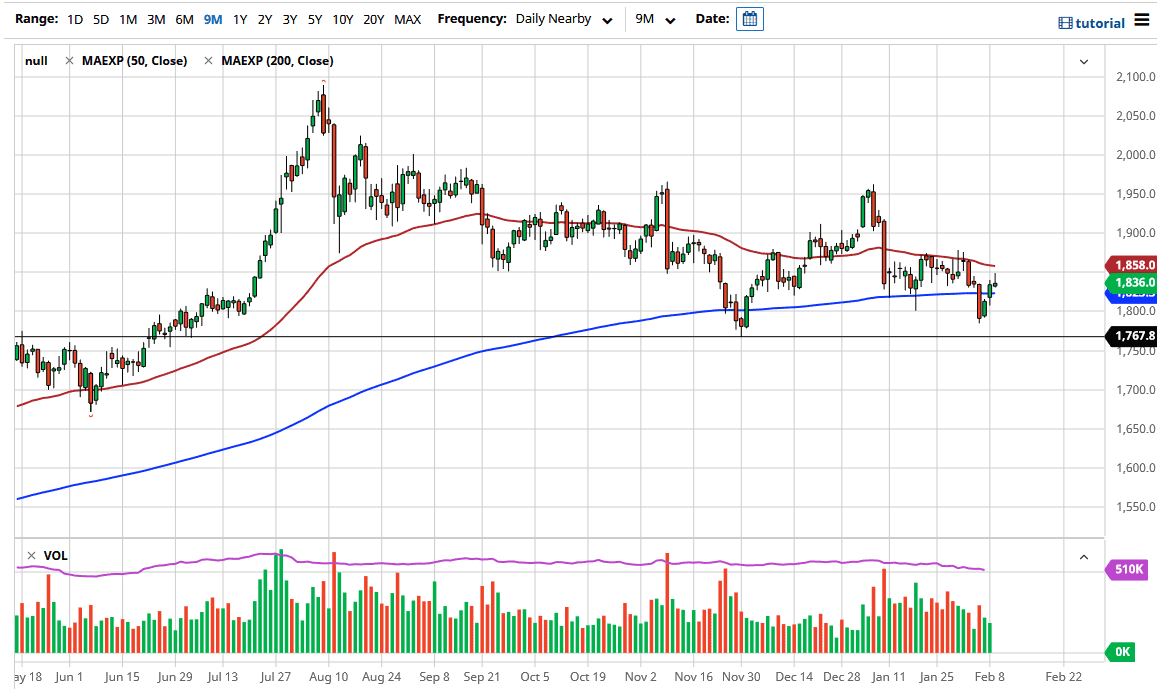

Gold markets initially rallied during the trading session on Tuesday to reach towards the $1850 level. However, we have pulled back from there to show signs of exhaustion as we ended up forming a shooting star. The shooting star is a negative candlestick, and I think at this point we will have to wait and see whether or not the interest rates in the United States continue to go higher. The market is struggling to break out to the upside, especially at the 50-day EMA. If we can break above the 50 day EMA, then that would obviously be a very bullish sign.

To the downside, the gold market has plenty of support near the $1750 level, and if we break down below that level, then it is likely that gold will continue collapsing. It will be interesting to see how this plays out, because we are starting to see a lot of concern about interest rates rising in the United States, which is toxic for gold markets, as it then brings up the question of “Why would I hold gold when I can be paid to hold paper?”

On the other hand, if we were to break above the top of the shooting star in the 50-day EMA, then it is likely that we could go looking towards the $1900 level which is a large, round, psychologically significant figure. Breaking above there then opens up the possibility of a move to the $1960 level. That is an area in which we have seen selling more than once, so I think that breaking above there would lead to the next major leg higher. I do not think that will happen in the short term, and I believe that we may get a short-term pullback in the meantime. Expect a lot of volatility, but until we break down below the support level underneath, I am more likely to buy dips for short-term trades than anything else. I think it is also likely that we will see more of a sideways overall action in this market for the next couple of weeks. Pay attention to the US Dollar Index, because it will obviously have its influence on gold as well.