The US dollar's strength contributed to the decline in the price of gold, which breached the $1800 support level, reaching a 2-month low at $1785. Gold tried to rebound higher at the end of last week’s trading, taking advantage of the weak US jobs figures for January 2021, and closing the week’s transactions around the $1814 level. The performance confirms the extent of our view regarding trading in gold, which is buying from every downward level. The coronavirus and its effects will continue to support this strategy in the coming months.

All markets are awaiting the launch of the US economic stimulus plans, with negotiations between Joe Biden and the Republicans still ongoing. In general, the new US administration is determined to expand the scope of the stimulus plans vigorously and continuously to revive the US and global economy in the face of the effects of the pandemic.

The US ISM Manufacturing PMI for January fell below expectations of 60, at 58.7. On the other hand, the Services PMI exceeded expectations by 56.8, with a reading of 58.7. The Manufacturing and Non-Manufacturing PMIs released by statistics agency NBS in China were also against expectations, while German retail sales for December rose 1.5% year-on-year versus 5% in the prior period. The Reserve Bank of Australia kept the benchmark interest rate unchanged at 0.1%, as decided by the Bank of England.

Preliminary EU GDP growth for the fourth quarter exceeded expectations on a (quarterly) and (annual) basis. Initial and general CPI indicators for the region also beat expectations, while Canada's unemployment rate for January came in below estimates. The US ADP employment change for January exceeded expectations of 49K by 174K. This month's non-farm payrolls came in below expectations of 50K with a reading of 49K while the average hourly wage and unemployment rate came in better than expected.

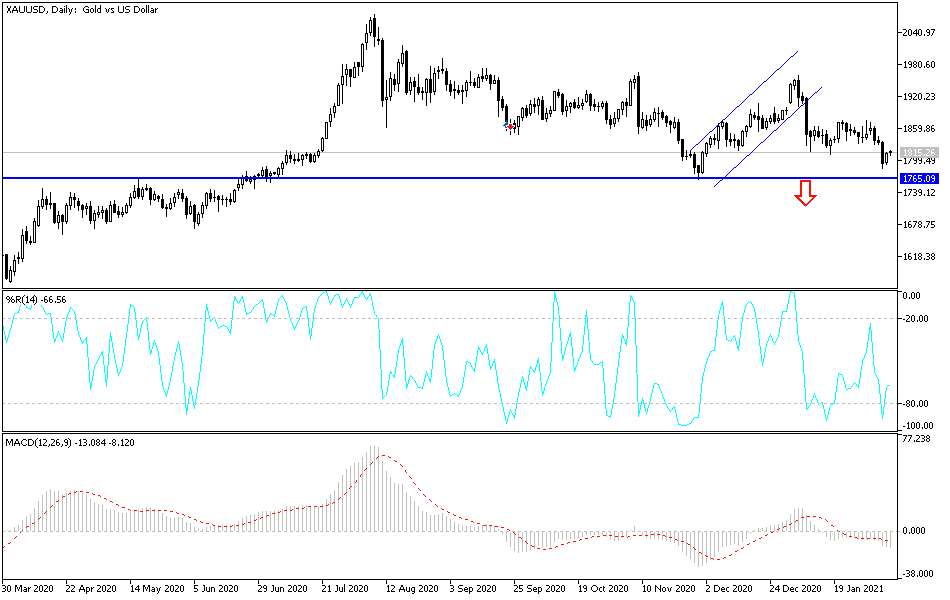

Technical analysis of gold:

In the near term, it appears that the price of gold is trading within the formation of a sharp downward channel, which indicates a strong bearish bias in the short term in market sentiment. Accordingly, the bulls will target short-term gains around $1,820 or higher at $1,838. On the other hand, the bears will be looking to pounce on profits at around $1,802 or less at $1,792.

In the long term, and based on the performance on the daily chart, it appears that gold is trading within a descending channel, which indicates significant long-term downward momentum in market sentiment. The price of gold has now fallen near oversold levels in the 14-day RSI. Accordingly, the bears will look to extend the current bearish performance towards 50% and 61.80% Fibonacci levels at $1767 and $1694, respectively. On the other hand, bulls will target profits around $1859 or higher at the 23.60% Fibonacci level at $1.927.

Today's gold price will be affected by investor risk sentiment and the strength of the US dollar, amid the absence of any important economic data today.