At the end of last week's trading, the GBP/USD pair tested the 1.3758 resistance level after optimism about Britain's employment data and vaccination progress. A recovering dollar pushed the pair to the support level of 1.3630 before closing trading around the 1.3700 level. The vaccination program in the United Kingdom has received a boost of good news, which confirmed two new vaccines that have proven effective in trials against both strains of the virus issued from the United Kingdom and South Africa.

It is also likely to boost the prospect of getting vaccines from Johnson & Johnson and Novavax, and thus support the economy and the British pound. Accordingly, Forex analysts say, the pound is currently benefiting from a rapid vaccine rollout program compared to other major developed countries.

The Novavax, Inc. vaccine has an 89.3% effectiveness against the COVID-19 variant in the UK, and the Johnson & Johnson-owned pharmaceutical company Janssen announced on Friday that its single vaccine has shown high efficacy, and that submissions for permission will now begin.

The UK has requested 30 million doses of J&J's vaccine, which has been made available on a non-profit basis, and the UK Vaccine Task Force advisor says they can be approved and released as soon as February. Commenting on the sterling’s future in light of the news, Francesco Bisol, Forex Strategist at ING, says: “We expect the UK vaccination advantage to continue pushing the EUR/GBP down for the rest of 2021”.

The change in the number of claimants for unemployment benefits in the United Kingdom for the month of December exceeded expectations of 35,000 with the number of 7,000. As of November, the unemployment rate was better than expected, at 5% versus 5.1%. On the other hand, average wages including bonuses beat expectations (year-on-year) by 2.9% with a growth of 3.6% over the three-month period. Average wages outperformed excluding bonuses, with (annual) growth of 3.6% versus expectations of 3.2%.

US President Joe Biden has warned of the steep and growing "cost of inaction" over his $1.9 trillion COVID relief plan as the White House searches for "creative" ways to garner public support for a package that is coldly accepted by Republicans in the Senate.

"I am in favor of passing COVID relief with the support of Republicans if we can get it," he told reporters. "But relief from COVID must pass. No exceptions.” His message so far has been that new aid worth $1.9 trillion will be a bargain compared to the potential damage to the world's largest economy if it is not passed. Biden said at a meeting on Friday with Treasury Secretary Janet Yellen that a strong push for vaccinations and generous individual aid would help get parents back into work, allow children to return to school and improve their lifetime income.

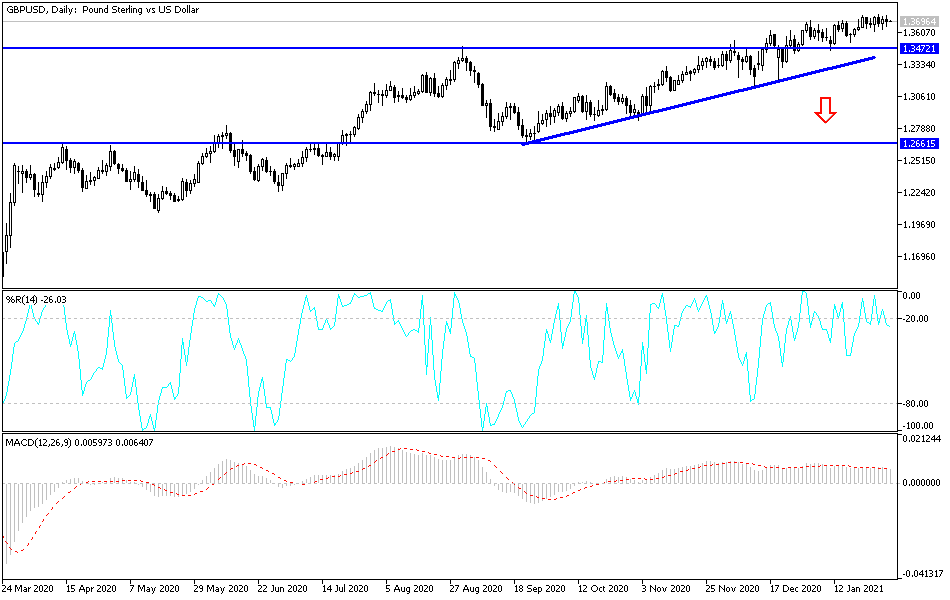

Technical analysis of the pair:

In the near term and according to the performance on the hourly chart, it appears that the GBP/USD is trading within a rising wedge formation, which indicates significant short-term bullish momentum in market sentiment. The pair retreated on Friday to avoid crossing into overbought levels in the 14-hour RSI. Therefore, the bulls - will target the short-term bounce gains around 1.3748 or higher at 1.3797. On the other hand, the bears will look to pounce for profits around 1.3639 or lower at 1.3563.

In the long term and based on the performance on the daily chart, it appears that the GBP/USD is trading within a sharply rising wedge formation, which indicates a strong long-term bullish momentum in market sentiment. The pair remains closer to the overbought levels of the 14-day RSI. Accordingly, the bulls will look to riding the current bullish wave by targeting profits at around 1.3898 or higher at 1.4099. On the other hand, the bears will target long-term pullbacks around 1.3438 or lower at 1.3194.

Today's economic calendar:

For the GBP, the Industrial Purchasing Managers' Index reading, money supply and net lending to individuals will be announced. For the USD, the ISM Manufacturing PMI and Construction Spending Index will be announced.