The easing of UK coronavirus restrictions caused the GBP/USD to correct upwards, its gains reaching the 1.4086 resistance level, where it settled around as of this writing. The British prime minister's office announced that the four conditions for easing restrictions have been met, enabling the government to move forward with the first phase of reopening the economy starting March 8th. All schools in England will reopen on March 8, with after-school sports and outdoor activities permitted.

Also, outdoor recreation between two people is allowed. Starting March 9, outdoor gatherings will be allowed for a maximum of six people or two families. Tennis courts, golf courses and other outdoor sports facilities are expected to open starting on the same date.

The strongest support for the pound in the Forex market came from British Prime Minister Johnson's announcement that the government's plan would take the country "cautiously but irreversibly" out of closure. "We are now on a one-way street towards freedom," he said in a televised news conference.

Britain has witnessed the deadliest outbreak of the coronavirus in Europe, with more than 120,000 people dead. Faced with the prevalent virus variant that scientists say is more transmissible and deadly than the original virus, the country has spent most of the winter under a tight lockdown, the third since March 2020. Bars, restaurants, gyms, schools, hairdressing salons, and non-essential stores have been closed. The prime minister urged people not to travel outside their local area.

All that will start to change, slowly, on March 8th, when children in England will return to school and people will be allowed to meet a friend or relative for a chat or a picnic in the fresh air. After three weeks, people will be able to meet in small groups outdoors for exercise or relaxation.

The yield on US bonds rose to their highest levels in one year, pushing down equity markets and the US dollar. The yield on US government debt for ten years reached its highest in one year at 1.394% on Monday as investors began to worry about higher inflation rates going forward.

Investors are demanding a greater return on the bonds they buy to compensate for higher inflation in the future. The high yields, in turn, attract international investors to the US markets who are bidding on the value of the dollar. At the same time, some investors exploit stocks in bonds, indicating improved returns that provide an opportunity to diversify their portfolios.

Investors expect inflation in the United States and the world to start rising as the global economy recovers from the COVID-19 pandemic, with the help of generous support packages from the US government. All the while, the US Federal Reserve maintains a generous program of quantitative easing and low interest rates that are unlikely to change before 2022.

Inflation expectations in the United States have risen steadily from their lowest levels in March 2020 when the COVID-19 virus began sweeping the world and caused a significant drop in global asset prices. The rally means that inflation expectations have now recovered to what they were in 2019. If expectations continue to rise, investors are likely to continue demanding higher returns on US government bonds, thus supporting the dollar. “After four decades of declining inflation, the tide is turning in the developed world,” says Holger Schmidding, Chief Economist at Bernberg Bank. Several cyclical and long-term structural factors indicate that core inflation will rise in the coming years.

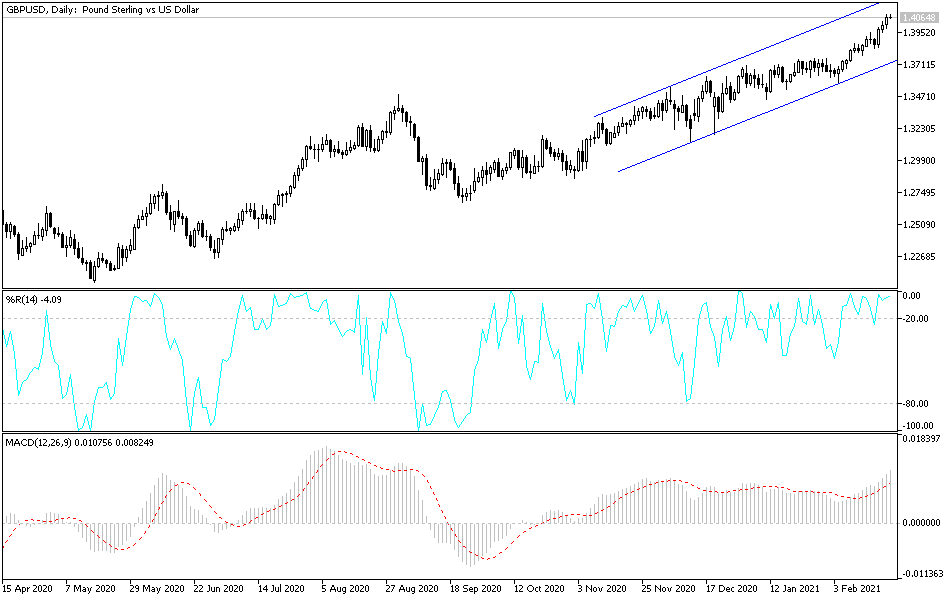

Technical analysis of the pair:

A breach of the 1.4000 psychological resistance will signal a strong bullish performance. At the same time, it may push the technical indicators to strong overbought areas, which can trigger profit-taking at any time, leading to a correction before the currency pair completes its stronger bullish path. On the downside, and in the same period of time, there will be no first reversal of the current trend without moving towards the support level at 1.3760.

Today's economic calendar:

From Britain, the average wages, rate of change in jobs and the unemployment rate in the country will be announced. During the American session, the Consumer Confidence Index will be announced, followed by the testimony of US Federal Reserve Chairman Jerome Powell.