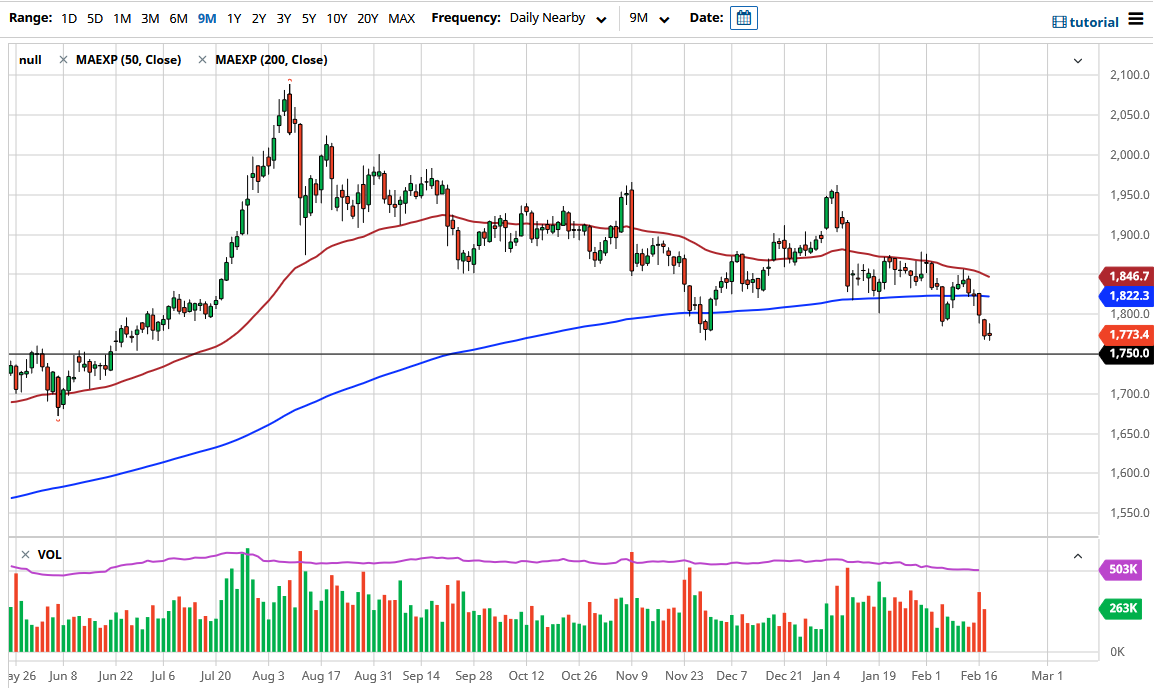

Gold markets initially tried to rally during the trading session on Thursday but then gave back the gains early to turn around and form an inverted hammer. Ultimately, the market is suggesting that perhaps we are going to struggle to keep the market to the upside but having said that if we break down below the $1750 level the market could really fall apart. Looking at this chart, it certainly seems as if we are struggling at this point and we could look at the market as potentially forming a “death cross” as well.

The market breaking above the top of the candlestick for the trading session would be a bullish sign, and therefore could send the market looking towards the $1800 level, perhaps the $1822 level where the 200 day EMA sits. Nonetheless, I think gold is in serious trouble and it does make quite a bit of sense considering that the 10 year yield continues to rally in the United States, meaning that it becomes more palatable to own bonds that it does to own gold. With that being the case, I think that the market breaking down below the $1750 level could open up a nice shorting opportunity for a couple of hundred dollars. We could be looking at the possibility of a move towards the $1500 level, but at that point I think it would end up being a nice buying opportunity for the longer term. However, one thing you need to keep an eye on is whether or not the 10 year note can get significantly above the 1.30% level and reach towards 1.50% level. If it does, that would be more than enough to break this market down.

If we turned around, it would be some type of move based upon the US dollar falling, but at this point in time it certainly looks as if the US Dollar Index is starting to bottom out a bit, so that is another reason to think that gold may struggle in the short term. Longer-term, I do think that eventually inflation runs beyond the yields offered in the bond markets, and it is at that point where gold becomes a bit more palatable. Until then, we are more than likely going to continue to see a choppy but negative market in general.