The GBP/USD pair has been under downward pressure, pushing it towards the 1.3611 support level before settling around 1.3670 at the time of writing. Despite the decline, the pair still has a stronger chance of bouncing back up quickly, as acceleration in the UK's vaccination rollout and the gains in global stock markets will be in the interest of the pound in the end. ING Bank expects a further significant rally later in 2021 as the post-referendum devaluation fades, which is expected to raise the GBP/USD pair again above the 1.50 level before the end of the year.

The dollar's gains resulted in the pound ceding the position it recently gained as the best-performing major currency for 2021, although the pound was still comfortably the second-best performing of this year and is seen as having ample room for recovery. “The outlook for sterling has improved dramatically and the undervalued currency should benefit from the combination of a faster vaccination and stronger rebound in the second quarter and a less pessimistic Bank of England (versus the European Central Bank),” said Peter Karbata, Chief Currency Strategist at ING.

In general, the United Kingdom overtook other major economies, including the United States, in the race to be vaccinated against the coronavirus, which provided the economy with a glimpse of the eventual beginning of the recovery. The British government aims to provide a large majority of the population with at least one dose of vaccination before the end of the summer and it is said that it will work to achieve this by the end of June. It has actually purchased more than 350 million doses, more than five for every person in the country.

Consequently, achieving herd immunity in the middle of the year could enable the British economy to reopen up to three months before those on continental Europe, which, although apparently little difference in the grand scheme of things, is still likely to be important to the currency market. This is especially so since the pound has lagged behind other major currencies in last year's rise against the dollar, and many of them are now at extended levels and losing momentum. Nevertheless, some analysts and observers believe that it is not entirely unreasonable for most adults to have their first dose by the end of the second quarter, especially if other vaccines (such as Johnson & Johnson) arrive in the UK earlier than currently planned. All this means the UK will achieve a slightly earlier reopening - although this will undoubtedly be a gradual process.

According to ING's expectations, the GBP/USD pair should have more evident gains as the pair will also benefit from the EUR/USD rally, and the bank expects the EUR/USD pair to move into the 1.25-1.30 area later this year, which would cause the GBP/USD pair to breach the 1.5000 resistance level later in 2021. The fact that the GBP/USD is still one of the least overbought crosses in the G10 region in terms of speculative mode (as reported by the Commodity Futures Trading Commission) also points to a further upside for the pound.

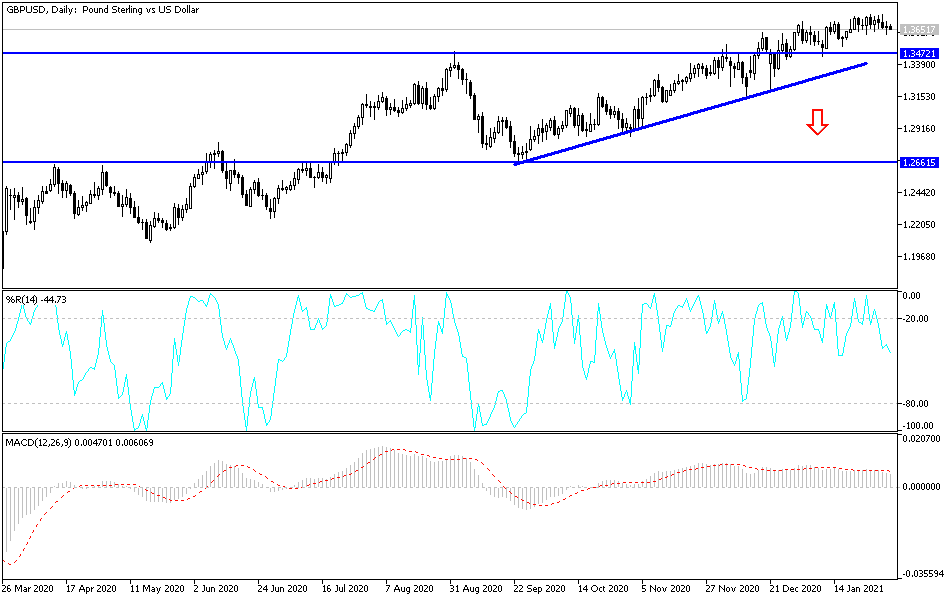

Technical analysis of the pair:

With the recent decline of the GBP/USD, technical indicators still have room to reach oversold levels. Therefore, if the pound gets quick momentum, the pair may move towards support levels at 1.3620, 1.3555 and 1.3480 before indicators reach oversold areas. All in all, I would still prefer buying the currency pair at every downside. In return, the bulls will regain control of the performance in the event that the currency pair moves steadily above the 1.3700 resistance.

The GBP awaits today the announcement of the British Service PMI reading. For the USD, the ADP report to measure the change in US non-farm payroll numbers and the ISM Service PMI will be released.