After sell-offs pushed the GBP/USD pair towards the 1.3564 support level during last week's trading, the pair returned to the upside and closed the week around 1.3736. This was likely due to the Bank of England 's statement that there will be no chance for another rate cut in the near term, and the prospect of a strong economic recovery soon to take hold in the UK, thanks to the country's vaccination program. By removing the shadow of negative interest rates from the horizon, the Bank of England sparked a strong appreciation of the British pound, boosting the currency higher against all of its major competitors.

However, the bank lowered its near-term economic outlook due to the strict third national lockdown that was called in January, but the move was offset by cheerful prospects for the second half of the year as an economic recovery is expected amid strong progress in Britain's inoculation against the pandemic.

The Bank of England said that although it is not yet ready to cut interest rates to 0% or less, such an outcome could happen in the future and this move is actually part of their toolkit. If economic activity fails to re-emerge after the pandemic, the BoE could lower interest rates and boost quantitative easing again. Once the market begins to anticipate such a move, the British pound will be subject to a reversal of its recent gains, leading to a loss of purchasing power for those wishing to trade Forex. But this appears to be a diminishing risk for the time being, given that the BoE has in fact reported that it has instructed officials to work out guidance on an appropriate strategy for tightening monetary policy.

Thus, the discussion suggests that the next step may in fact be higher interest rates versus lower rates, an undoubtedly bullish development for the British pound in a world where global central banks are trying hard to cool down expectations about future rate hikes.

The relationship between economic fortunes, the Bank of England, interest rates and exchange rates underscores just how important the UK vaccination program is going forward. "The UK may enjoy the luxury of opening up faster to a more aggressive vaccine rollout and a faster recovery in economic activity on post-Brexit capital flows and fiscal stimulus," said John Hardy, analyst at Saxo Bank.

At the moment, the UK remains a leader in the global vaccination rate, with only Israel vaccinating a greater proportion of its population. From the perspective of the pound sterling, the UK has now vaccinated 15% of its population compared to the major Eurozone economies such as Germany (3.2%), France (2.63%) and Italy (3.5%).

Martin Beck, economist at Oxford Economics, said: “Given the easing of restrictions during the summer, the potential for the current underlying forces to drive a strong recovery will see 2021 calm in terms of monetary policy. On negative interest rates, while the Bank of England is judging that this is a viable option, it is unlikely to be required by the time preparations are complete."

The central assumption at the Bank of England is that economic growth in Britain will be fueled by a complete easing of restrictions related to the coronavirus by the third quarter of 2021 due to the relatively fast pace of vaccination in the UK.

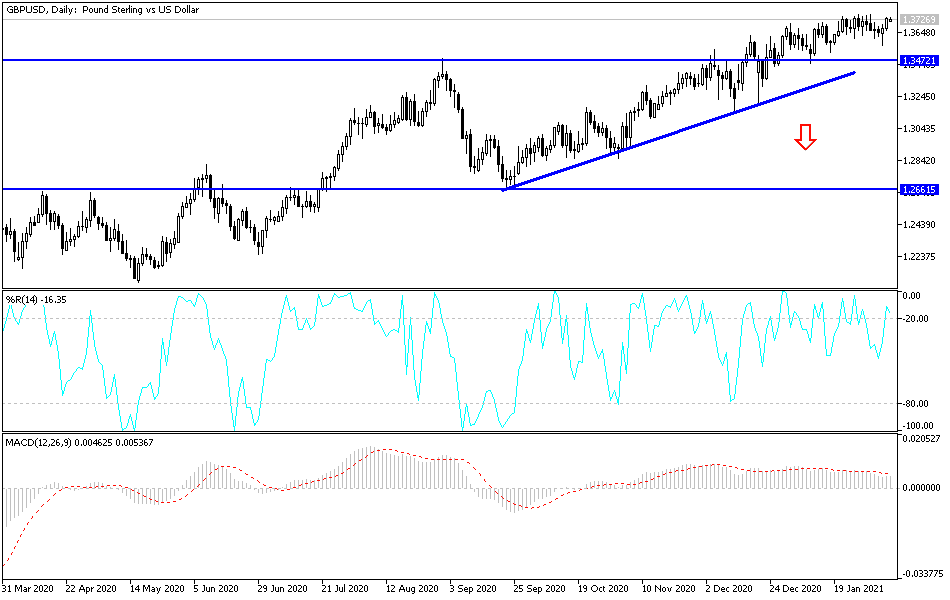

Technical analysis of the pair:

According to the performance on the daily chart, the general trend of the GBP/USD currency pair remains bullish, and stability above the 1.3700 resistance level will enable the pair to go higher. The psychological resistance 1.4000 may be a legitimate target if the positive outlook continues regarding the British vaccination campaign and if the pace of economic recovery is accelerated. On the downside, there will be no bearish reversal of the trend in the long term without breaching the support level at 1.3440.

Today's economic calendar is devoid of any influential US or UK economic data.