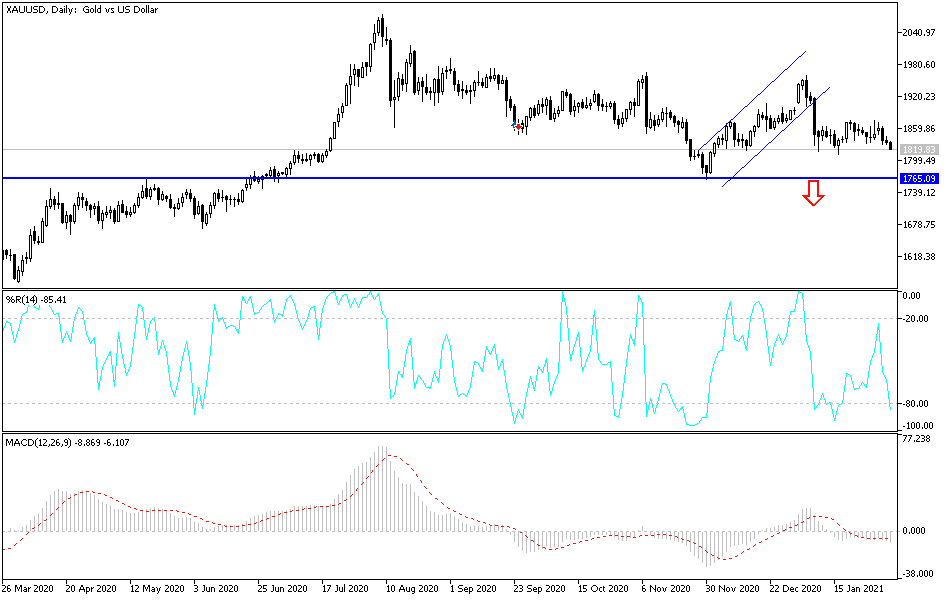

Gold markets did very little during the trading session on Wednesday, which is a good thing, considering just how negative the Tuesday session was. At this point, the market is hanging on to the 200-day EMA, and although that in and of itself is a major technical support level, it is also worth noting that there are support levels underneath there as well. I would not only look at the 200-day EMA as a potential buying opportunity, but you can also start to think about the idea of the $1800 level offering support, and then the $1750 level after that. It is not until we break through all of that that I am willing to start selling this market. Beyond that, I would also need to see a strengthening US dollar to get excited.

On the other hand, we could simply grind back and forth the way we have over the last couple of weeks, as the market simply looks as if it is trying to figure out its next direction. Part of this is probably due to the fact that the stimulus package in the United States is essentially on hold for the short term, but it is very likely that something gets passed sooner or later. If that is going to be the case, then it is very likely that we will see money flowing into the gold markets if the US dollar does in fact fall due to that. However, one thing that is worth being cautious of is the fact that the US dollar is at extreme lows as of late, and it certainly looks as if it is trying to form some type of bottoming pattern on the US Dollar Index. If we start to see rates rise in the United States, that will attract money into the US dollar as well, so this is a very complex issue to deal with in one shot.

In the short term, we will probably continue to go sideways overall, perhaps between the 200-day EMA underneath and the 50-day EMA above, but this is essentially a “basing pattern” that the market is trying to climb out of from what I can see. Furthermore, you are not necessarily forced to trade gold against the US dollar if you see other currencies get hit; you may be able to trade gold against the Australian dollar, the euro, or some other flavor if your broker offers it.