index data, any reading above the 50 level indicates growth in the services sector. Economists had expected the index to decline to 56.8 from 57.2 originally announced for the previous month.

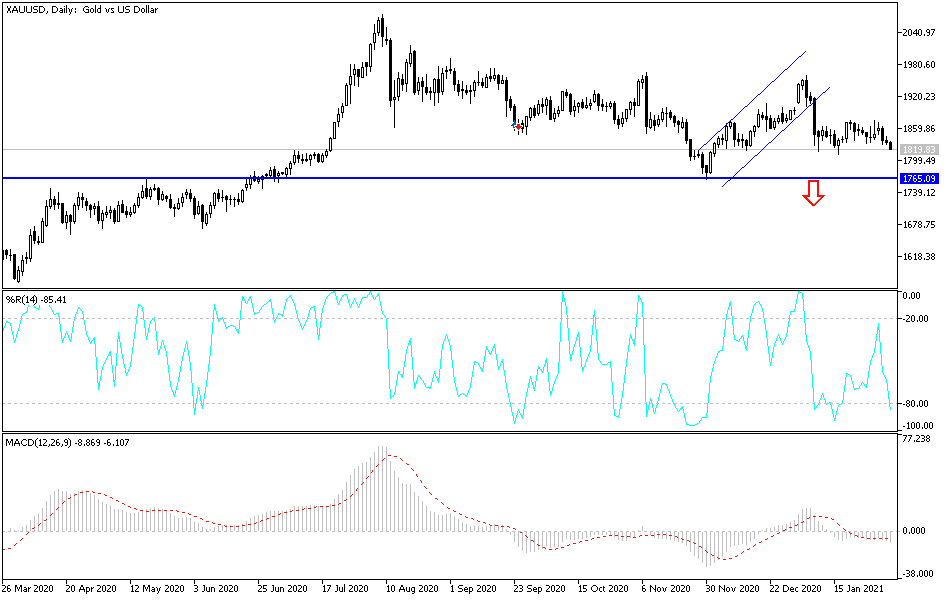

Technical analysis of gold:

The formation of the descending channel on the daily chart is getting stronger, and bears are now preparing to test the psychological support of $1800. Breaking through that level would mean sell-offs that would push the pair towards the support levels at $1792 and $1780. I still prefer to buy gold from every downside. Global efforts to eliminate the coronavirus and stimulate the global economy will take more time, which is an opportunity for gold to continuously achieve its gains. The US dollar is now awaiting the launch of the stimulus plans of the new US administration and the announcement of US jobs numbers on Friday. On the upside, according to the performance over the same period of time, the bulls will regain control of the general trend of gold by moving towards the resistance level at $1875 again.

The price of gold will be affected today by the performance of the US dollar and the extent of investor risk appetite, as well as the reaction to the monetary policy decisions of the Bank of England in case it is contrary to what the markets expect.