The GBP/USD's strong upward correction path resulted in the pair testing the 1.3952 resistance, its highest in more than three years, before settling around 1.3880. What happened to the pair confirms the strength and solidity of the pound in the Forex trading market, which increased expectations that the pair is currently ready to test the 1.4000 psychological resistance. Commenting on the performance, Joe Manembo, Senior Market Analyst at Western Union, said: "Global optimism and stronger stocks helped the British pound extend its gains trajectory as it reached new highs, its highest in 34 months."

The distinct performance of the pound has been closely linked to the performance of global stock markets since the fears of Brexit as a major influencing factor faded after the signing of a trade agreement between the European Union and the United Kingdom in December. Thus, what happens to equities has a link to the extent of the GBP's rally in early 2021.

Zach Abraham, Director/Chief Investment Officer at Bulwark Capital Management says, “I think the equity markets will continue to go up, maybe much higher. We are in a similar situation to Japan in the late 1980s, for many reasons. In Japan in the late 1980s, this was referred to as window dressing, which forces banks to lend to companies. This was the biggest driver of its bubble.” The latest survey by Bank of America's Global Fund Manager released today also shows that sentiment about global growth has now reached its highest levels ever, as the view that the V-shaped recovery from the COVID crisis is now the strongest forecast.

Domestically, the UK vaccination program remains one of the pillars of the sterling's outperformance. But the sterling outlook received further support on the back of temporary data showing that trade flows between the EU and the UK are close to normal, easing concerns that trade difficulties could pose a major headwind to the UK's economic growth potential.

Real-time trade data shows that post-Brexit trade is recovering, with rejection rates reported by those exporting goods to the European Union across the French border. Says Shawn Osborne, Forex Strategist at Scotiabank: “It appears that the UK virus infection is slowing, vaccines are advancing rapidly, and there are signs that the post-Brexit loopholes in cross-border trade are fading, adding to the positive factors for the pound’s performance.”

Developments, if they continue, are likely to be supportive of the pound's outlook given that analysts see trade frictions over Brexit as a major downside risk for the currency in 2021. According to data from Transporean - a logistics facilitator and data provider - the rate of refusal of shipments has decreased. Shipments to France from the UK nearly halved last week. It was the lowest since the last week of November.

While the European Union and the United Kingdom agreed to free trade, the non-tariff barriers that were put in place remained significant and pose some difficulties for UK exporters in January. Accordingly, Tho Lan Nguyen, a Forex analyst at Commerzbank says, “The obstacles threaten to lead to weak foreign trade and thus have a negative impact on economic growth - especially since trade frictions are expected to increase further during the year when the UK starts implementing full customs controls at its borders."

Commerzbank says that the pound may maintain a period of outperformance in the near term, but a downward turn is likely during the quarter.

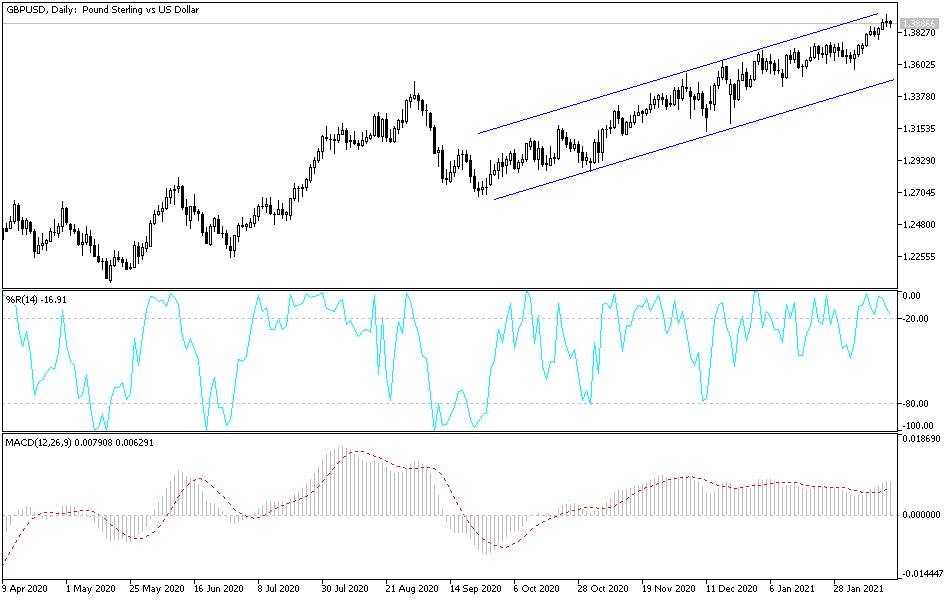

Technical analysis of the pair:

The GBP/USD touched the upper line of its bullish channel, as shown on the daily chart. Nevertheless, bulls have a stronger opportunity to rush towards the psychological resistance level 1.4000, which will push the technical indicators strongly to strong overbought levels, and its impact is expected to activate profit-taking if the current momentum of the pound stops. On the downside, the pair moving below the 1.3550 support level will support the beginning of a bearish reversal. So far, the general trend is still bullish due to Britain's vaccination progress, paving the way to accelerate the British economic recovery compared to other global economies.

Today's economic calendar:

From Britain, inflation numbers will be announced by reading the CPI, producer prices and Retail Price Index. We then expect US data, which include the announcement of the retail sales figures, the Producer Price Index and the industrial production rate, ending with the announcement of the minutes of the last meeting of the US Federal Reserve Bank.