The bullish performance of the GBP/USD continued during last week's trading as the pair jumped to the 1.3866 resistance level, its highest in three years, before closing the week’s trading around 1.3853. The pound’s gains in the Forex market are treading in the same direction as the gains in global stock markets, and global investor sentiment has become increasingly important to the British pound after Brexit, as the S&P 500 has proven to be a particularly useful guide for the pound.

Commenting on this, Kenneth Brooks, a strategist at Société Générale says: “The British pound maintained the bullish momentum thanks to the correlation of 0.7 with the S&P and 0.6 with the price of Brent crude.”

The pound retreated ahead of Friday's session from its 33-month high against the dollar, and fell again towards 1.14 against the euro, after a weak trading session in the US stock markets indicated a weakening of investor appetite on a larger scale. The return of investor confidence contributed to the preparation of the GBP/USD pair to test higher highs, the closest of which is currently the psychological peak of 1.4000.

The pound has not changed much in the wake of the UK's GDP data, which showed that the British economy grew at a faster rate than expected in December, although the Office for National Statistics confirmed that 2020 witnessed the largest single annual decline in activity in the country's history. As for the Forex markets, all eyes are focused on the potential recovery that awaits us now after rates of coronavirus infections drop and 20% of the country's population has received their first dose of the vaccine.

With the British economy entering a strict lockdown at the beginning of the new year to contain new strains of the coronavirus, the first quarter is likely to lead to negative growth. But the positive growth in the fourth quarter of 2020 means that the definition of a technical recession - two consecutive quarters of decline - will be avoided.

Britain recently announced the UK’s GDP growth figure in the fourth quarter over the expected (quarterly) growth of 0.5% with a growth of 1%. The GDP figure for the month of December outperformed the expected change by 1%, with a rate of 1.2% (compared to the previous month), while the GDP growth (on an annual basis) for the fourth quarter outperformed the expected change by -8.1% with a change of -7.8%. On the other hand, industrial production for the month of December came in below expectations (monthly) of 0.6% with a change of 0.2%. The manufacturing production rate for the month also decreased by 0.5% to 0.2% on a monthly basis.

By the end of the week, it was announced that the preliminary Michigan Consumer Confidence Index reading for February was declining, with expectations for a reading of 80.8, and an actual reading of 76.2. Prior to that, it was announced that US jobless claims for the week ending February 5th exceeded the expected number of claims at 757,000, with a count of 793,000. Also, the continuing claims for the previous week were absent from the cumulative number of 4.49 million, with a total of 4,545 million claims.

As for the US inflation figures, the US CPI excluding food and energy for January eased. The expected change (monthly) was 0.2%, with a change of 0.0%. Consumer prices (year-on-year) were below expectations of 1.5% with a change of 1.4%. The general CPI for January came in below expectations (year-on-year) at 1.5% with a reading of 1.4% while its equivalent (monthly) was in line with expectations of 0.3%. Vacancies in the United States for the month of December outperformed the projected 6.5 million with a total of 6.646 million.

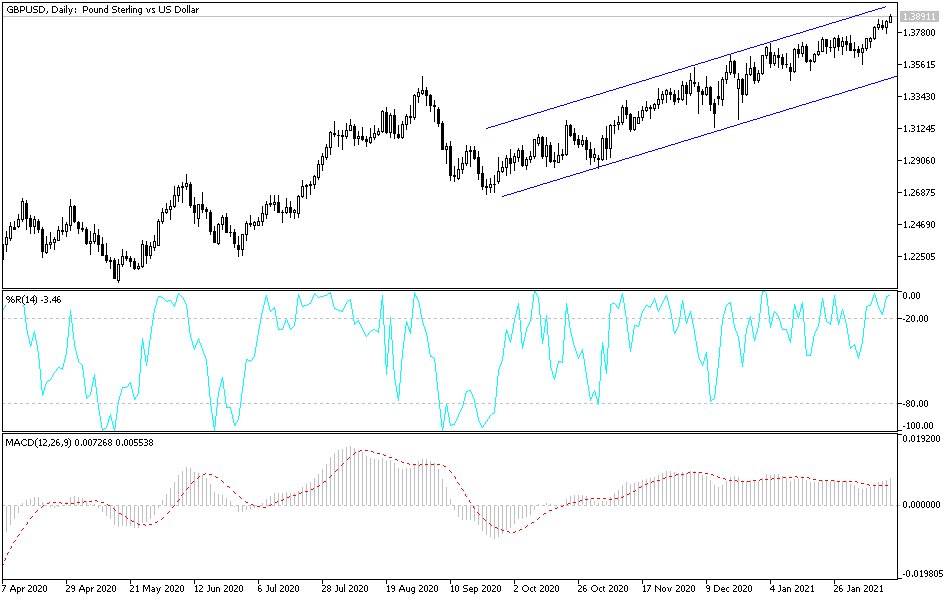

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the GBP/USD is trading within the formation of an upward channel, which indicates significant short-term bullish momentum in market sentiment. Therefore, the bulls will be looking to extend the current short-term rally towards 1.3900 or higher to 1.3950. On the other hand, the bears will target short-term pullbacks around 1.3800 or below at 1.3750.

In the long term, and based on the performance on the daily chart, it appears that the GBP/USD is trading within a sharp rising wedge formation, which indicates a strong long-term bullish momentum in market sentiment. Accordingly, bulls will target long-term gains around the 1.4000 high or higher at the 1.4162 high. On the other hand, the bears will be looking for profits around 1.3695 or lower at 1.3532.

Today's economic calendar is devoid of any important economic data from Britain or the United States of America.