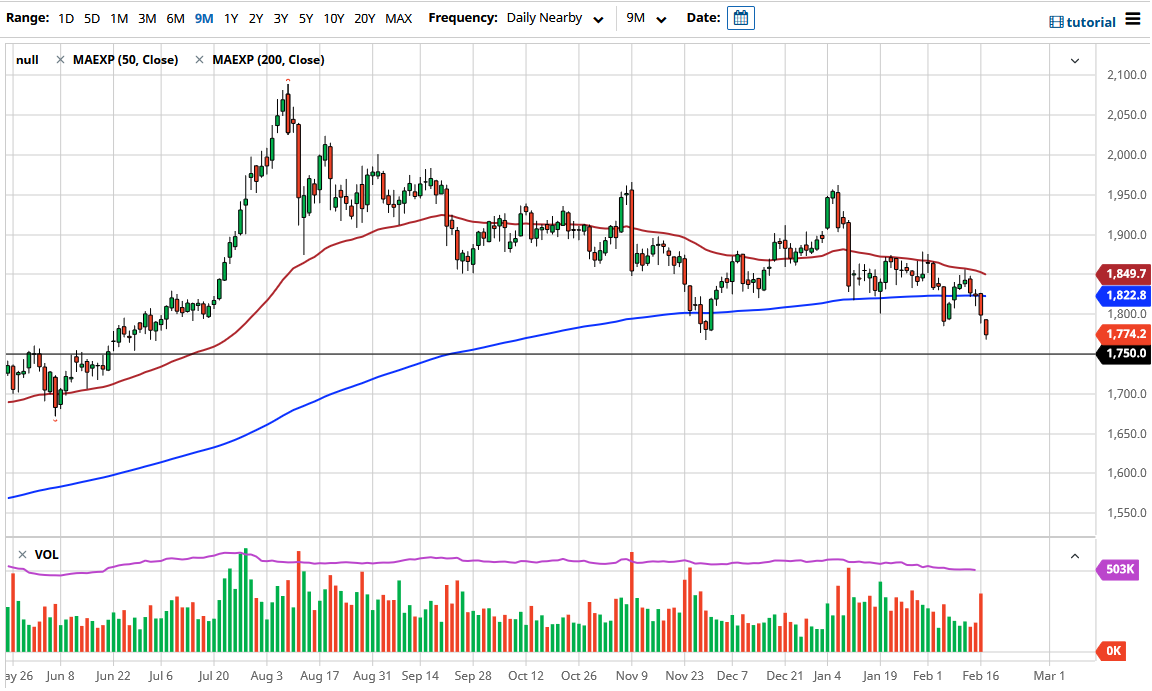

Gold markets fell yet again during the trading session on Wednesday, reaching down towards the $1775 level. The $1750 level underneath is the bottom of a significant support region, and if we were to break down below that it is likely that the market could fall apart. At that point, I would anticipate that gold would probably go down to the $1600 level, possibly even down to the $1500 level.

Looking at this chart, you can also make an argument that we are perhaps trying to form some type of “double bottom”, but if we are going to turn around and save the market, it needs to happen right now. A turnaround could send this market towards the 200-day EMA at the $1822 level, and then perhaps to the $1849 level which is where the 50-day EMA sits. After that, you are looking at the $1900 level, followed by the $1960 level.

In general, I believe that this market will be very sensitive to the interest rate markets in the United States, which currently are working against it. If the 10-year note continues to climb as far as rates are concerned, that will almost certainly crush the gold market. In fact, that has been one of the biggest problems that it has suffered as of late, as real interest rates are starting to rise, meaning that suddenly the 10-year note is somewhat attractive instead of paying for the storage of gold.

In general, it certainly looks as if gold is in trouble, and it is worth contrasting it to the silver market due to the fact that silver has been relatively stable, with the exception of an attempted retail short squeeze. This is because silver is much more of an industrial metal then gold, so the correlation is starting to break down because of the interest rate situation more than anything else. Yes, there is going to be a significant amount of stimulus coming out, but that in and of itself is not going to help gold. However, it does drive up the need for silver. Because of this dynamic that we are seeing right now, gold is played second fiddle which is something that it has not had to do for the most part of the last several years.