Gold is trying to benefit from the weak US dollar, but its rebound gains did not exceed $1816 before stabilizing around $1806 as of this writing. The price of gold is caught between healthy risk appetite and a weak dollar, which explains its limited performance in recent trading sessions. The bearish performance will strengthen in the event that the price stabilizes below the level of $1800. Global financial markets have recently gained momentum from the global progress in the pace of vaccinations, which paves the way for a strong global economic recovery. Britain has begun developing a roadmap for gradually lifting COVID-19 restrictions in the next few months.

Consumer confidence in the United States rose again in February, as an accelerated batch of COVID-19 vaccines provided hope for Americans who lived through a year of unprecedented restrictions. The US Consumer Confidence Index rose to a reading of 91.3, up from a reading of 88.9 in January. However, despite the introduction of improved vaccination, consumers are more optimistic about current conditions than they are in the near future. Whereas, the Current Situation index, which is based on consumers' assessment of current labor market conditions, rose to 92 from 85.5 last month.

But the Expectation Index - based on consumer short-term expectations of income, business and business conditions - fell slightly to 90.8 this month from 91.2 in January. This was somewhat surprising to economists as many experts predicted that prevalent vaccines and warmer weather could lead to a relatively normal summer.

The percentage of consumers who say that working conditions are "good" increased from 15.8% to 16.5%, while the percentage that claimed that working conditions are "bad" decreased to 39.9% from 42.4%. Consumer perceptions of the job market also improved. The proportion of consumers who expect improved business conditions over the next six months has decreased to 31% from 34.1%. But those who had expected conditions to get worse pulled back as well.

Consumer evaluation of the labor market was mixed as well. While fewer of those surveyed said they expected more jobs in the coming months, those who believed there would be fewer jobs also declined. Few consumers expect their incomes to increase in the next six months, but fewer of them are seeing a decrease in their incomes.

The US Consumer Confidence Index, which companies and economists watch closely because consumer spending makes up about 70% of economic activity in the United States, was over 100 for nearly 4 years before the pandemic broke out last spring. The scale has remained mostly weak in the 1980s and 1990s since, with the exception of two months this fall.

The average US deaths and daily cases of COVID-19 have decreased in the past few weeks. Deaths from the virus have dropped from more than 4,000 reported cases on some days in January to an average of less than 1,900 per day. While winter weather has hampered vaccination efforts in the past two weeks, supplies are following needs and experts expect distribution to accelerate as the weather improves.

The Fed's new policy means that the federal funds rate range will likely remain steady at 0% to 0.25% for years and that the bank will have to continue buying large amounts of new government bonds for the foreseeable future, which is headwinds of yields on nearly all maturities. However, the new White House administration's spending plans and emerging capacity constraints in some sectors due to coronavirus-related restrictions on activity led to a sharp rise in inflation expectations. The result was a sharp decline in "real returns" that made the US dollar increasingly unattractive to investors of all kinds and helped facilitate widespread falls in US exchange rates over the past year.

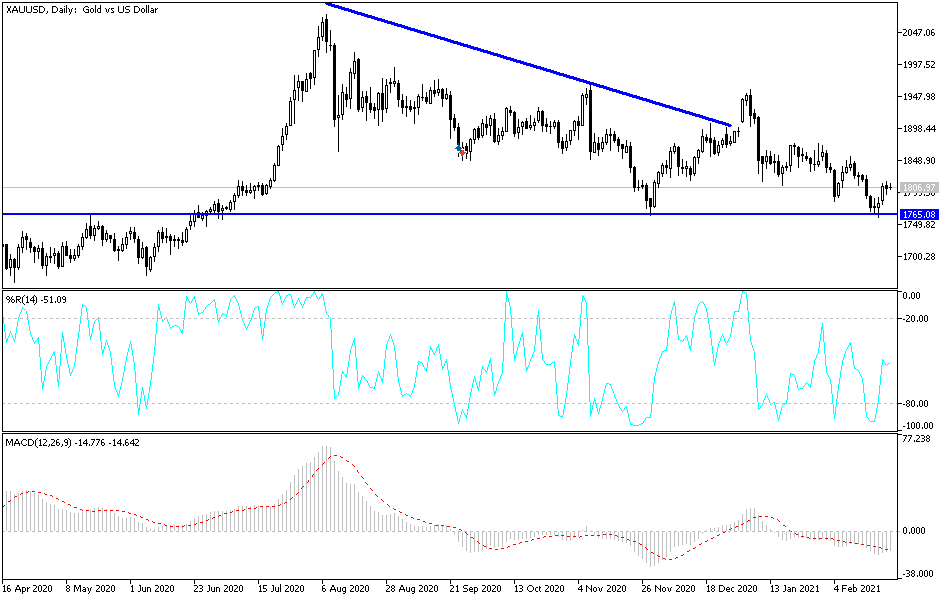

Technical analysis of gold:

On the four-hour chart, the price of gold still needs more momentum to launch strongly to the top and the performance will be strongly bullish in the event that the gold price moves towards the resistance levels of $1818, $1832 and $1855. On the downside, the $1760 psychological support will remain the most important level for bears to control performance for a longer period. I still prefer to buy gold from every dip.