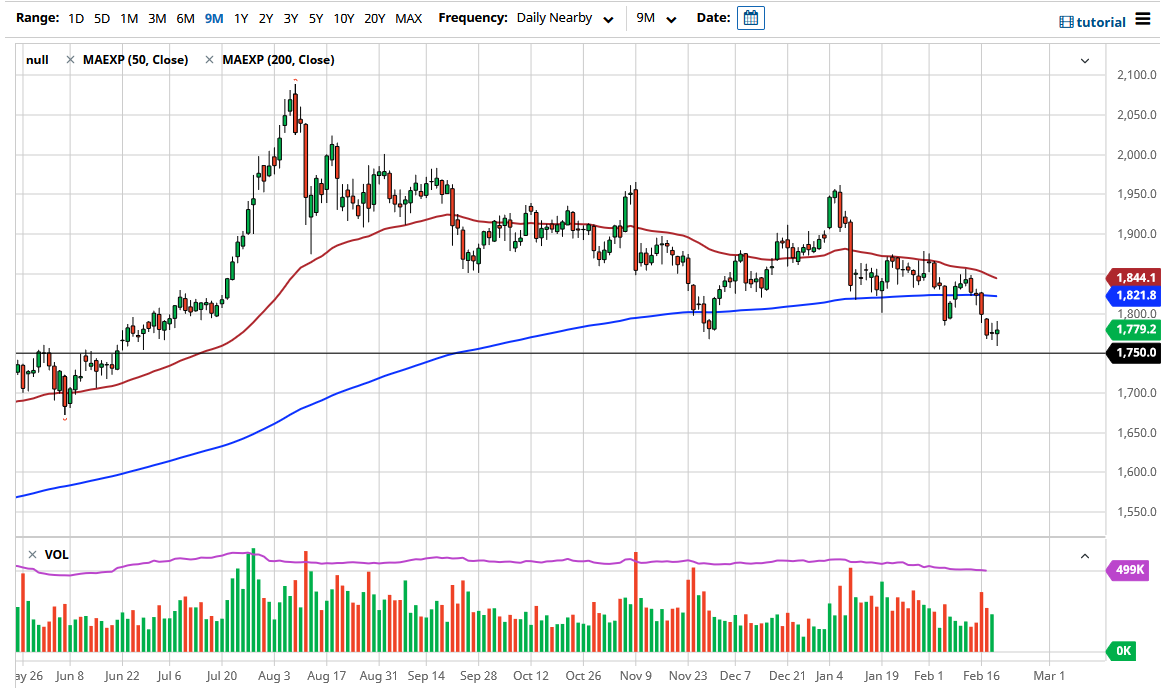

Gold markets fluctuated during the course of the trading session on Thursday as we have heard a lot of noise just above the crucial $1750 support level. That is an area that needed to hold, because if we break down below there it would be a breach of a previous support level, as well as an area that has already shown itself to be massive resistance earlier in the year. The question now is whether or not we are trying to form a double bottom, or if are we about to break down.

I believe that the answer lies in the 10-year note, as we have seen yields in America rise quite significantly. If real interest rates rise, meaning that you get paid more in interest than inflation, then gold loses its luster due to the fact that it costs money to store the metal as opposed to simply sitting on paper and collecting interest. I think this question will be answered rather soon, and the fact that we have formed a bit of a hammer-like candlestick does suggest that it is only a matter of time before we make a bigger move in some type of momentum. The market breaking above the $1800 level offers a sign that we are going to go looking towards the 200-day EMA, perhaps even the $1850 level.

On the other hand, if we were to break down below the $1750 level, I think at that point we could probably drop another couple hundred dollars, maybe even down to the $1500 level. In general, this is a market that will continue to be a bit choppy, as we are at a major inflection point. If the 10-year note reaches the 1.5% level, that could cause a significant amount of negative pressure. However, if yields start to fall, then it is likely that gold could get a little bit of a reprieve. We are most certainly sitting on the precipice right now, so I think that you need to be cautious about the amount of gold that you buy or sell at any one point in time, but once we get an impulsive candlestick in one direction or the other, then we can start to put more to work.