The gold markets rallied slightly during the trading session on Friday as the US dollar lost a little bit of strength. This is mainly due to the fact that the jobs number came in at an addition of 49,000 jobs added for the month of January. While this was better than the previous reading, it was nowhere near enough to insinuate that the US was on strong footing. Granted, some of the most recent economic numbers have been better than other places like the European Union, but at the end of the day it is all about stimulus.

Speaking of stimulus, the Democrats are going to force the $1.9 trillion COVID-19 relief and budget package through Congress in a process known as “reconciliation.” This means that they will simply need a slight majority in the Senate in order to make that happen, and therefore they do not need any of the opposing party voting for it. This is bad news for the US dollar, as it will flood the market with even more of them.

It is very possible that the US dollar may behave better than some other currencies such as the euro, while at the same time, gold may rally anyway. At the end of the day, the US dollar can strengthen against everything else, but gold might strengthen against the greenback due to the overprinting.

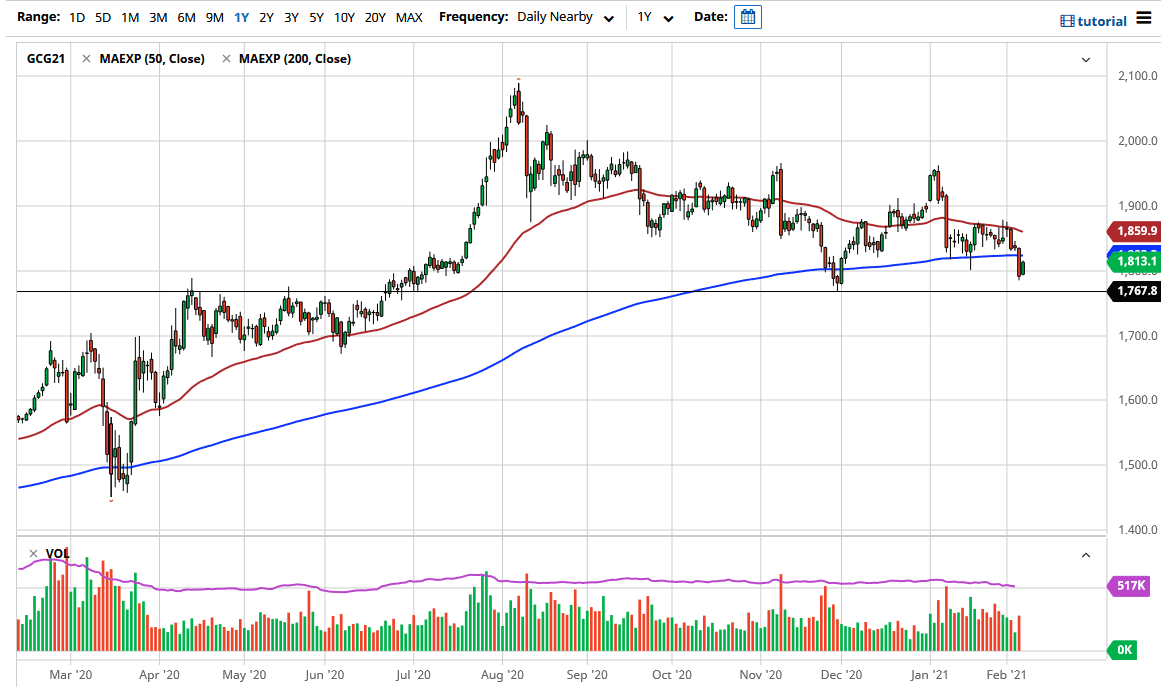

From a technical analysis standpoint, this is essentially forming what is known as a “harami”, which means “pregnant lady” in Japanese. This is a candlestick pattern that can be a reversal pattern, so I think that if we take out the candlestick from Thursday, it is very likely that the gold markets will turn around significantly. However, if we were to break down below the bottom area of support, which I see as being somewhere near the $1750 level, then the bottom of this market will continue to go much lower. The US dollar does have a major influence on the gold market, but it can decouple from time to time. Lots of stimulus out there just waiting to be implemented almost certainly means that gold will go higher given enough time. However, rising interest rates have been working against gold market, so we will have to pay attention to that as well.